- Switzerland

- /

- Electrical

- /

- SWX:GAV

Carlo Gavazzi Holding AG's (VTX:GAV) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

Carlo Gavazzi Holding's (VTX:GAV) stock is up by a considerable 21% over the past three months. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. In this article, we decided to focus on Carlo Gavazzi Holding's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Carlo Gavazzi Holding

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Carlo Gavazzi Holding is:

6.3% = CHF5.9m ÷ CHF94m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. So, this means that for every CHF1 of its shareholder's investments, the company generates a profit of CHF0.06.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Carlo Gavazzi Holding's Earnings Growth And 6.3% ROE

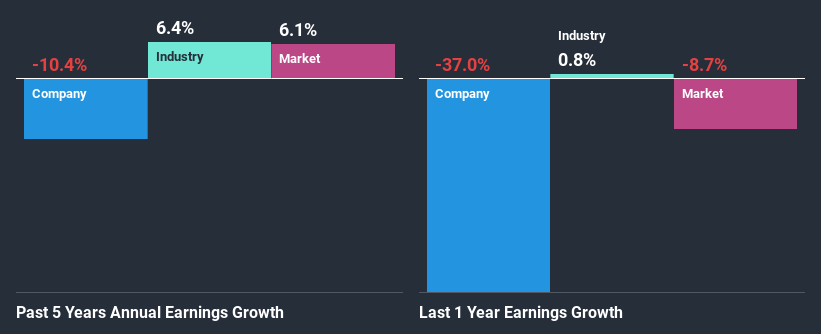

At first glance, Carlo Gavazzi Holding's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 10% either. For this reason, Carlo Gavazzi Holding's five year net income decline of 10% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. Such as - low earnings retention or poor allocation of capital.

Next, when we compared with the industry, which has shrunk its earnings at a rate of 2.1% in the same period, we still found Carlo Gavazzi Holding's performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Carlo Gavazzi Holding fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Carlo Gavazzi Holding Efficiently Re-investing Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 85%. Still, forecasts suggest that Carlo Gavazzi Holding's future ROE will rise to 8.7% even though the the company's payout ratio is not expected to change by much.

Conclusion

On the whole, Carlo Gavazzi Holding's performance is quite a big let-down. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Carlo Gavazzi Holding and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

When trading Carlo Gavazzi Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:GAV

Carlo Gavazzi Holding

Designs, manufactures, and sells electronic control components for building and industrial automation markets.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026