- Switzerland

- /

- Banks

- /

- SWX:LLBN

Shareholders Of Liechtensteinische Landesbank (VTX:LLBN) Must Be Happy With Their 89% Return

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Liechtensteinische Landesbank Aktiengesellschaft (VTX:LLBN) share price is up 59% in the last 5 years, clearly besting the market return of around 15% (ignoring dividends).

See our latest analysis for Liechtensteinische Landesbank

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

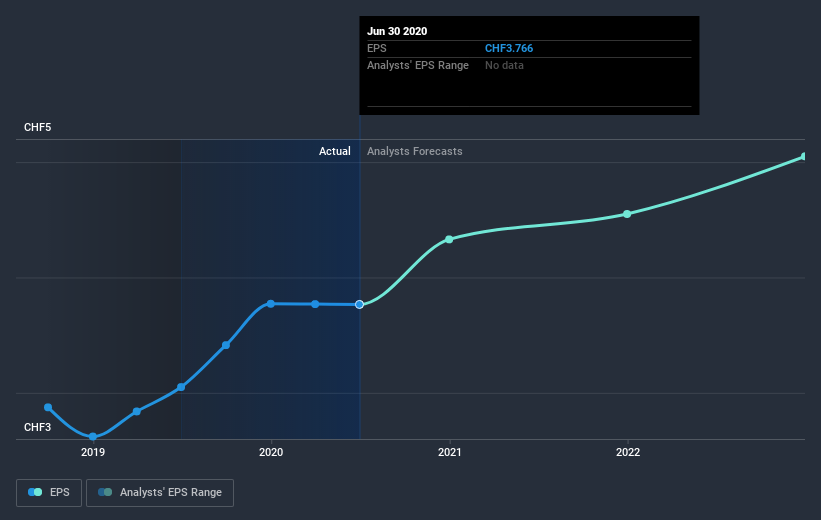

During five years of share price growth, Liechtensteinische Landesbank achieved compound earnings per share (EPS) growth of 9.5% per year. That makes the EPS growth particularly close to the yearly share price growth of 10%. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Liechtensteinische Landesbank has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Liechtensteinische Landesbank's TSR for the last 5 years was 89%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Liechtensteinische Landesbank shareholders are down 9.9% for the year (even including dividends), but the market itself is up 2.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 14%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Liechtensteinische Landesbank better, we need to consider many other factors. Even so, be aware that Liechtensteinische Landesbank is showing 1 warning sign in our investment analysis , you should know about...

Of course Liechtensteinische Landesbank may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you’re looking to trade Liechtensteinische Landesbank, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:LLBN

Liechtensteinische Landesbank

Provides banking products and services in Liechtenstein, Switzerland, Germany, and Austria.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives