- Switzerland

- /

- Banks

- /

- SWX:SGKN

Is There Still Opportunity in St. Galler Kantonalbank as Shares Rise 28% This Year?

Reviewed by Bailey Pemberton

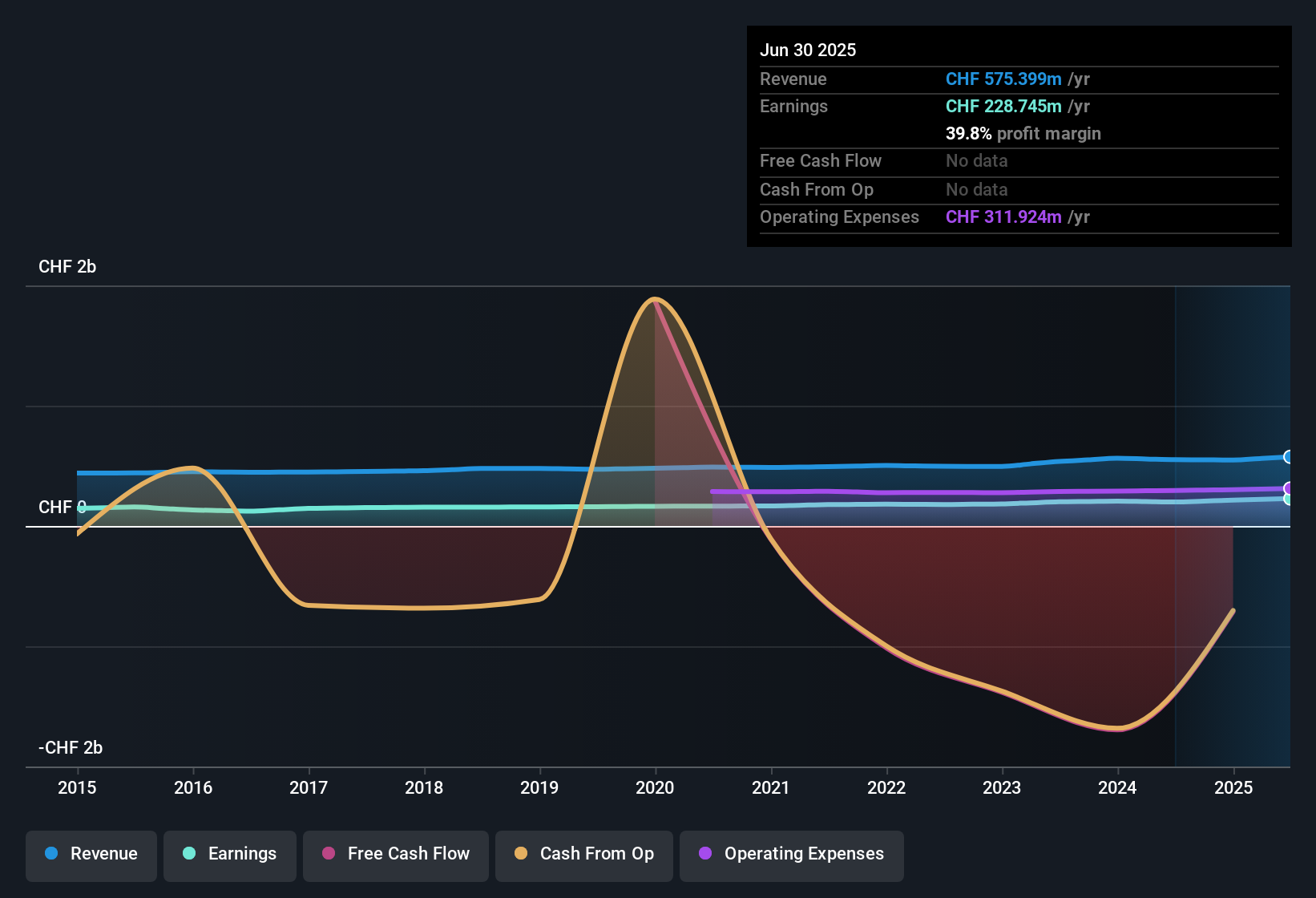

Thinking about what to do with your St. Galler Kantonalbank shares, or maybe contemplating whether now is the right moment to jump in? You are not alone. This established Swiss bank has quietly rewarded patient investors, with the stock climbing nearly 28.3% over the past year and an impressive 55.6% over the last five years. Even in the short term, the stock posted a solid 2.0% gain this week, extending its steady 14.8% rise year-to-date. Recent price movements may reflect shifting market sentiment, as investors increasingly view traditional banks as safe harbors in turbulent conditions, and as Swiss lenders like St. Galler Kantonalbank have benefited from increased demand for regional financial services.

So what does all this mean for its valuation? By the numbers, St. Galler Kantonalbank currently scores 3 out of 6 on our undervaluation checklist. This is a signal that the stock meets half of our key value metrics. On some fronts, it looks like there is still upside to be unlocked for value-focused investors.

But before you make any moves, it is worth digging deeper into how we arrive at these valuation checks, and why the real story of value sometimes cannot be captured by numbers alone. Let us break down the valuation methods and see where St. Galler Kantonalbank stands. Later in this article, we will explore an even more revealing way to weigh up its true worth.

Approach 1: St. Galler Kantonalbank Excess Returns Analysis

The Excess Returns Model evaluates a company's ability to generate returns above its cost of equity, focusing on how effectively it puts shareholder capital to work. For St. Galler Kantonalbank, this approach highlights the relationship between its stable earnings power and the long-term value it creates for investors.

Based on the latest data, St. Galler Kantonalbank has a Book Value of CHF502.70 per share and a Stable Earnings Per Share (EPS) of CHF33.93, calculated using the median return on equity from the past five years. The Cost of Equity is CHF24.74 per share, so the bank achieves an Excess Return of CHF9.19 per share. Its average Return on Equity is 7.02%, with a stable book value tracked at CHF483.20 per share. These figures suggest the bank has consistently earned more on its equity than required, supporting a robust intrinsic valuation.

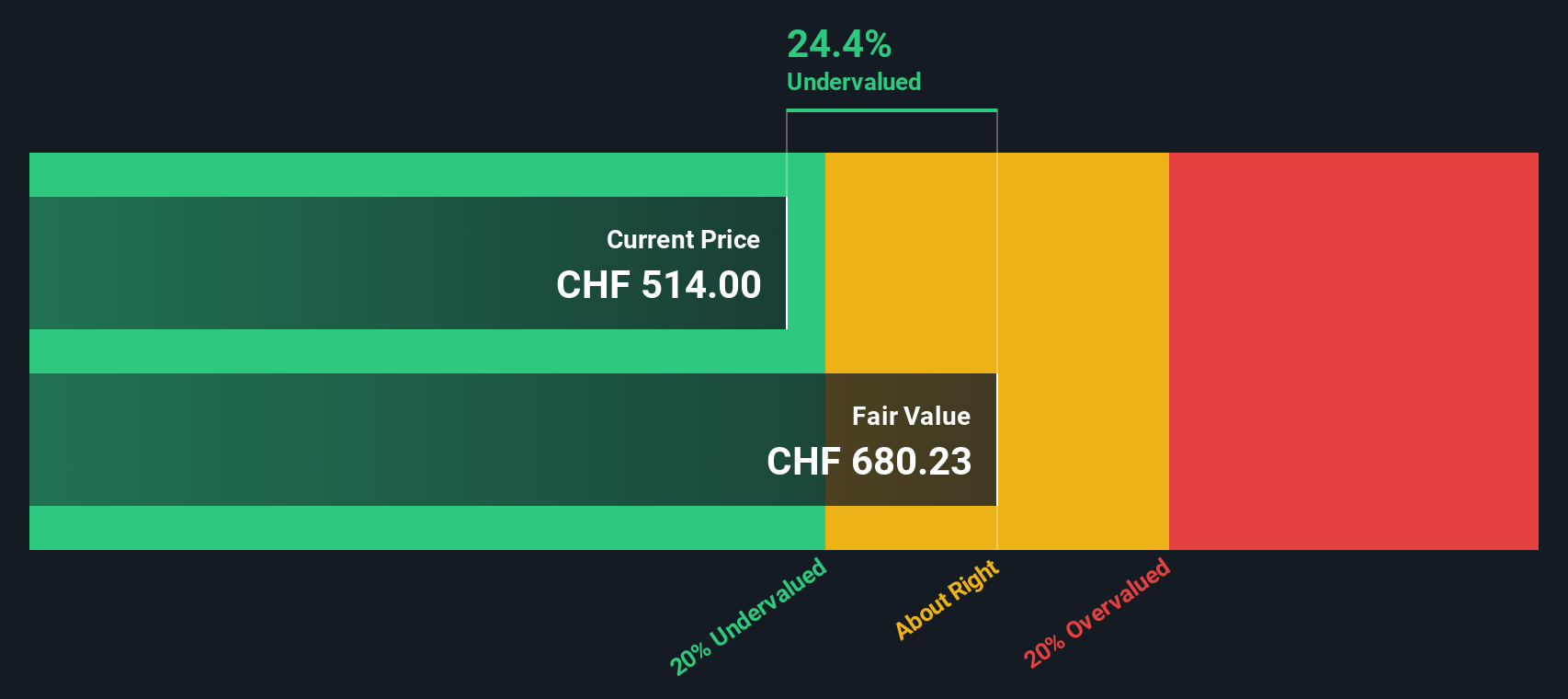

Applying this model, the estimated intrinsic value of the stock signals that St. Galler Kantonalbank is trading at a 24.6% discount to its fair value. This means the stock currently appears undervalued relative to its underlying profitability and growth fundamentals.

Result: UNDERVALUED

Our Excess Returns analysis suggests St. Galler Kantonalbank is undervalued by 24.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: St. Galler Kantonalbank Price vs Earnings

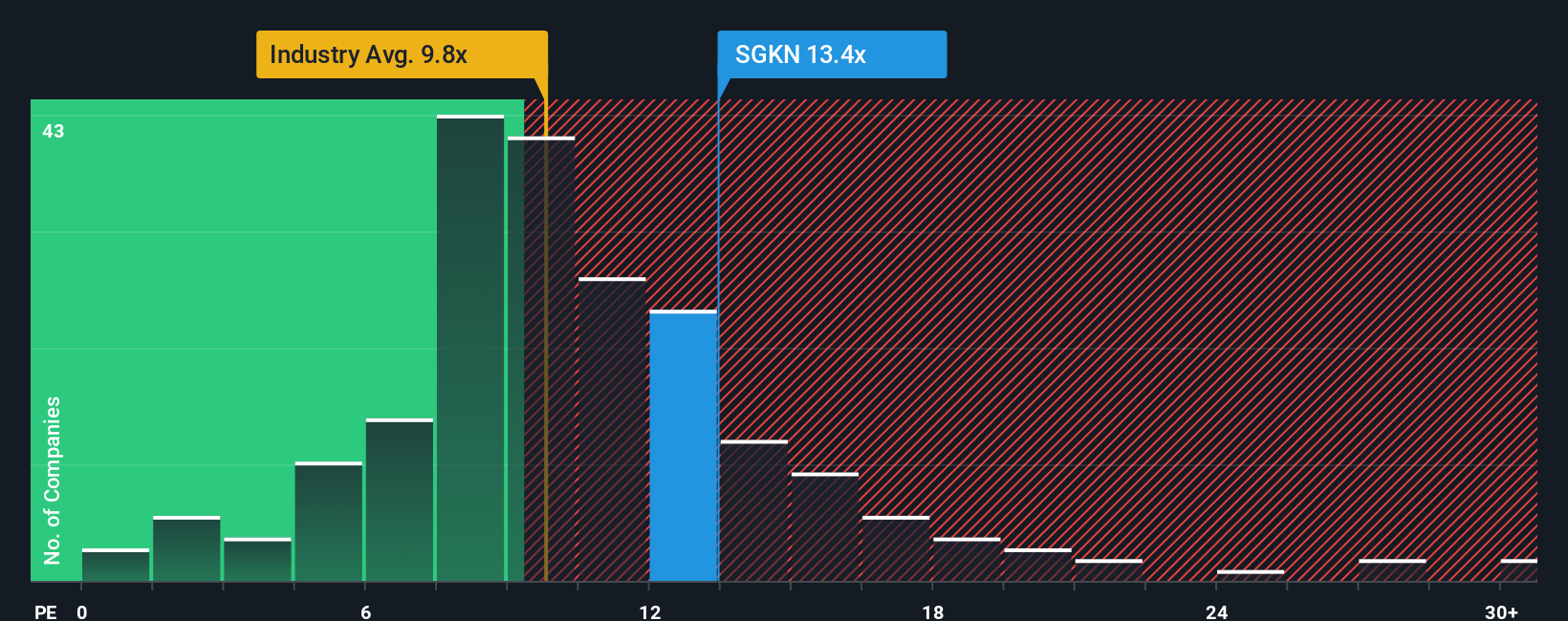

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like St. Galler Kantonalbank because it connects the current share price to the underlying earnings power. For mature and consistently profitable businesses, the PE ratio can help investors quickly gauge whether the company is reasonably valued based on how much profit it generates relative to its market price.

Growth expectations and risk profile are key factors influencing what counts as a “fair” PE ratio. Companies with strong expected growth or lower perceived risk often command higher PE multiples. Those with uncertain outlooks or industry headwinds tend to trade at lower ratios. This is why PE ratios can vary meaningfully even within the same sector.

Currently, St. Galler Kantonalbank trades at a PE ratio of 13.41x. This places it below the peer average of 16.10x but above the industry average for banks, which stands at 10.34x. At first glance, this could suggest the stock is attractively valued compared to similar companies, though not especially cheap compared to the overall sector.

Simply Wall St's proprietary “Fair Ratio” goes a step further. Rather than simply benchmarking against the sector or direct peers, it generates a tailored PE multiple using an algorithm that considers earnings growth, profit margin, size, industry landscape and specific business risks. This approach provides investors with a clearer sense of whether the company’s unique profile is priced efficiently by the market.

In this case, because the difference between St. Galler Kantonalbank’s actual PE ratio and its Fair Ratio is less than 0.10x, the stock appears to be valued about right according to these custom benchmarks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your St. Galler Kantonalbank Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personal story behind the numbers, combining your view of a company's prospects with your assumptions for its future revenue, earnings, and margins to arrive at your own fair value. Narratives connect what you believe about St. Galler Kantonalbank’s future to a financial forecast and, ultimately, a data-driven estimate of what the stock should be worth.

Using Narratives on Simply Wall St’s platform is straightforward and accessible. This dynamic feature is a favorite among millions of investors in the Community page. Narratives make decision-making simpler by letting you easily compare your personalized Fair Value to the current market price, helping you identify if a stock is overvalued or undervalued. They update automatically as new information is released, ensuring your forecasts always reflect the latest news or earnings results.

For instance, some investors see St. Galler Kantonalbank’s future fair value as high as CHF900 per share, while others estimate it closer to CHF520. This reflects how different narratives shape each user’s investment view.

Do you think there's more to the story for St. Galler Kantonalbank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGKN

St. Galler Kantonalbank

A cantonal bank, provides banking products and services to the local population, and small and middle-sized companies in the Cantons of St.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives