- Switzerland

- /

- Machinery

- /

- SWX:GF

Shareholders May Not Be So Generous With Georg Fischer AG's (VTX:GF) CEO Compensation And Here's Why

Key Insights

- Georg Fischer to hold its Annual General Meeting on 16th of April

- CEO Andreas Muller's total compensation includes salary of CHF957.0k

- The total compensation is 38% higher than the average for the industry

- Georg Fischer's total shareholder return over the past three years was 4.9% while its EPS was down 5.8% over the past three years

CEO Andreas Muller has done a decent job of delivering relatively good performance at Georg Fischer AG (VTX:GF) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 16th of April. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Georg Fischer

Comparing Georg Fischer AG's CEO Compensation With The Industry

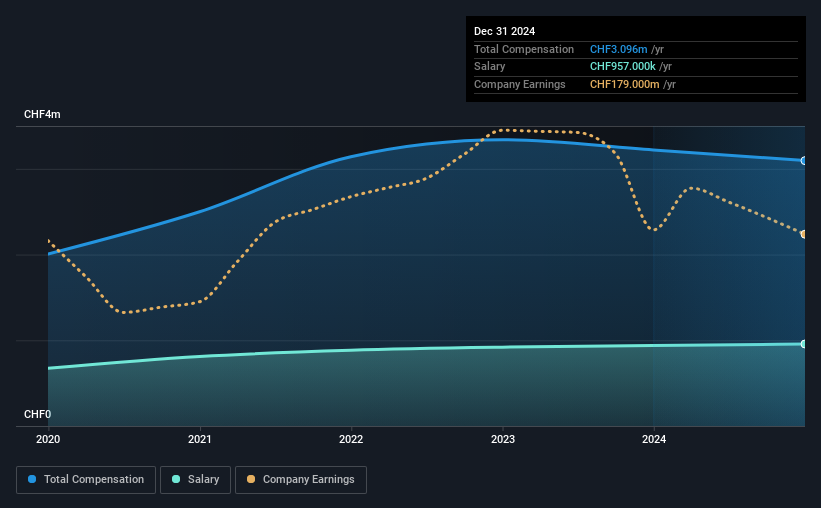

Our data indicates that Georg Fischer AG has a market capitalization of CHF4.4b, and total annual CEO compensation was reported as CHF3.1m for the year to December 2024. That's a slight decrease of 3.9% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at CHF957k.

For comparison, other companies in the Swiss Machinery industry with market capitalizations ranging between CHF3.4b and CHF10b had a median total CEO compensation of CHF2.2m. Accordingly, our analysis reveals that Georg Fischer AG pays Andreas Muller north of the industry median. Furthermore, Andreas Muller directly owns CHF2.7m worth of shares in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF957k | CHF939k | 31% |

| Other | CHF2.1m | CHF2.3m | 69% |

| Total Compensation | CHF3.1m | CHF3.2m | 100% |

On an industry level, around 44% of total compensation represents salary and 56% is other remuneration. Georg Fischer sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Georg Fischer AG's Growth Numbers

Georg Fischer AG has reduced its earnings per share by 5.8% a year over the last three years. Its revenue is up 24% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future .

Has Georg Fischer AG Been A Good Investment?

Georg Fischer AG has not done too badly by shareholders, with a total return of 4.9%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Although the company has performed relatively well, we still think there are some areas that could be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Georg Fischer (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:GF

Georg Fischer

Engages in the provision of piping systems, and casting and machining solutions in Europe, the Americas, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.