- Switzerland

- /

- Electrical

- /

- SWX:ABBN

ABB (SWX:ABBN) Valuation in Focus After New Nottingham Facility Boosts Infrastructure Expansion

Reviewed by Kshitija Bhandaru

ABB (SWX:ABBN) has opened a major new manufacturing and research facility in Nottingham, U.K., focused on advanced earthing and lightning protection solutions. This move signals ABB’s commitment to infrastructure safety, research, and expanding global capacity.

See our latest analysis for ABB.

ABB’s unveiling of its new Nottingham facility comes amid a steady climb in total shareholder returns, with a 1-year TSR of 21.6% and an impressive 85.9% over the past five years. Strong sector investments like this, along with a recent $110 million U.S. expansion, suggest momentum is building as the company sharpens its focus on infrastructure upgrades and electrification demand.

If big infrastructure moves capture your attention, now is a good time to discover other leaders with fast growth and high insider ownership through our constantly updated screener: fast growing stocks with high insider ownership

With ABB shares delivering robust returns and growth investments, the question remains: is the stock trading below its true value, or have investors already priced in the next wave of growth potential?

Most Popular Narrative: 13% Overvalued

ABB's fair value, according to the most popular narrative, sits noticeably below its recent close. With the share price outpacing consensus, valuation tension is mounting and a deeper dive into the underlying assumptions is essential.

ABB's robust order intake, especially in electrification, utility, and data center demand, reflects structural increases in global electricity consumption and grid upgrades as industries and urban infrastructure transition away from fossil fuels. This underpins visible multi-year revenue growth and an expanding order backlog. The company's expansion of embedded intelligence and digital capabilities (as seen in the Emax 3 circuit breaker and broader ABB Ability™ platform) is driving higher-margin service and software revenues along with recurring income, supporting long-term margin and earnings improvement.

Curious what sales and profit leaps are fueling this 2028 forecast? One core assumption hinges on rising margins and a future profit multiple that could surprise even long-term bulls. Find out what ambitious projections drive this high-stakes valuation.

Result: Fair Value of $51.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key end-markets or intensifying competition, especially in China, could quickly challenge the assumptions underpinning ABB’s current outlook.

Find out about the key risks to this ABB narrative.

Another View: Ratio Risks and Market Comparisons

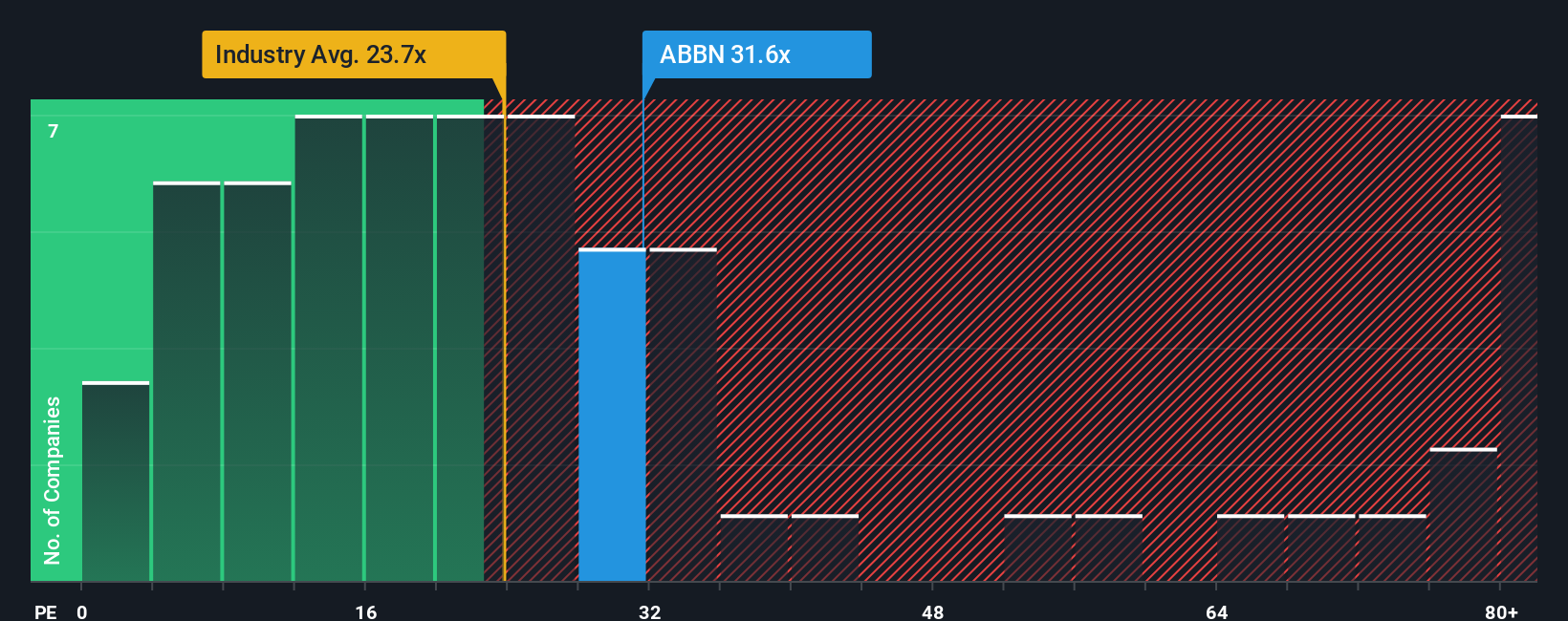

Looking at ABB through the lens of its price-to-earnings ratio, a different picture emerges. At 32x, ABB trades higher than both its peer average of 29.4x and the European Electrical industry at 23.7x. However, it remains below its fair ratio of 35.1x. This premium suggests optimism is already reflected in its valuation, but also exposes investors to potential downside if the company faces challenges or if sector sentiment changes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ABB Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own narrative in just a few minutes, your way: Do it your way

A great starting point for your ABB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of market moves by tapping into fresh opportunities. Don’t wait for tomorrow’s news; other growth stories are taking shape right now.

- Capitalize on the rush for consistent income by reviewing these 19 dividend stocks with yields > 3% with yields above 3% and the fundamentals to back them up.

- Spot tomorrow’s healthcare disruptors by scanning these 32 healthcare AI stocks driving breakthroughs with AI across medical research and patient care.

- Catch the surge of innovation with these 24 AI penny stocks, uncovering companies at the cutting edge of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ABBN

ABB

Provides electrification, motion, and automation solutions and products for customers in utilities, industry and transport, and infrastructure in Europe, the Americas, Asia, the Middle East, and Africa.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives