- Canada

- /

- Other Utilities

- /

- TSX:CU

What Canadian Utilities (TSX:CU)'s CA$250 Million Preferred Share Redemption Means For Shareholders

Reviewed by Sasha Jovanovic

- Canadian Utilities Limited announced on October 15, 2025, that it will redeem all outstanding Cumulative Redeemable Second Preferred Shares Series FF for CA$25.00 per share, with the CA$250 million redemption funded using available cash and a final dividend of CA$0.28125 to be paid on December 1, 2025.

- This decision finalizes dividend obligations for the Series FF shares, reflecting an active approach to capital management and potentially influencing shareholder composition and future funding structure.

- We’ll assess how the planned CA$250 million preferred share redemption could impact Canadian Utilities' investment outlook and growth strategy.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Canadian Utilities Investment Narrative Recap

Investors focused on Canadian Utilities typically prioritize the stability of its regulated utility operations, reliable dividend income, and the company’s ability to manage regulatory challenges in Alberta. The CA$250 million redemption of preferred shares, while a sign of active capital management, is not expected to materially affect the immediate catalysts for the business or alter the key risks related to regulatory outcomes or capital expenditure pressures in the short term.

Of the recent announcements, the preferred share dividend declarations on October 9, 2025 stand out as closely linked with this buyback event. This series of dividend payments, including the final payout for Series FF, underscores Canadian Utilities’ ongoing commitment to fulfilling obligations to preferred shareholders alongside significant capital actions.

However, investors should be alert to regulatory risk in Alberta, which could impact Canadian Utilities’ rate base recovery if ...

Read the full narrative on Canadian Utilities (it's free!)

Canadian Utilities' narrative projects CA$4.6 billion revenue and CA$808.3 million earnings by 2028. This requires 7.4% yearly revenue growth and a CA$362.3 million earnings increase from CA$446.0 million today.

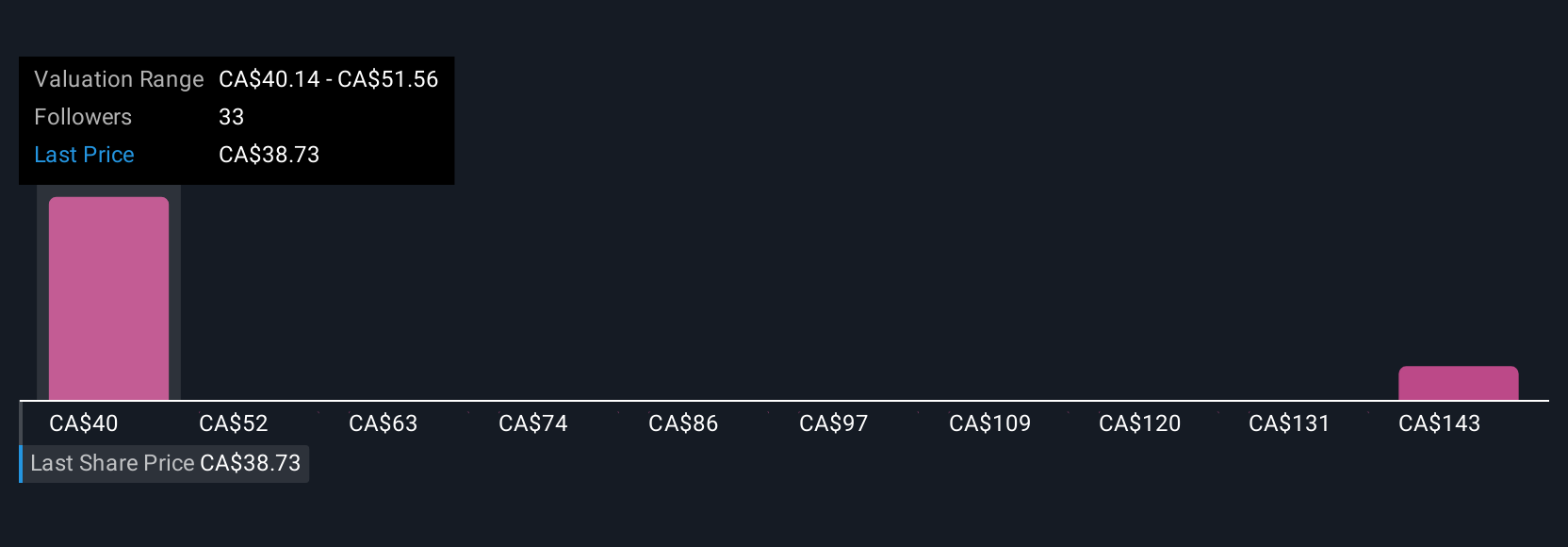

Uncover how Canadian Utilities' forecasts yield a CA$40.14 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members offered three fair value estimates for Canadian Utilities, spanning from CA$34.75 to CA$151.77 per share. This range reflects sharply contrasting views, particularly relevant as rising Alberta regulatory risk could shape how you assess the company’s future income stability.

Explore 3 other fair value estimates on Canadian Utilities - why the stock might be worth over 3x more than the current price!

Build Your Own Canadian Utilities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Utilities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Utilities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Utilities' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives