For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Boralex (TSE:BLX). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Boralex

Boralex's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Boralex's EPS went from CA$0.031 to CA$0.26 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

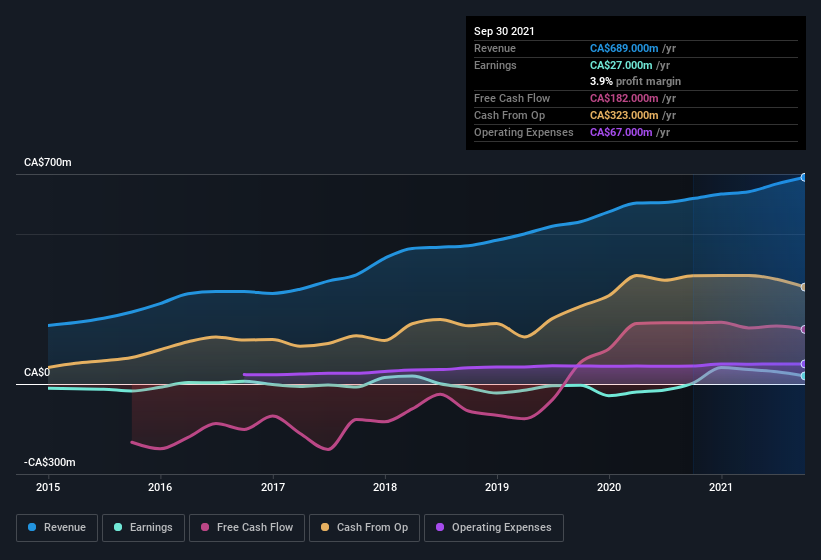

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Boralex did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Boralex's forecast profits?

Are Boralex Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months Boralex insiders spent CA$157k more buying shares than they received from selling them. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. Zooming in, we can see that the biggest insider purchase was by Independent Director Zin Smati for CA$168k worth of shares, at about CA$37.42 per share.

It's reassuring that Boralex insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Boralex with market caps between CA$2.5b and CA$8.1b is about CA$3.3m.

The CEO of Boralex only received CA$1.1m in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Boralex To Your Watchlist?

Boralex's earnings have taken off like any random crypto-currency did, back in 2017. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Boralex may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. Even so, be aware that Boralex is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

As a growth investor I do like to see insider buying. But Boralex isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boralex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BLX

Boralex

Engages in the developing, building, and operating power generating and storage facilities in Canada, France, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)