- Switzerland

- /

- Building

- /

- SWX:BEAN

BELIMO Holding AG's (VTX:BEAN) Popularity With Investors Is Under Threat From Overpricing

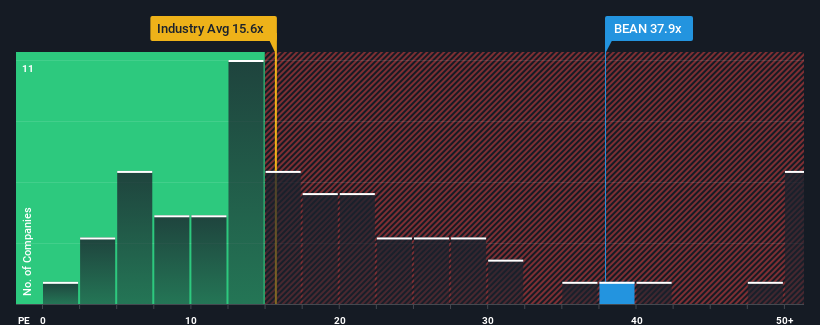

With a price-to-earnings (or "P/E") ratio of 37.9x BELIMO Holding AG (VTX:BEAN) may be sending very bearish signals at the moment, given that almost half of all companies in Switzerland have P/E ratios under 21x and even P/E's lower than 13x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for BELIMO Holding as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for BELIMO Holding

How Is BELIMO Holding's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like BELIMO Holding's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. Pleasingly, EPS has also lifted 58% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 5.9% per annum as estimated by the nine analysts watching the company. With the market predicted to deliver 11% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's alarming that BELIMO Holding's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of BELIMO Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for BELIMO Holding that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BELIMO Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BEAN

BELIMO Holding

Engages in the development, production, and sale of damper actuators, control valves, sensors, and meters for heating, ventilation, and air conditioning systems (HVAC) in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential and pays a dividend.