- Canada

- /

- Metals and Mining

- /

- TSXV:USCU

3 TSX Penny Stocks With Market Caps Over CA$5M

Reviewed by Simply Wall St

As Canadian markets navigate a landscape of mixed signals, with persistent inflation and solid corporate earnings, investors are keenly observing how these dynamics unfold. Despite the term "penny stock" sounding somewhat antiquated, it remains relevant for those seeking opportunities in smaller or newer companies that often fly under the radar. By focusing on penny stocks with strong financial foundations, investors can uncover potential gems that offer both stability and growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.92 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.71 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$1.86 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.16 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Altamira Gold (TSXV:ALTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Altamira Gold Corp. is involved in the acquisition, exploration, development, and mining of mineral properties in Brazil and Canada, with a market cap of CA$22.26 million.

Operations: As of the latest report, there are no specific revenue segments disclosed for Altamira Gold Corp.

Market Cap: CA$22.26M

Altamira Gold Corp., with a market cap of CA$22.26 million, is pre-revenue and focuses on exploration activities in Brazil and Canada. Recent trenching at the Cajueiro Central Project confirmed high-grade gold intercepts, suggesting promising extensions to existing resources. Despite its potential, Altamira faces challenges such as high volatility and less than a year of cash runway if current cash flow trends continue. The company has no debt but remains unprofitable with increasing losses over the past five years. Its board is experienced, but management tenure data is insufficient to assess leadership stability fully.

- Jump into the full analysis health report here for a deeper understanding of Altamira Gold.

- Assess Altamira Gold's previous results with our detailed historical performance reports.

US Copper (TSXV:USCU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: US Copper Corp. is an exploration stage company focused on the exploration and evaluation of mineral properties in Canada and the United States, with a market cap of CA$7.31 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$7.31M

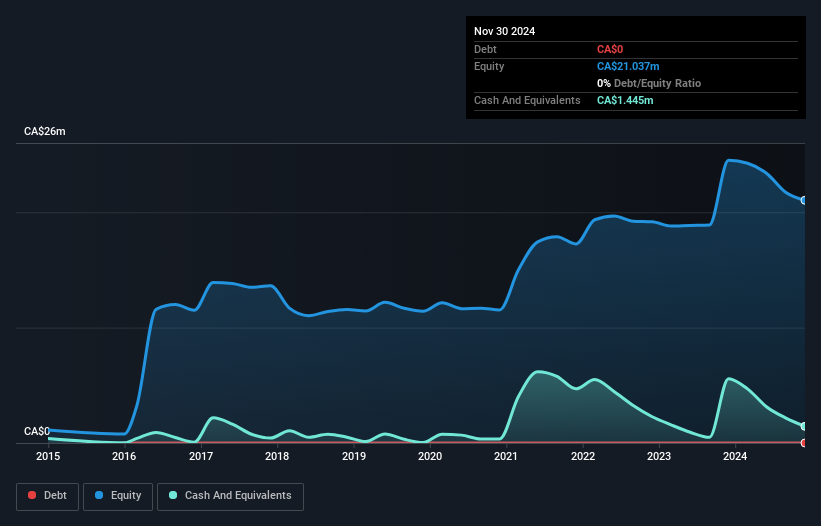

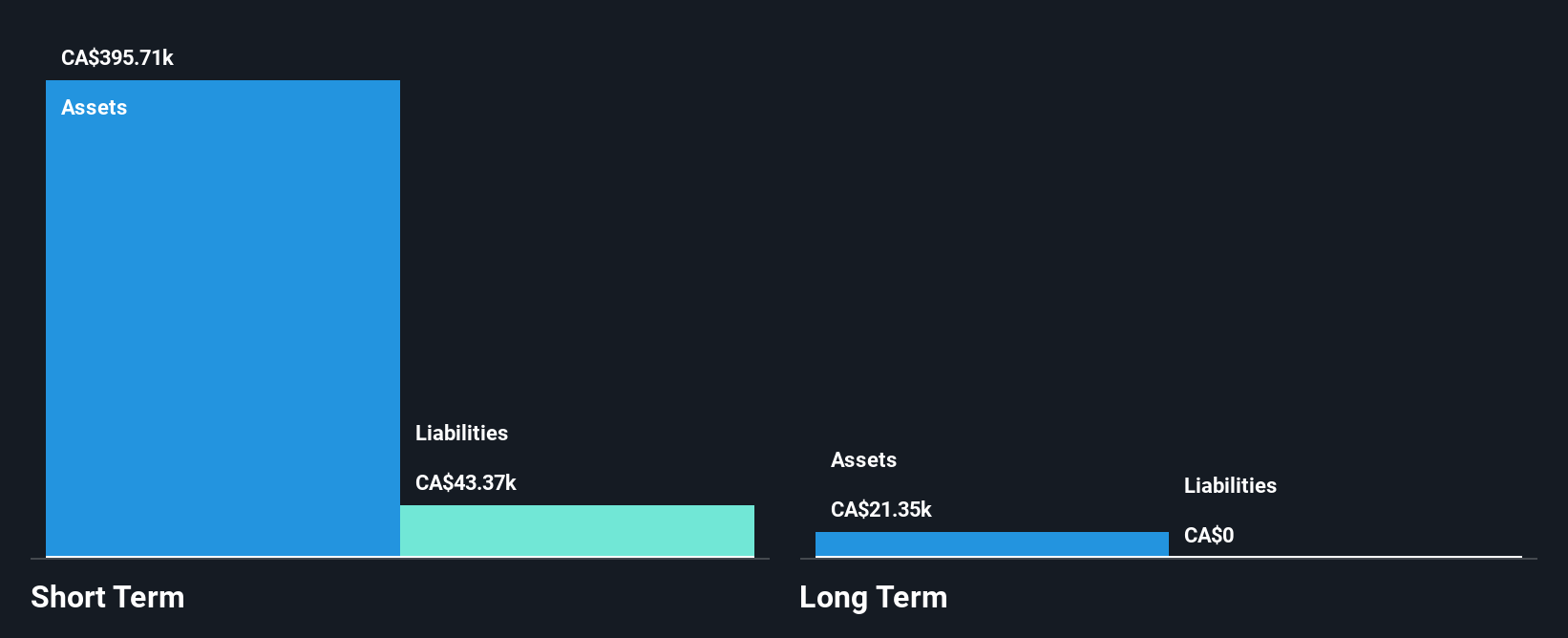

US Copper Corp., with a market cap of CA$7.31 million, is pre-revenue and focused on mineral exploration in North America. The company recently announced a significant increase in its copper resource estimate at the Moonlight-Superior Project, which could enhance future project evaluations. Despite being debt-free and having short-term assets exceeding liabilities, US Copper faces high share price volatility and limited cash runway, though a recent private placement aims to bolster finances. The board's experience contrasts with insufficient management data to evaluate leadership stability fully. Losses have decreased year-over-year but remain substantial as profitability remains elusive.

- Take a closer look at US Copper's potential here in our financial health report.

- Evaluate US Copper's historical performance by accessing our past performance report.

Current Water Technologies (TSXV:WATR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Current Water Technologies Inc. focuses on developing electrochemical water treatment and environmental technologies in Canada and the United States, with a market cap of CA$5.72 million.

Operations: Current Water Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$5.72M

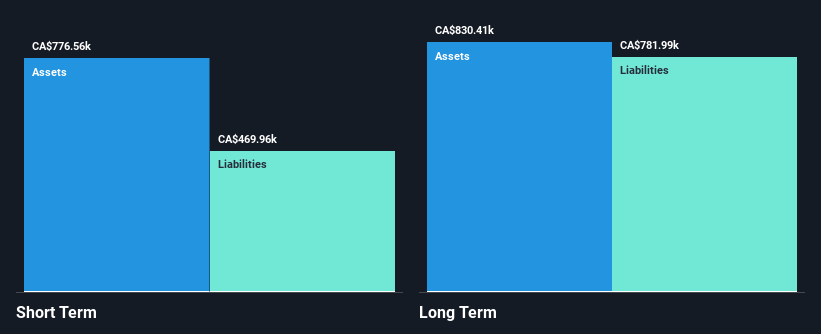

Current Water Technologies Inc., with a market cap of CA$5.72 million, is pre-revenue and focuses on electrochemical water treatment technologies. The company recently closed private placements totaling CAD 670,000 to extend its cash runway beyond the initial two to three months forecasted from free cash flow estimates. Despite being debt-free and having short-term assets that exceed liabilities, the company faces high share price volatility and has not achieved profitability. A strategic research partnership involving US federal funding could potentially pave the way for future commercial opportunities in ammonia treatment systems, though financial stability remains a challenge.

- Click here to discover the nuances of Current Water Technologies with our detailed analytical financial health report.

- Gain insights into Current Water Technologies' past trends and performance with our report on the company's historical track record.

Key Takeaways

- Dive into all 936 of the TSX Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:USCU

US Copper

An exploration stage company, engages in the mineral exploration activities in Canada and the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives