- Canada

- /

- Renewable Energy

- /

- TSX:BEP.UN

Brookfield Renewable Soars 12.7% as Investors React to Latest Clean Energy Optimism

Reviewed by Bailey Pemberton

If you've found yourself eyeing Brookfield Renewable Partners lately, you're not alone. The stock has posted an impressive 12.7% gain over the last 30 days, and it’s up 17.1% since the start of the year. These are solid numbers, especially in a sector where sentiment can swing with the latest headlines about clean energy policies and global investment flows. With a 4.8% bump just in the past week, clearly something is catching investors’ attention.

Of course, deciding what to actually do with Brookfield Renewable Partners at this point takes more than just glancing at recent gains. Some of this momentum reflects renewed optimism in the renewable energy space as market participants grow more confident in the long-term upside for companies leading the transition to cleaner power. Still, price moves only tell part of the story. The big question is whether the stock is actually undervalued, or if this recent performance has pushed it past a reasonable entry point.

To tackle that, let’s look at the data. Based on a six-point valuation framework, Brookfield Renewable Partners currently checks the box on three out of six criteria, giving it a value score of 3. Not bad, but not a slam dunk either. Up next, we will dive into what those different valuation checks actually mean, and why there might be an even smarter way to judge the company’s worth by the time we are finished.

Why Brookfield Renewable Partners is lagging behind its peers

Approach 1: Brookfield Renewable Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic worth by projecting its future cash flows and then discounting those projections back to today’s value. This method helps to reveal whether a stock’s current market price lines up with its underlying business fundamentals.

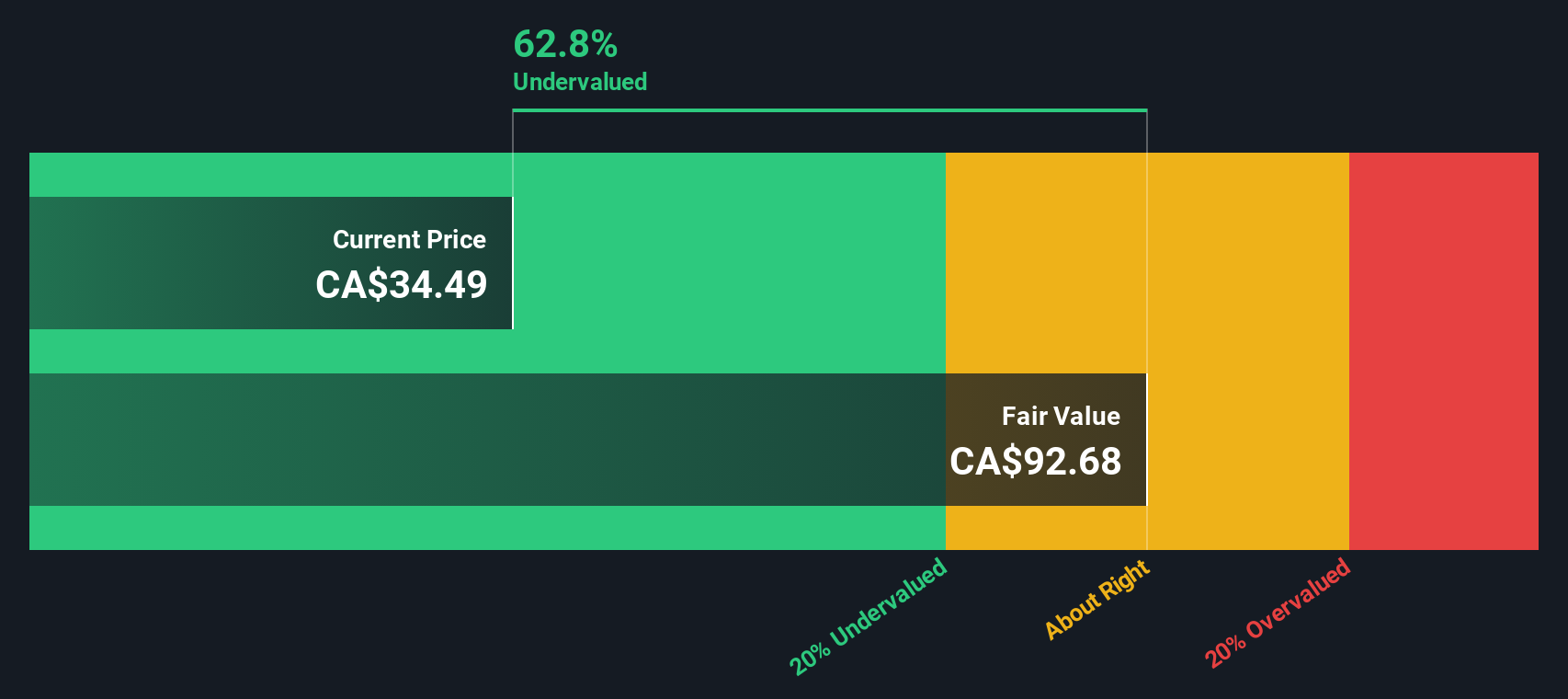

For Brookfield Renewable Partners, the DCF approach uses a “2 Stage Free Cash Flow to Equity” model based on cash flow projections. The company’s latest twelve months Free Cash Flow (FCF) stands at a negative $2.58 Billion, but is forecasted to turn positive going forward. Analyst estimates project FCF to reach $3.75 Billion by the end of 2028. Beyond analyst projections, Simply Wall St extrapolates additional growth and estimates FCF to climb as high as $6.00 Billion by 2035. All these figures are in US dollars.

Crunching the numbers, this DCF model arrives at an intrinsic value of $127.00 per share for Brookfield Renewable Partners. Compared to recent price levels, the stock appears about 69.3% undervalued by this calculation. This signals substantial upside if these projections prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brookfield Renewable Partners is undervalued by 69.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Brookfield Renewable Partners Price vs Sales

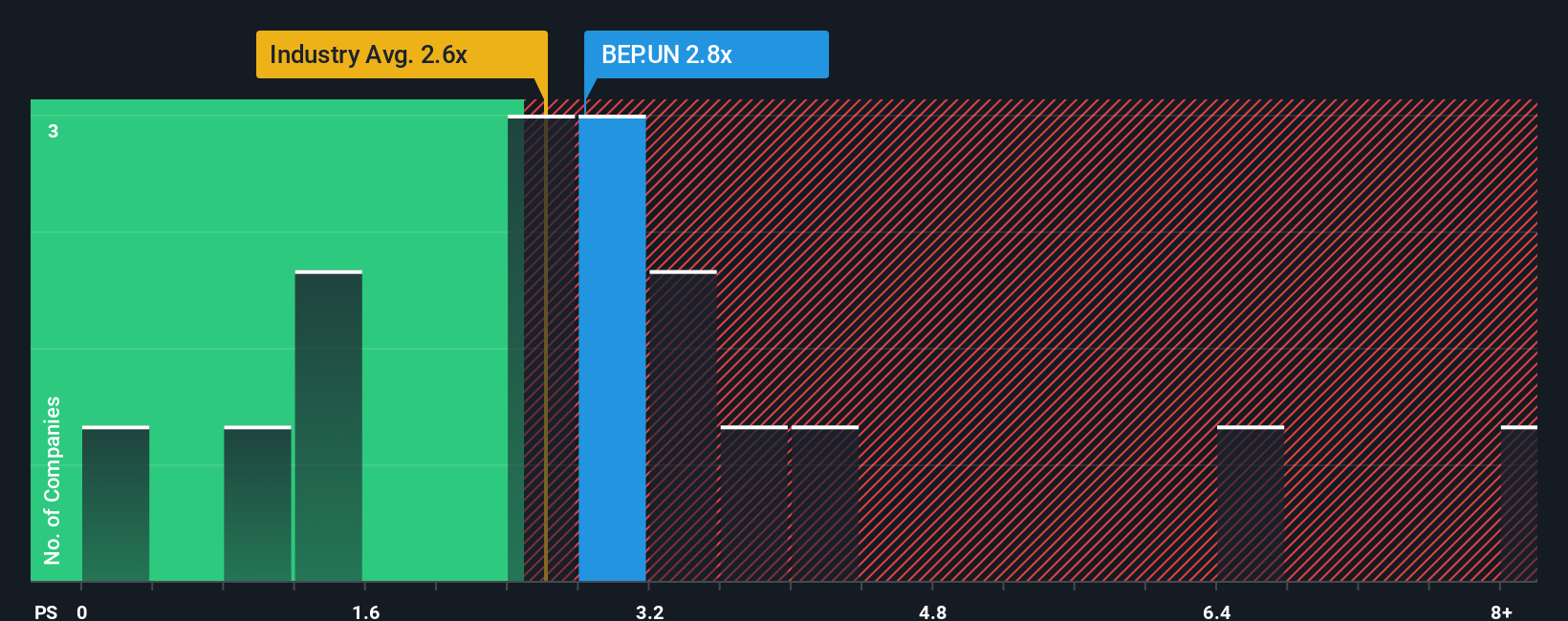

The Price-to-Sales (P/S) ratio is the preferred valuation metric here because it is especially useful for companies like Brookfield Renewable Partners, where profits may fluctuate due to heavy reinvestment or cyclical earnings, but sales remain a reliable gauge of the company’s size and growth.

Growth expectations and risk play a significant role in determining what counts as a “fair” P/S ratio. Generally, companies that are expanding quickly or operating in less risky markets can justify higher multiples, while slower growers or riskier bets tend to trade at lower ratios.

Currently, Brookfield Renewable Partners has a P/S ratio of 2.99x. This is just below the average of its closest peers (3.15x) but above the broader renewable energy industry average (2.39x). On the surface, pricing appears to be somewhere in the middle, which can be reassuring; however, these raw numbers only tell part of the story.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike a simple peer or industry comparison, the Fair Ratio (2.92x) is designed to reflect Brookfield’s specific characteristics, such as projected growth, profit margins, market cap, and the risks it faces. This approach is more tailored, providing a valuation yardstick that is truly relevant to Brookfield’s profile instead of just a broad industry snapshot.

Comparing Brookfield Renewable’s current P/S ratio of 2.99x to its Fair Ratio of 2.92x suggests the stock is trading roughly in line with expectations. The narrow gap indicates that the market has priced in most of the relevant factors.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brookfield Renewable Partners Narrative

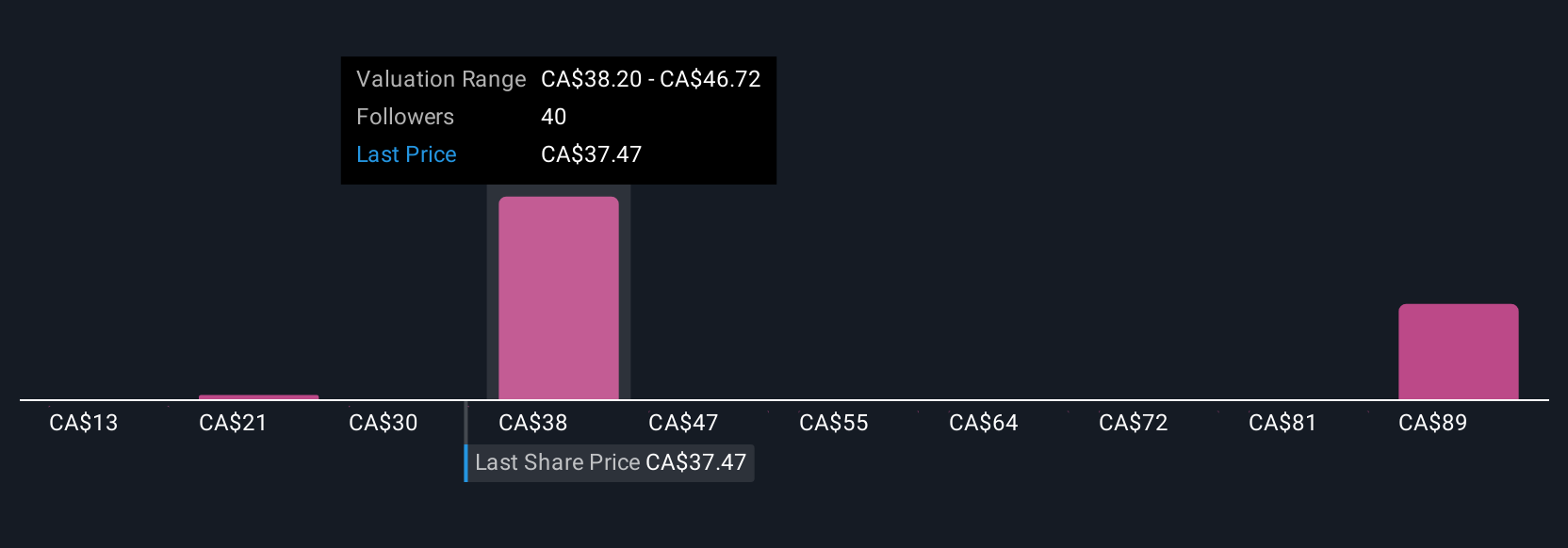

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you connect your view of a company’s story, such as its future prospects, risks, and opportunities, to your own financial forecasts and estimate of fair value. Rather than relying solely on ratios and historical numbers, Narratives help you spell out the assumptions behind your valuation, showing how your expectations for things like revenue, margins, and market outlook translate directly into a price target.

Narratives are available right now in the Simply Wall St Community, making it accessible for anyone to turn their insights into actionable investing frameworks used by millions worldwide. By comparing the Fair Value generated from your Narrative to the current share price, you can quickly see whether Brookfield Renewable Partners looks like a buy or sell based on what you believe is likely to happen.

What sets Narratives apart is that they dynamically update in response to new news, results, or major developments. This ensures your analysis stays relevant. For example, some investors may forecast a fair value over $45 for Brookfield due to bullish growth assumptions, while others might see a fair value under $32 because they anticipate margin pressures or regulatory risks.

Do you think there's more to the story for Brookfield Renewable Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEP.UN

Brookfield Renewable Partners

Owns a portfolio of renewable power generating facilities in North America, Colombia, and Brazil.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026