- Canada

- /

- Transportation

- /

- TSXV:ARGH

If You Had Bought Facedrive (CVE:FD) Shares A Year Ago You'd Have Earned 276% Returns

Some Facedrive Inc. (CVE:FD) shareholders are probably rather concerned to see the share price fall 48% over the last three months. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 276% in that time. So it may be that the share price is simply cooling off after a strong rise. The real question is whether the business is trending in the right direction.

Check out our latest analysis for Facedrive

Facedrive wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Facedrive's revenue grew by 552%. That's well above most other pre-profit companies. And the share price has responded, gaining 276% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

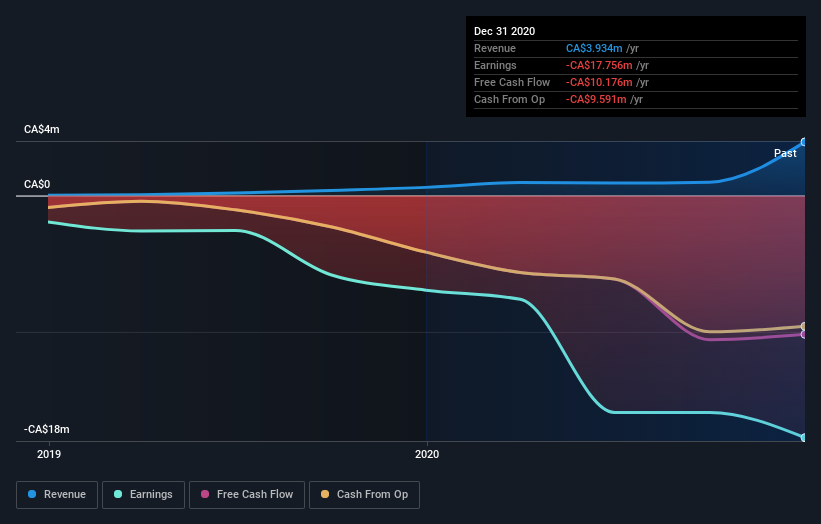

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Facedrive boasts a total shareholder return of 276% for the last year. We regret to report that the share price is down 48% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand Facedrive better, we need to consider many other factors. For instance, we've identified 3 warning signs for Facedrive that you should be aware of.

Facedrive is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ARGH

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives