- Switzerland

- /

- Electrical

- /

- SWX:ABBN

ABB’s $110 Million US Expansion Could Be a Game Changer for ABB (SWX:ABBN)

Reviewed by Simply Wall St

- ABB recently announced a further US$110 million investment to expand its R&D and manufacturing presence across the United States, adding new production lines and jobs in Mississippi, Virginia, North Carolina, and Puerto Rico to meet growing demand for advanced electrification solutions.

- This expansion targets the surging electricity needs of US data centers and utilities, as annual power demand growth now exceeds twice the previous decade's pace.

- We’ll examine how ABB’s multi-site US investment in advanced electrification shapes its long-term growth narrative and market positioning.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ABB Investment Narrative Recap

To be comfortable holding ABB shares, an investor needs to believe in the structural demand for electrification and grid modernization, especially as data center and utility growth accelerates. The company’s major new investments in US production directly address rising power needs, which could act as a near-term catalyst, though persistent weakness in industrial segments and competitive pricing in China remain the most significant risks, largely unchanged by this US-focused expansion.

The launch of ABB’s Emax 3 circuit breaker and a dedicated new production line in Mississippi is especially connected to surging data center power demand, which underpins optimism about the company’s earnings pipeline. This aligns with recent earnings momentum, though exposure to more volatile industrial markets worldwide continues to shape forward risk and reward.

Yet, even as ABB doubles down on high-growth markets powered by digitalization, investors also need to watch for signs that end-market weakness could...

Read the full narrative on ABB (it's free!)

ABB's outlook anticipates $39.3 billion in revenue and $5.5 billion in earnings by 2028. This is based on a 5.4% annual revenue growth rate and a $1.3 billion increase in earnings from the current $4.2 billion level.

Uncover how ABB's forecasts yield a CHF51.11 fair value, a 9% downside to its current price.

Exploring Other Perspectives

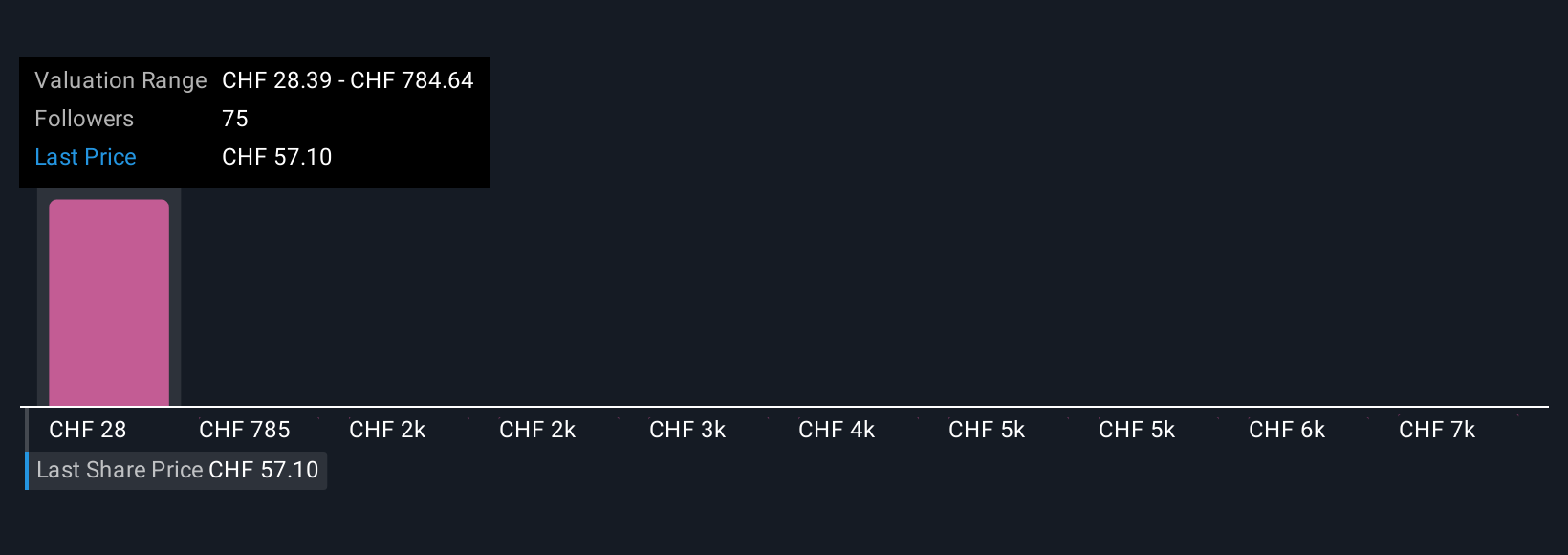

Nine members of the Simply Wall St Community place fair values for ABB from as low as US$28.39 up to US$7,590.93 per share. With such varied outlooks, consider how ABB’s focus on advanced electrification solutions shapes potential returns and the risks around global industrial demand.

Explore 9 other fair value estimates on ABB - why the stock might be a potential multi-bagger!

Build Your Own ABB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ABB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABB's overall financial health at a glance.

No Opportunity In ABB?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ABBN

ABB

Provides electrification, motion, and automation solutions and products for customers in utilities, industry and transport, and infrastructure in Europe, the Americas, Asia, the Middle East, and Africa.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives