- Switzerland

- /

- Banks

- /

- SWX:SGKN

St. Galler Kantonalbank (SWX:SGKN): Is the Current Valuation Justified by Its Recent Steady Performance?

Reviewed by Kshitija Bhandaru

St. Galler Kantonalbank (SWX:SGKN) stock has kept investors curious this past month, returning just over 1%. The broader gains over the past year show steady interest as the Swiss bank continues to chart its growth story.

See our latest analysis for St. Galler Kantonalbank.

After a brief pullback last week, St. Galler Kantonalbank's 1-month share price return of 1.2% points to steady momentum. This has contributed to a robust 1-year total shareholder return of 26.3%. Investors appear to be recognizing the bank's consistent performance and its potential for further growth.

If recent returns have you curious about what other standout performers are out there, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The bank’s steady climb and strong shareholder returns over the past year make it tempting to view St. Galler Kantonalbank as a bargain. However, are investors missing hidden value, or is future growth already factored in?

Price-to-Earnings of 13.4x: Is it justified?

St. Galler Kantonalbank currently trades at a price-to-earnings ratio of 13.4x. This puts the latest close of CHF508 under the microscope compared to peers.

The price-to-earnings ratio is a measure of how much investors are willing to pay for a franc of earnings and is often used to benchmark how highly a bank is valued relative to its profits. A higher multiple can signal optimism about future growth or profitability, while a lower one may point to skepticism.

In this case, St. Galler Kantonalbank's multiple of 13.4x is higher than the European Banks industry average of 9.9x, indicating that the market may be assigning a premium to its shares based on earnings expectations. However, compared to the peer average of 16.1x, the stock still appears reasonably valued relative to direct competitors.

There is insufficient data to determine the company's price-to-earnings fair ratio, so the current premium may persist if growth and quality remain strong, or adjust if industry dynamics shift.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.4x (ABOUT RIGHT)

However, shifts in industry dynamics or unexpected revenue headwinds could quickly challenge expectations for St. Galler Kantonalbank's continued outperformance.

Find out about the key risks to this St. Galler Kantonalbank narrative.

Another View: Discounted Cash Flow Perspective

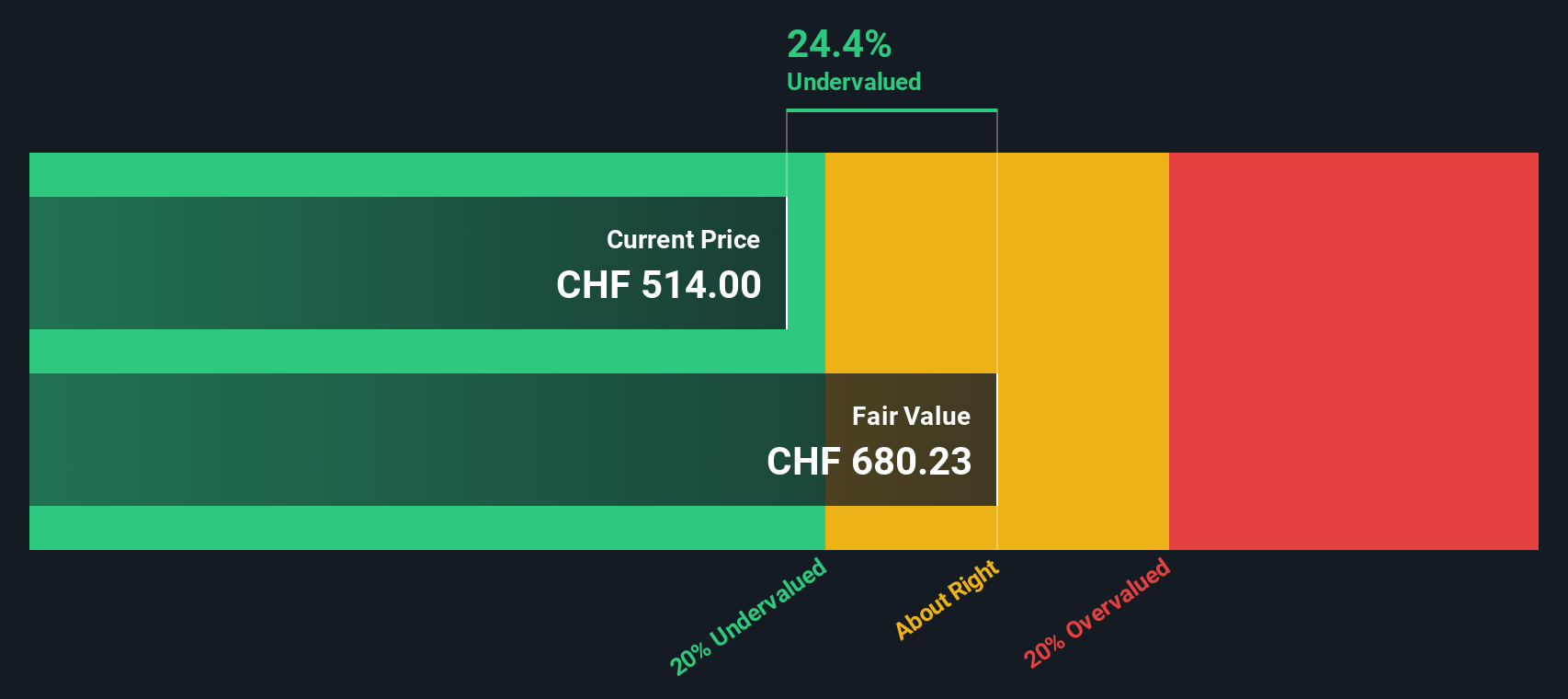

Taking a different approach, our DCF model suggests St. Galler Kantonalbank could be undervalued by about 25% compared to its fair value estimate. This challenges the notion that the current market price fully reflects the bank’s prospects. Could there be more upside hidden beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out St. Galler Kantonalbank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own St. Galler Kantonalbank Narrative

If you have a different take or want to dive deeper on your own, it's quick and easy to build your own analysis in just a few minutes. Do it your way

A great starting point for your St. Galler Kantonalbank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities pass you by. Cast a wider net with Simply Wall Street’s Screeners and see what other gems are waiting for you.

- Accelerate your search for future market leaders and check out these 25 AI penny stocks, which are at the forefront of breakthrough innovation.

- Supercharge your portfolio’s income by spotting these 18 dividend stocks with yields > 3%, featuring attractive yields and strong fundamentals.

- Jump ahead of the crowd and find these 3575 penny stocks with strong financials, bursting with growth potential before they make headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGKN

St. Galler Kantonalbank

A cantonal bank, provides banking products and services to the local population, and small and middle-sized companies in the Cantons of St.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives