- Switzerland

- /

- Auto Components

- /

- SWX:AUTN

Autoneum Holding AG (VTX:AUTN) Released Earnings Last Week And Analysts Lifted Their Price Target To CHF168

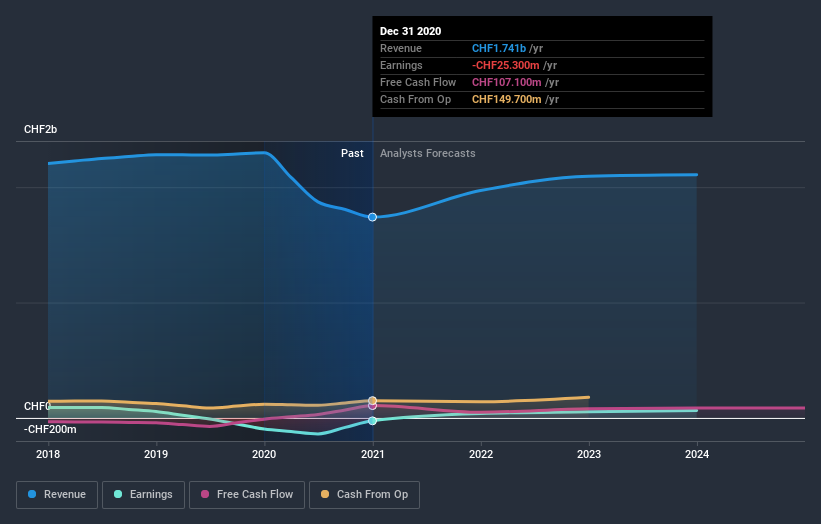

Last week saw the newest yearly earnings release from Autoneum Holding AG (VTX:AUTN), an important milestone in the company's journey to build a stronger business. It was a pretty bad result overall; while revenues were in line with expectations at CHF1.7b, statutory losses exploded to CHF5.45 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Autoneum Holding after the latest results.

View our latest analysis for Autoneum Holding

Taking into account the latest results, the consensus forecast from Autoneum Holding's five analysts is for revenues of CHF1.97b in 2021, which would reflect a solid 13% improvement in sales compared to the last 12 months. Earnings are expected to improve, with Autoneum Holding forecast to report a statutory profit of CHF8.43 per share. Before this earnings report, the analysts had been forecasting revenues of CHF1.97b and earnings per share (EPS) of CHF6.06 in 2021. Although the revenue estimates have not really changed, we can see there's been a sizeable expansion in earnings per share expectations, suggesting that the analysts have become more bullish after the latest result.

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 5.5% to CHF168. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Autoneum Holding at CHF200 per share, while the most bearish prices it at CHF150. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that Autoneum Holding is forecast to grow faster in the future than it has in the past, with revenues expected to display 13% annualised growth until the end of 2021. If achieved, this would be a much better result than the 1.7% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 7.4% per year. Not only are Autoneum Holding's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Autoneum Holding following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Autoneum Holding going out to 2023, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 1 warning sign for Autoneum Holding that you need to be mindful of.

If you decide to trade Autoneum Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:AUTN

Autoneum Holding

Develops and manufactures acoustic and thermal management solutions for light and commercial vehicles.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.