In recent weeks, global markets have experienced volatility as geopolitical tensions and consumer spending concerns weigh on investor sentiment. Despite these challenges, opportunities may exist in the form of undervalued stocks that could be trading at significant discounts to their intrinsic value. Identifying such stocks often involves looking for companies with strong fundamentals that are temporarily out of favor due to broader market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | US$133.63 | US$264.41 | 49.5% |

| Hibino (TSE:2469) | ¥2795.00 | ¥5545.38 | 49.6% |

| Celestica (TSX:CLS) | CA$169.73 | CA$335.20 | 49.4% |

| 3onedata (SHSE:688618) | CN¥24.76 | CN¥49.00 | 49.5% |

| Neosem (KOSDAQ:A253590) | ₩12020.00 | ₩23933.78 | 49.8% |

| Shanghai Haohai Biological Technology (SEHK:6826) | HK$26.70 | HK$52.81 | 49.4% |

| Sobha (NSEI:SOBHA) | ₹1191.35 | ₹2382.65 | 50% |

| Laboratorio Reig Jofre (BME:RJF) | €2.69 | €5.32 | 49.4% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.77 | 49.9% |

| Superloop (ASX:SLC) | A$2.19 | A$4.35 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

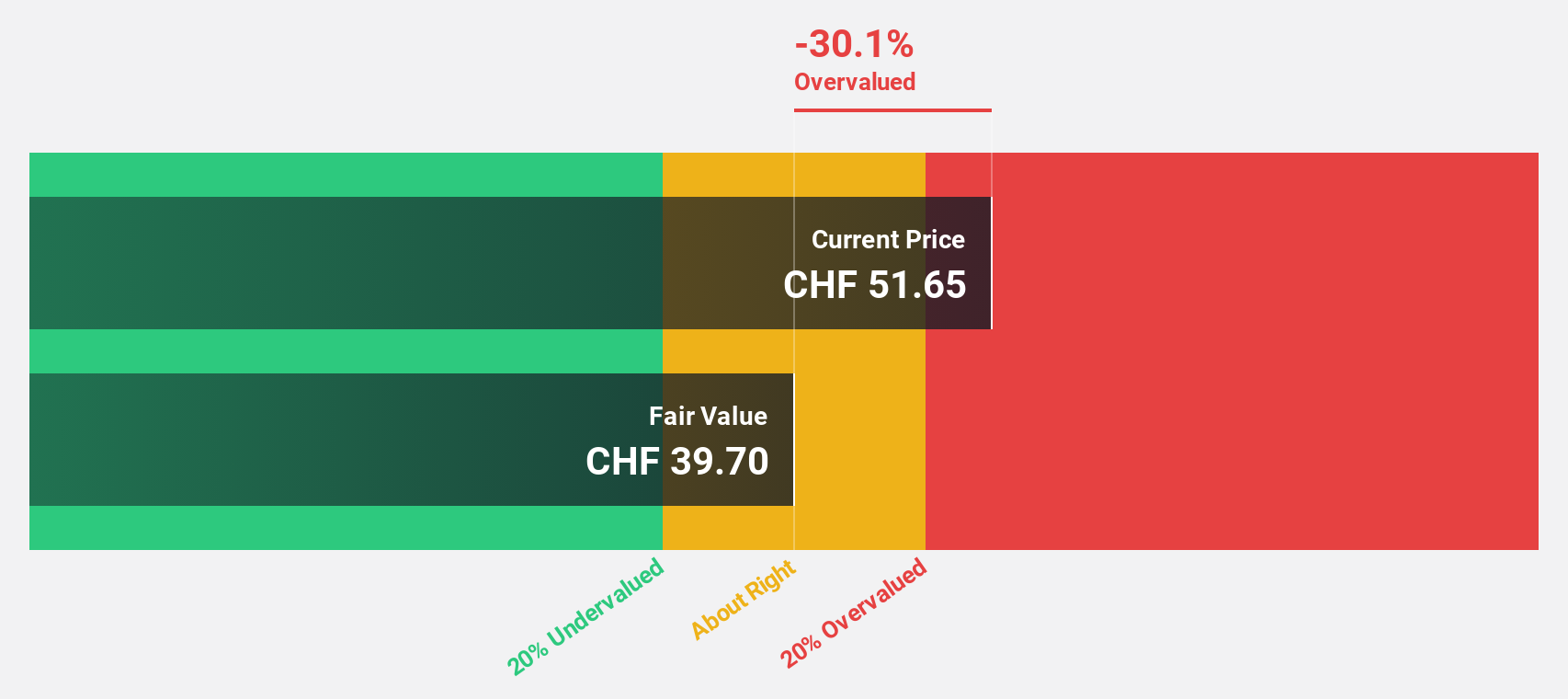

Accelleron Industries (SWX:ACLN)

Overview: Accelleron Industries AG is a global company specializing in the development, manufacturing, sales, and servicing of turbochargers and digital solutions, with a market cap of CHF4.03 billion.

Operations: The company generates revenue from its High Speed segment, contributing $245.87 million, and its Medium & Low Speed segment, which accounts for $725.83 million.

Estimated Discount To Fair Value: 14.9%

Accelleron Industries, trading at CHF42.94, is undervalued based on cash flow analysis compared to its fair value estimate of CHF50.45. The stock's earnings are expected to grow 13.5% annually, outpacing the Swiss market average of 11.5%. However, revenue growth is projected at a modest 4.7% per year and the company carries a high level of debt. Return on equity is forecasted to be very high in three years at 54.1%.

- The growth report we've compiled suggests that Accelleron Industries' future prospects could be on the up.

- Navigate through the intricacies of Accelleron Industries with our comprehensive financial health report here.

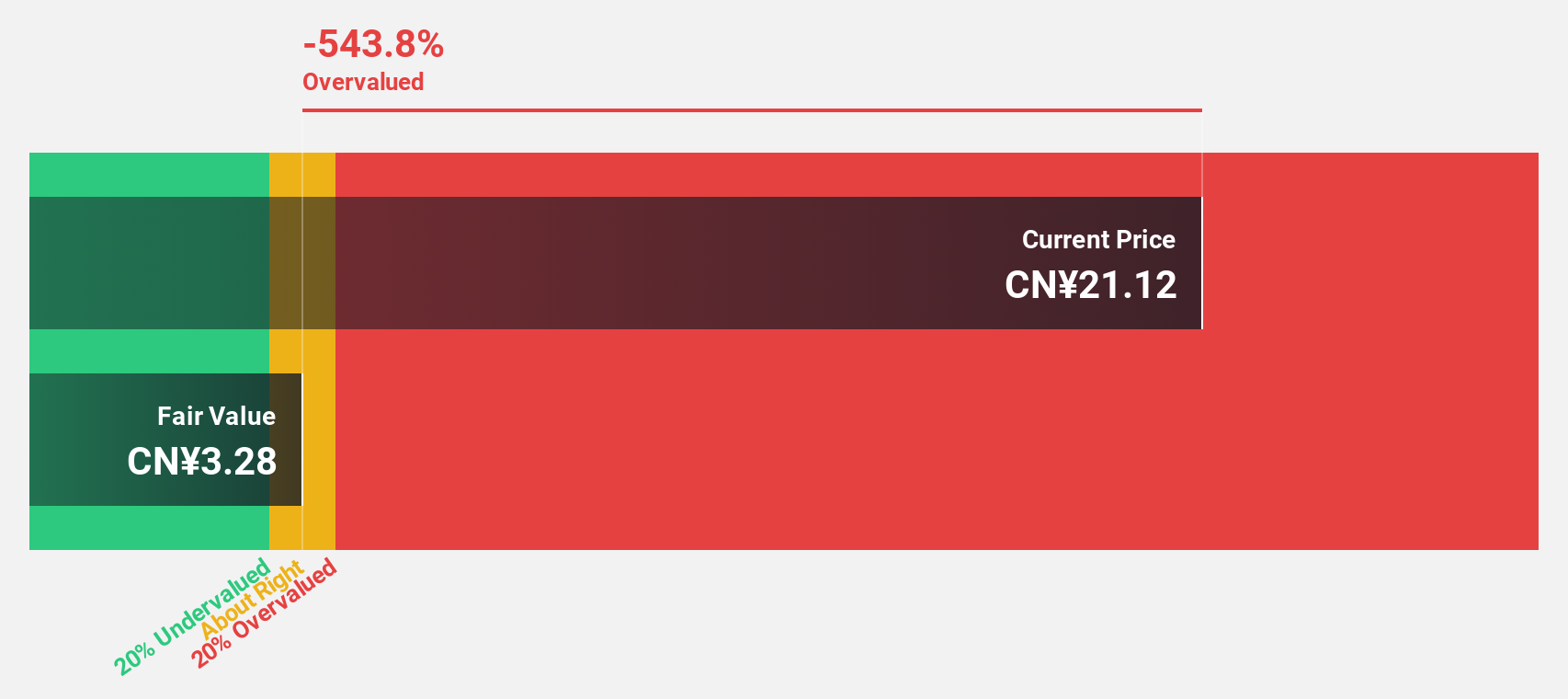

Shenzhen Yinghe Technology (SZSE:300457)

Overview: Shenzhen Yinghe Technology Co., Ltd specializes in the R&D, production, and sale of lithium-ion battery automation equipment in China, with a market cap of CN¥13.83 billion.

Operations: The company generates revenue primarily through its research, development, production, and sale of automation equipment for lithium-ion batteries in China.

Estimated Discount To Fair Value: 39.6%

Shenzhen Yinghe Technology, trading at CNY 21.43, is significantly undervalued based on cash flow analysis compared to a fair value estimate of CNY 35.49. The company has announced a share repurchase program worth up to CNY 200 million, which may enhance shareholder value. Earnings and revenue are forecast to grow faster than the Chinese market at 32.3% and 20.1% annually, respectively, though return on equity remains modest at an expected 14.1%.

- Insights from our recent growth report point to a promising forecast for Shenzhen Yinghe Technology's business outlook.

- Click here to discover the nuances of Shenzhen Yinghe Technology with our detailed financial health report.

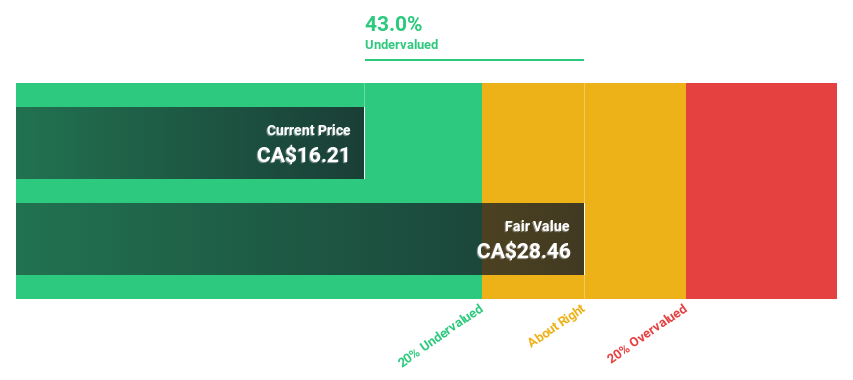

Peyto Exploration & Development (TSX:PEY)

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin with a market cap of CA$3.30 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, which generated CA$900.94 million.

Estimated Discount To Fair Value: 41.5%

Peyto Exploration & Development, priced at CA$16.57, is trading significantly below its estimated fair value of CA$28.34, highlighting its undervaluation based on cash flows. Despite a high debt level and unsustainable dividend coverage by free cash flows, the company’s earnings are projected to grow substantially at 24.6% annually over the next three years, outpacing Canadian market averages. Recent dividend affirmations reinforce shareholder returns with a consistent monthly payout of CA$0.11 per share.

- According our earnings growth report, there's an indication that Peyto Exploration & Development might be ready to expand.

- Get an in-depth perspective on Peyto Exploration & Development's balance sheet by reading our health report here.

Summing It All Up

- Embark on your investment journey to our 909 Undervalued Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300457

Shenzhen Yinghe Technology

Engages in the research and development, production, and sale of lithium-ion battery automation equipment in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives