- Switzerland

- /

- Machinery

- /

- SWX:INRN

There's Reason For Concern Over Interroll Holding AG's (VTX:INRN) Massive 27% Price Jump

Interroll Holding AG (VTX:INRN) shares have continued their recent momentum with a 27% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

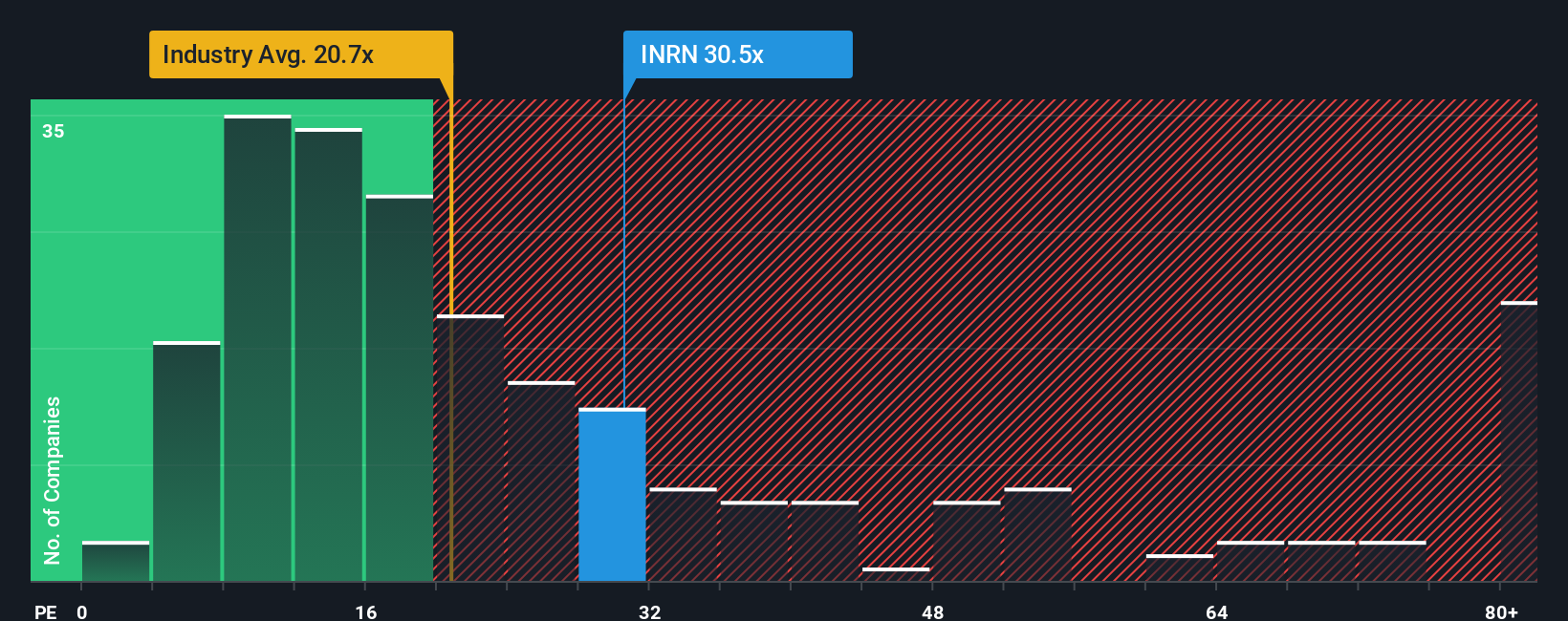

Following the firm bounce in price, Interroll Holding may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 30.5x, since almost half of all companies in Switzerland have P/E ratios under 20x and even P/E's lower than 14x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Interroll Holding hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Interroll Holding

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Interroll Holding's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.3%. This means it has also seen a slide in earnings over the longer-term as EPS is down 23% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 6.8% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 8.6% per annum, which is not materially different.

In light of this, it's curious that Interroll Holding's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Interroll Holding shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Interroll Holding currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Interroll Holding that you should be aware of.

If you're unsure about the strength of Interroll Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:INRN

Interroll Holding

Provides material-handling solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026