- Canada

- /

- Transportation

- /

- TSX:TFII

How Does TFI International's (TSE:TFII) P/E Compare To Its Industry, After Its Big Share Price Gain?

Those holding TFI International (TSE:TFII) shares must be pleased that the share price has rebounded 30% in the last thirty days. But unfortunately, the stock is still down by 8.9% over a quarter. But shareholders may not all be feeling jubilant, since the share price is still down 12% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for TFI International

How Does TFI International's P/E Ratio Compare To Its Peers?

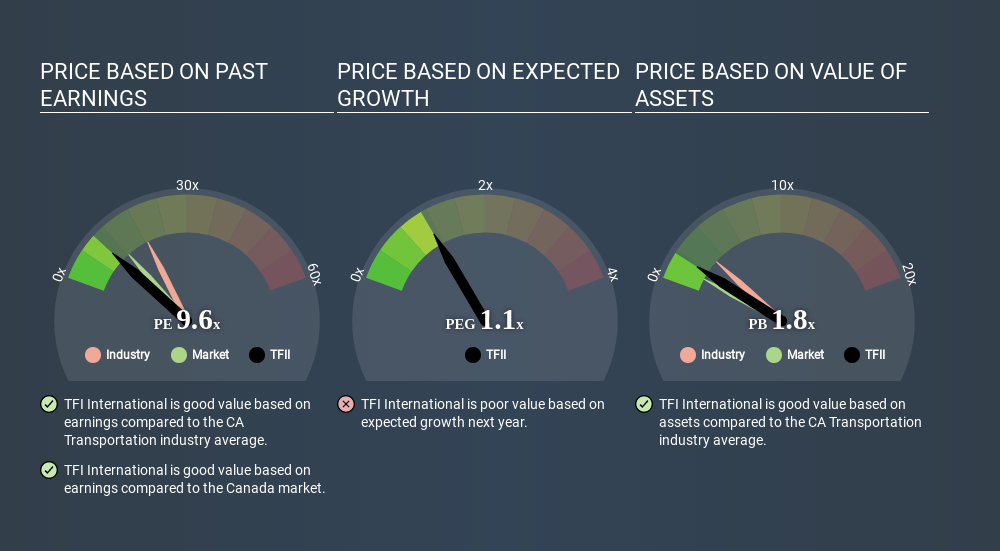

TFI International's P/E of 9.59 indicates relatively low sentiment towards the stock. The image below shows that TFI International has a lower P/E than the average (18.7) P/E for companies in the transportation industry.

TFI International's P/E tells us that market participants think it will not fare as well as its peers in the same industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. When earnings grow, the 'E' increases, over time. That means even if the current P/E is high, it will reduce over time if the share price stays flat. Then, a lower P/E should attract more buyers, pushing the share price up.

Most would be impressed by TFI International earnings growth of 13% in the last year. And earnings per share have improved by 27% annually, over the last five years. So one might expect an above average P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

How Does TFI International's Debt Impact Its P/E Ratio?

TFI International's net debt equates to 42% of its market capitalization. While that's enough to warrant consideration, it doesn't really concern us.

The Bottom Line On TFI International's P/E Ratio

TFI International's P/E is 9.6 which is below average (12.3) in the CA market. The EPS growth last year was strong, and debt levels are quite reasonable. The low P/E ratio suggests current market expectations are muted, implying these levels of growth will not continue. What we know for sure is that investors are becoming less uncomfortable about TFI International's prospects, since they have pushed its P/E ratio from 7.4 to 9.6 over the last month. For those who like to invest in turnarounds, that might mean it's time to put the stock on a watchlist, or research it. But others might consider the opportunity to have passed.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

You might be able to find a better buy than TFI International. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:TFII

TFI International

Provides transportation and logistics services in the United States, Mexico, and Canada.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)