Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Capital Power Corporation (TSE:CPX) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Capital Power

What Is Capital Power's Net Debt?

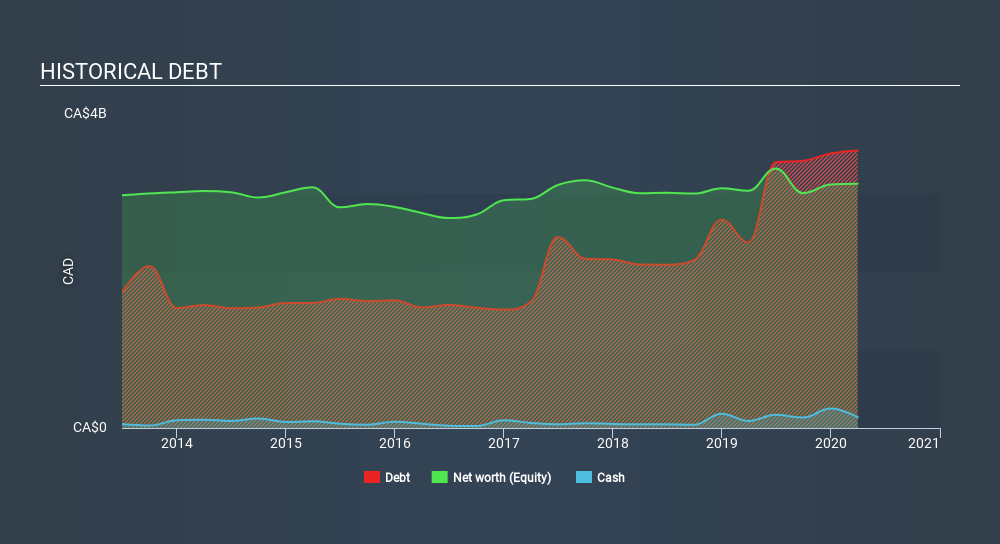

The image below, which you can click on for greater detail, shows that at March 2020 Capital Power had debt of CA$3.54b, up from CA$2.36b in one year. However, because it has a cash reserve of CA$137.0m, its net debt is less, at about CA$3.40b.

A Look At Capital Power's Liabilities

Zooming in on the latest balance sheet data, we can see that Capital Power had liabilities of CA$917.0m due within 12 months and liabilities of CA$4.79b due beyond that. Offsetting these obligations, it had cash of CA$137.0m as well as receivables valued at CA$354.0m due within 12 months. So it has liabilities totalling CA$5.22b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CA$2.82b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Capital Power would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Capital Power has a debt to EBITDA ratio of 3.1 and its EBIT covered its interest expense 3.9 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Looking on the bright side, Capital Power boosted its EBIT by a silky 75% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Capital Power can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Capital Power's free cash flow amounted to 27% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Mulling over Capital Power's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, we think it's fair to say that Capital Power has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Capital Power you should be aware of, and 1 of them doesn't sit too well with us.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Capital Power, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Moderate, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives