- Switzerland

- /

- Banks

- /

- SWX:LUKN

Texaf And 2 Other Reliable Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are increasingly seeking stability in their portfolios. Amidst these dynamics, dividend stocks like Texaf offer a reliable source of income, appealing to those who prioritize steady returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

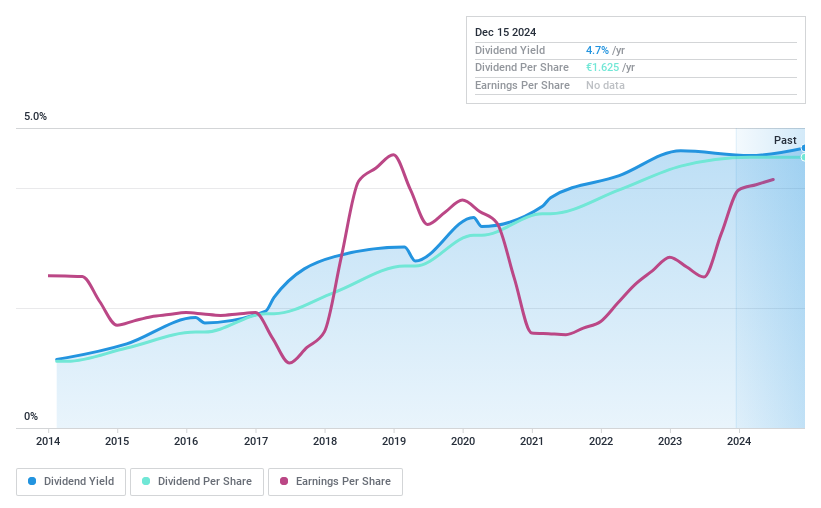

Texaf (ENXTBR:TEXF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Texaf S.A. develops, owns, and leases real estate properties in Kinshasa with a market cap of €128.33 million.

Operations: Texaf S.A.'s revenue segments include €24.26 million from Real Estate, €6.30 million from Carrigres, and €0.03 million from Digital operations.

Dividend Yield: 4.6%

Texaf offers a stable dividend profile, with dividends reliably paid and increased over the past decade. Its payout ratio of 49.6% ensures dividends are well covered by earnings, while a cash payout ratio of 56.5% indicates sustainability from free cash flows. Despite its attractive price-to-earnings ratio of 10.7x compared to the Belgian market's 13.1x, its dividend yield of 4.56% remains below the top tier in Belgium at 7.6%.

- Get an in-depth perspective on Texaf's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Texaf is trading beyond its estimated value.

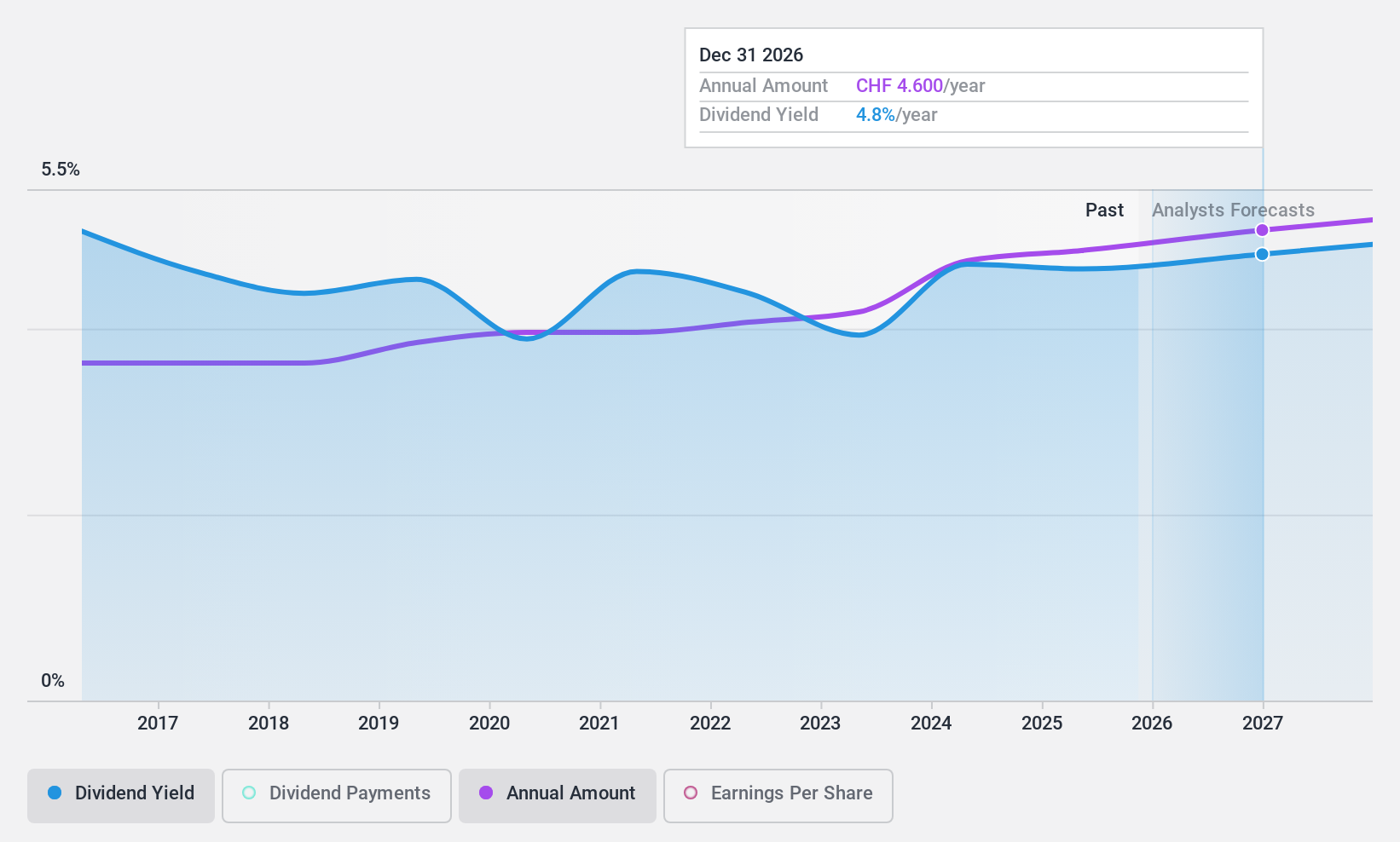

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise provides a range of financial services across Vaud Canton, Switzerland, the European Union, North America, and internationally, with a market cap of CHF7.17 billion.

Operations: Banque Cantonale Vaudoise generates revenue through its diverse financial services operations across Switzerland, the European Union, North America, and other international markets.

Dividend Yield: 5.1%

Banque Cantonale Vaudoise provides a compelling dividend profile, with consistent and growing payments over the past decade. Its dividend yield of 5.06% places it in the top 25% of Swiss market payers, supported by a sustainable payout ratio currently at 78.7%, forecasted to be covered by earnings in three years (87.3%). The price-to-earnings ratio is favorable at 16.2x compared to the Swiss market's average of 21x, enhancing its value proposition for investors seeking dividends.

- Click here to discover the nuances of Banque Cantonale Vaudoise with our detailed analytical dividend report.

- The analysis detailed in our Banque Cantonale Vaudoise valuation report hints at an inflated share price compared to its estimated value.

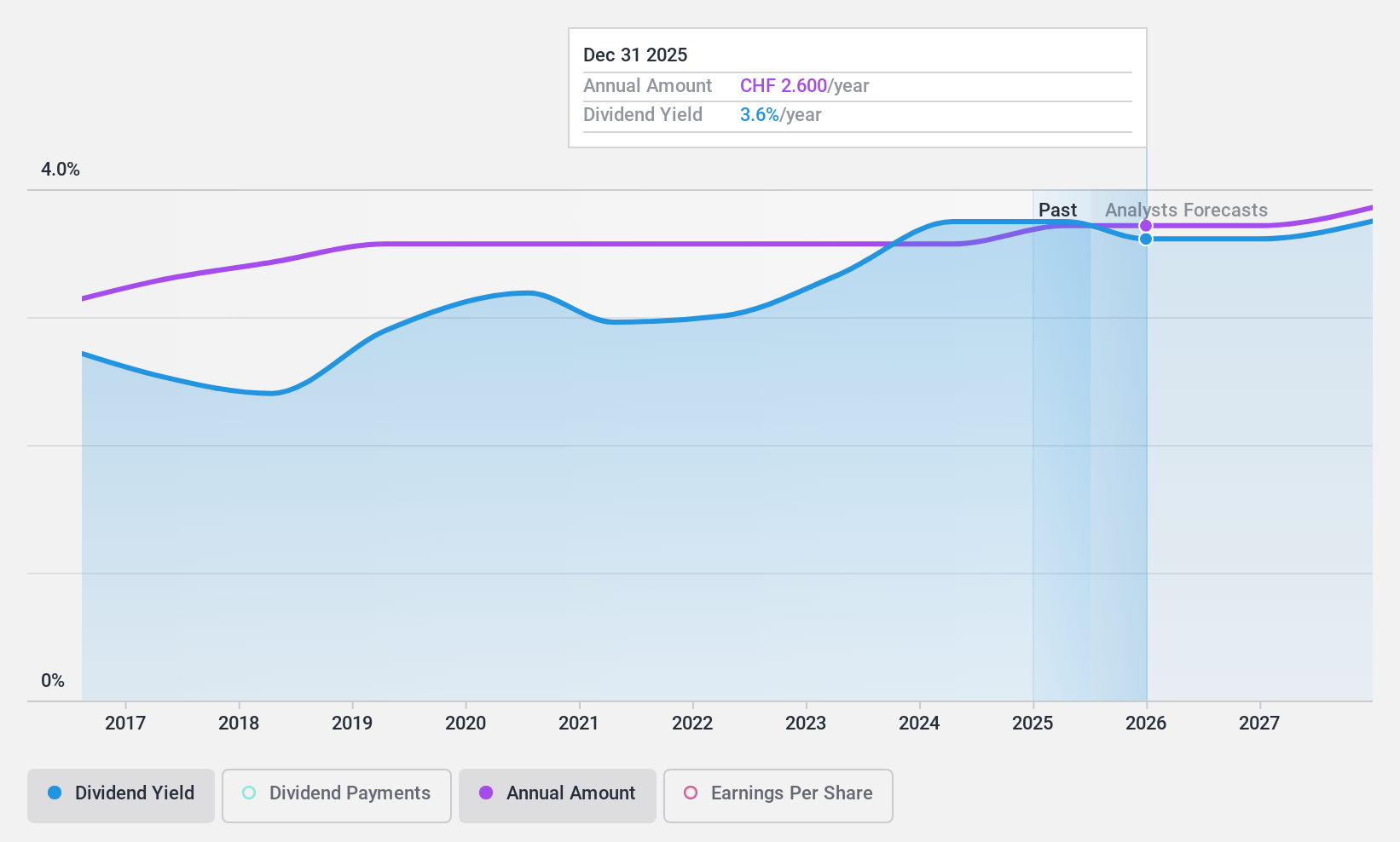

Luzerner Kantonalbank (SWX:LUKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzerner Kantonalbank AG offers a range of banking products and services in Switzerland, with a market cap of CHF3.15 billion.

Operations: Luzerner Kantonalbank AG generates revenue through diverse banking products and services within Switzerland.

Dividend Yield: 3.8%

Luzerner Kantonalbank offers a stable dividend profile with consistent growth over the past decade. The dividend yield stands at 3.85%, slightly below the top Swiss payers, but remains reliable and well-covered by earnings, with a current payout ratio of 46.5% and forecasted to decrease to 41.4%. Trading at 39.3% below estimated fair value enhances its appeal for value-conscious investors seeking dependable dividends amidst steady earnings growth of 10.4% last year.

- Delve into the full analysis dividend report here for a deeper understanding of Luzerner Kantonalbank.

- Our valuation report here indicates Luzerner Kantonalbank may be undervalued.

Taking Advantage

- Click here to access our complete index of 1982 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LUKN

Luzerner Kantonalbank

Provides various banking products and services in Switzerland.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives