Superior Plus Corp.'s (TSE:SPB) investors are due to receive a payment of CA$0.06 per share on 15th of November. This makes the dividend yield 7.2%, which will augment investor returns quite nicely.

Our analysis indicates that SPB is potentially undervalued!

Superior Plus' Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, the company's dividend was much higher than its earnings. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

The next 12 months could see EPS growing very rapidly. Assuming the dividend continues along the path it has been on, the payout ratio could get to 87% which is certainly still sustainable.

Superior Plus Has A Solid Track Record

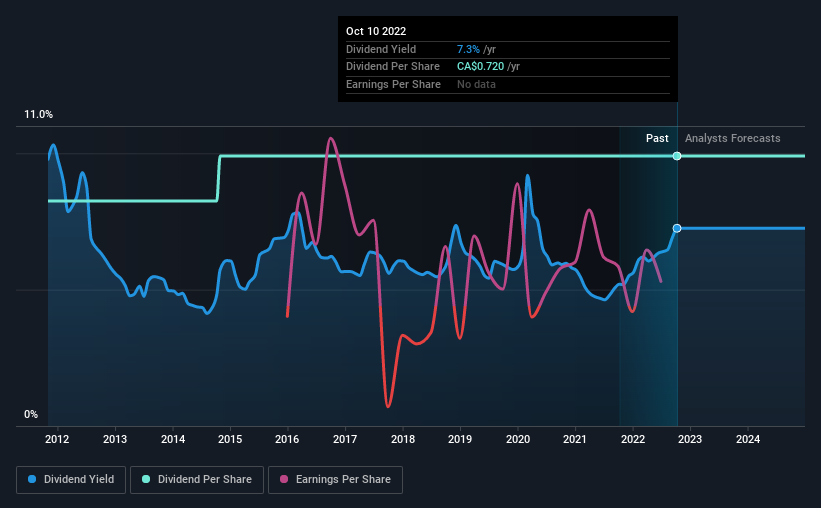

The company has an extended history of paying stable dividends. Since 2012, the annual payment back then was CA$0.60, compared to the most recent full-year payment of CA$0.72. This works out to be a compound annual growth rate (CAGR) of approximately 1.8% a year over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. Earnings per share has been sinking by 24% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We should note that Superior Plus has issued stock equal to 15% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Superior Plus' Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Superior Plus' payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 5 warning signs for Superior Plus (2 shouldn't be ignored!) that you should be aware of before investing. Is Superior Plus not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SPB

Superior Plus

Distributes and markets propane, compressed natural gas and renewable energy in both the United States and Canada.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives