In a week marked by cautious Federal Reserve commentary and looming political uncertainty, U.S. stocks faced broad-based declines, with smaller-cap indexes experiencing some of the most significant losses. Despite these challenges, economic indicators such as robust third-quarter growth and rising retail sales offer a mixed backdrop for investors seeking opportunities in under-the-radar stocks that might thrive amid volatility. In this environment, identifying promising small-cap companies requires a focus on those with strong fundamentals and resilience to navigate current market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Conoil | 27.59% | 16.64% | 46.05% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Proact IT Group (OM:PACT)

Simply Wall St Value Rating: ★★★★★★

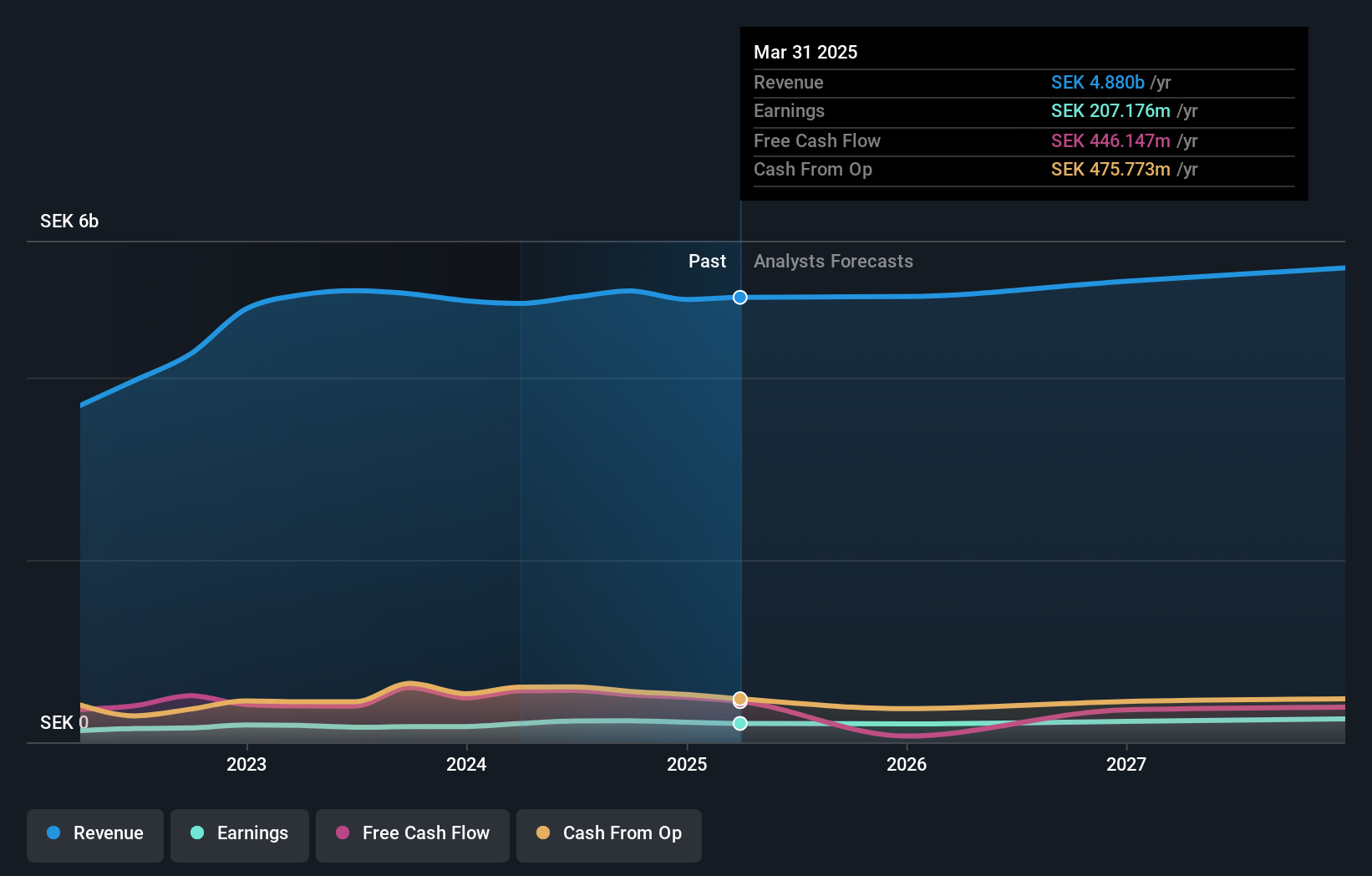

Overview: Proact IT Group AB (publ) offers data and information management services, focusing on cloud services and data center solutions across Sweden, the UK, the Netherlands, Germany, and other international markets, with a market cap of SEK3.16 billion.

Operations: Proact IT Group generates revenue primarily from its regional operations, with the Nordics & Baltics contributing SEK2.59 billion, followed by Central Europe at SEK907.25 million and the West region at SEK860.08 million. The UK adds SEK697.92 million to the total revenue stream, highlighting a diversified geographical income base.

Proact IT Group, a promising player in the IT sector, has demonstrated robust growth with earnings surging by 37% over the past year, outpacing the industry average. Its debt to equity ratio improved from 23.6% to 22.6% in five years, indicating prudent financial management. The company trades at a significant discount of approximately 41% below its estimated fair value, suggesting potential upside for investors. Despite recent executive changes and anticipated sales decline of up to 15%, Proact's strong historical performance and strategic positioning in cloud services highlight its resilience and adaptability within the dynamic tech landscape.

- Get an in-depth perspective on Proact IT Group's performance by reading our health report here.

Assess Proact IT Group's past performance with our detailed historical performance reports.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Burkhalter Holding AG, with a market cap of CHF958.52 million, operates through its subsidiaries to offer electrical engineering services to the construction sector in Switzerland.

Operations: The company generates revenue of CHF1.18 billion from its electrical engineering services.

Burkhalter Holding, a notable player in the construction sector, stands out with high-quality earnings and a price-to-earnings ratio of 17.8x, which is lower than the Swiss market average of 20.6x. Over the past year, its earnings have grown by 10.3%, surpassing the industry growth rate of 7.4%. Although its net debt to equity ratio has climbed from 17.4% to 89.5% over five years, interest payments are well-covered at an impressive EBIT coverage of 46.1x. Future prospects appear promising with projected annual earnings growth of about 4%, despite current high debt levels.

- Delve into the full analysis health report here for a deeper understanding of Burkhalter Holding.

Examine Burkhalter Holding's past performance report to understand how it has performed in the past.

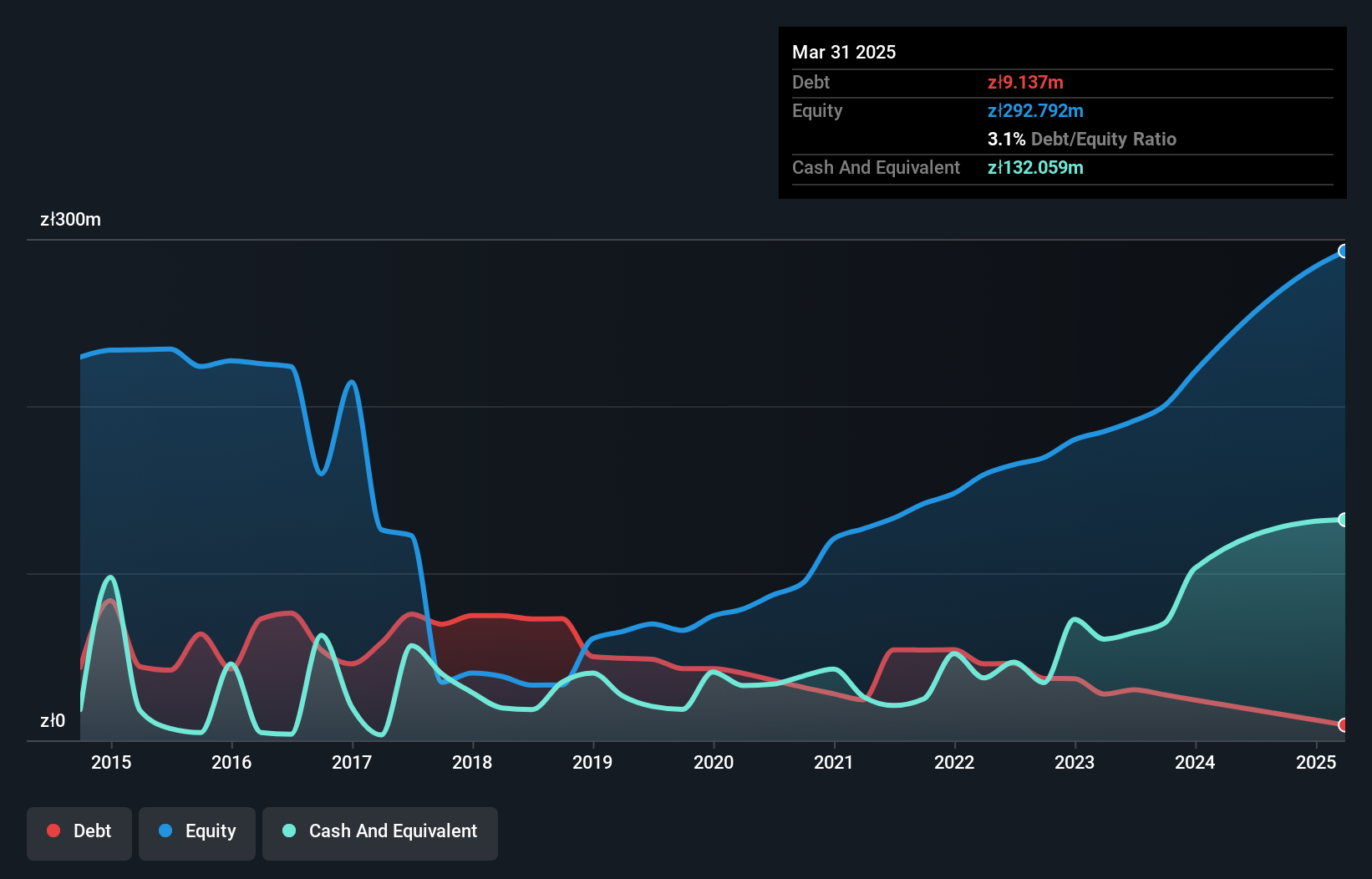

Sygnity (WSE:SGN)

Simply Wall St Value Rating: ★★★★★★

Overview: Sygnity S.A. is a company that manufactures and sells IT products and services both in Poland and internationally, with a market capitalization of PLN1.57 billion.

Operations: Sygnity generates revenue primarily from its IT segment, which amounted to PLN232.96 million.

Sygnity's recent performance highlights its potential as an intriguing investment prospect. Over the past year, earnings surged by 26.4%, outpacing the IT industry average of -25.1%. The company's financial health appears robust, with a debt to equity ratio dropping from 82.5% to 10.9% in five years, and it holds more cash than total debt, indicating prudent financial management. Additionally, EBIT covers interest payments 116 times over, suggesting strong operational efficiency. Recent reports show Q3 revenue at PLN 71 million and net income at PLN 13 million, reflecting significant growth compared to last year's figures of PLN 52 million and PLN 5 million respectively.

Next Steps

- Embark on your investment journey to our 4612 Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SGN

Sygnity

Manufactures and sells IT products and services in Poland and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives