- Canada

- /

- Renewable Energy

- /

- TSX:BLX

Inside Buying at Boralex (TSX:BLX): What Insider Confidence Means for Its Valuation

Reviewed by Kshitija Bhandaru

Multiple executives at Boralex (TSX:BLX) have been buying shares throughout the past year. Notably, there have been no reports of insider selling during this period. This activity tends to spark interest among investors looking for signs of management's confidence.

See our latest analysis for Boralex.

Boralex’s share price recently traded at CA$28.24 and has seen little short-term volatility. However, zooming out, its one-year total shareholder return of -18% highlights that momentum has been fading even as the company posts solid growth numbers. Investors seem to be weighing near-term challenges against management’s show of confidence.

If you’re curious where the next wave of opportunity might be, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

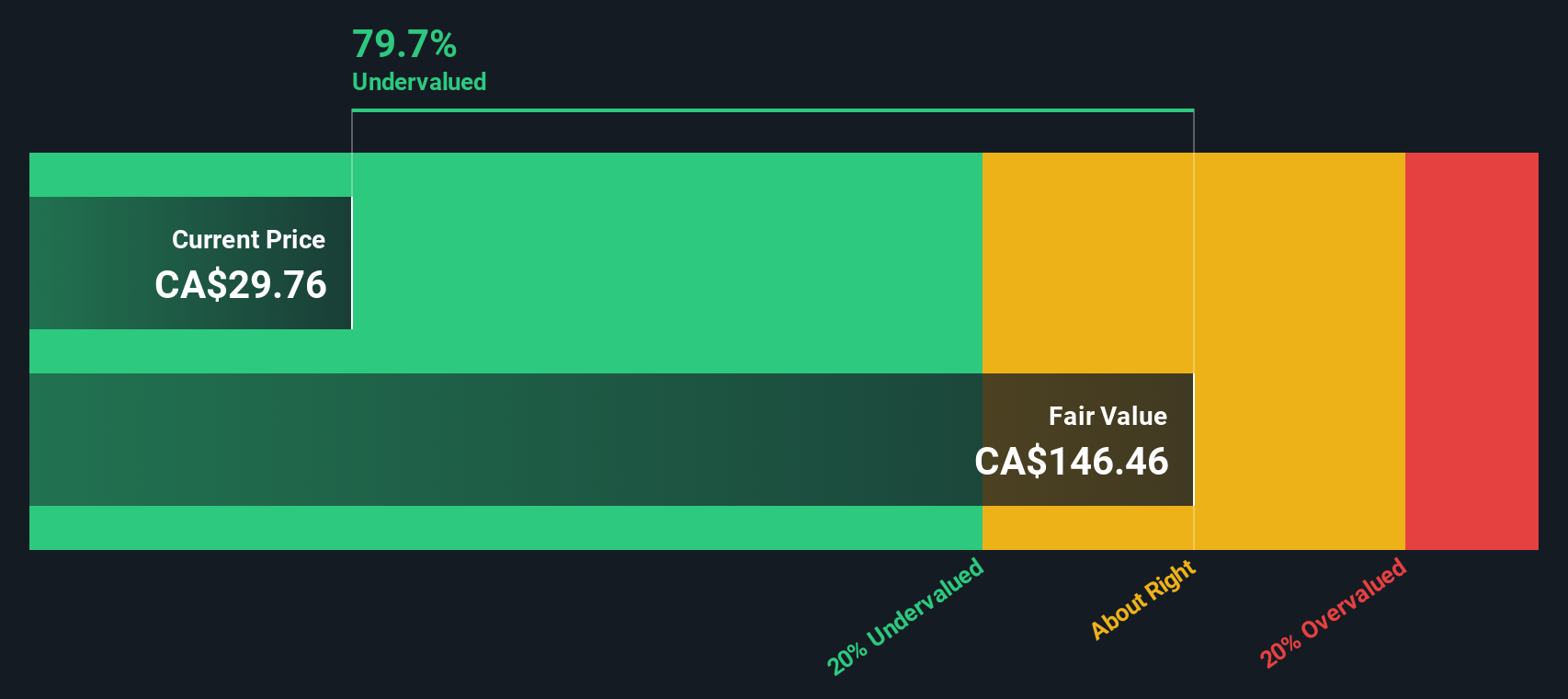

This leaves investors weighing whether the current price reflects an undervalued opportunity or if the market has already factored in all potential gains. This prompts the question: is now the moment to buy, or is future growth already priced in?

Most Popular Narrative: 25.9% Undervalued

With Boralex’s current share price sitting well below the narrative fair value, the stage is set for a potential upside if those projections materialize.

Greater regulatory clarity and renewed long-term decarbonization commitments in major markets, particularly in New York (via the "One Big Beautiful Bill") and the UK (with REMA reform), are helping de-risk new project development and support higher predictability of future cash flows. This, in turn, bolsters earnings and margins.

Want to know how these bold policy tailwinds and reliable cash flows could transform Boralex’s earnings? The secret sauce behind this narrative focuses on a leap in profit margins and a price multiple common to high-growth disruptors. Which forecasts are daring enough to back up this forecasted jump? Unlock what analysts see as the fuel for this big valuation call.

Result: Fair Value of $38.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if contract prices in France keep dropping or unpredictable weather affects output, Boralex’s projected margin rebound could be difficult to achieve.

Find out about the key risks to this Boralex narrative.

Another View: Our DCF Model Sees Even Bigger Upside

Looking through the lens of the SWS DCF model, the valuation story becomes even more dramatic for Boralex. The DCF suggests the shares could be worth up to CA$134.55, which is a sharp contrast to current prices and even the analyst target. Could the market be missing a much larger opportunity? Alternatively, is the risk just as outsized?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boralex Narrative

If you want to dive deeper or challenge these perspectives, you can explore the numbers and shape your own view in just a few minutes, and Do it your way

A great starting point for your Boralex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next winning stock slip through the cracks. The smartest investors look beyond the obvious. Fresh opportunities are waiting at your fingertips.

- Spot hidden gems with massive potential by checking out these 901 undervalued stocks based on cash flows for companies that the market may be overlooking.

- Boost your passive income and find stability in unpredictable markets by scanning these 19 dividend stocks with yields > 3% offering yields above 3%.

- Jump ahead of trends in artificial intelligence by reviewing these 24 AI penny stocks poised to benefit from this powerful technology wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boralex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BLX

Boralex

Engages in the developing, building, and operating power generating and storage facilities in Canada, France, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives