If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. So after we looked into Burkhalter Holding (VTX:BRKN), the trends above didn't look too great.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Burkhalter Holding, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = CHF17m ÷ (CHF202m - CHF115m) (Based on the trailing twelve months to June 2020).

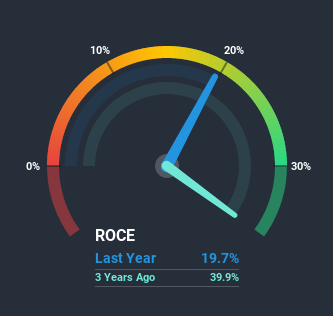

So, Burkhalter Holding has an ROCE of 20%. On its own, that's a standard return, however it's much better than the 10% generated by the Construction industry.

See our latest analysis for Burkhalter Holding

Above you can see how the current ROCE for Burkhalter Holding compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Burkhalter Holding.

So How Is Burkhalter Holding's ROCE Trending?

In terms of Burkhalter Holding's historical ROCE movements, the trend doesn't inspire confidence. Unfortunately the returns on capital have diminished from the 38% that they were earning five years ago. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Burkhalter Holding becoming one if things continue as they have.

On a separate but related note, it's important to know that Burkhalter Holding has a current liabilities to total assets ratio of 57%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.In Conclusion...

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Long term shareholders who've owned the stock over the last five years have experienced a 20% depreciation in their investment, so it appears the market might not like these trends either. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 2 warning signs for Burkhalter Holding (of which 1 doesn't sit too well with us!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Burkhalter Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:BRKN

Burkhalter Holding

Through its subsidiaries, provides electrical engineering services to the construction sector primarily in Switzerland.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.