In the current global market landscape, small-cap stocks have faced varied challenges and opportunities. The S&P 600 Index, representing small-cap companies, has seen fluctuations amid geopolitical tensions in the Middle East and robust job gains in the U.S., creating a complex environment for investors. In such conditions, identifying promising stocks often involves looking at companies with strong fundamentals and insider activity that could indicate confidence in their potential.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 26.0x | 5.9x | 6.38% | ★★★★★☆ |

| Trican Well Service | 7.2x | 0.9x | 18.25% | ★★★★★☆ |

| PSC | 8.0x | 0.4x | 40.32% | ★★★★☆☆ |

| Citizens & Northern | 12.7x | 2.9x | 44.08% | ★★★★☆☆ |

| Studsvik | 19.8x | 1.2x | 43.60% | ★★★★☆☆ |

| Franklin Financial Services | 9.7x | 1.9x | 39.40% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 41.35% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -57.60% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -218.04% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Genus is a company specializing in animal genetics, providing advanced breeding services and products primarily through its Genus ABS and Genus PIC segments, with a market capitalization of £1.88 billion.

Operations: Genus derives its revenue primarily from Genus ABS and Genus PIC, contributing £314.90 million and £352.50 million respectively. The company's gross profit margin has shown variability, reaching as high as 68.02% in March 2024 and a notable peak of 100% in June 2024 due to unreported COGS figures for that period. Operating expenses have fluctuated significantly, with a recent high of £614.90 million reported in June 2024, impacting net income margins which have varied over time but were recorded at approximately 1.18% during the same period.

PE: 178.9x

Genus, a smaller company in its sector, recently reported annual sales of £668.8 million, down from £689.7 million the previous year, with net income falling to £7.9 million from £33.3 million. Despite these challenges and lower profit margins at 1.2%, insider confidence is evident through share purchases over the past year. The company maintains a consistent dividend of 21.7 pence per share and forecasts earnings growth of 37% annually, suggesting potential for future value realization despite relying on higher-risk external borrowing sources for funding.

- Take a closer look at Genus' potential here in our valuation report.

Assess Genus' past performance with our detailed historical performance reports.

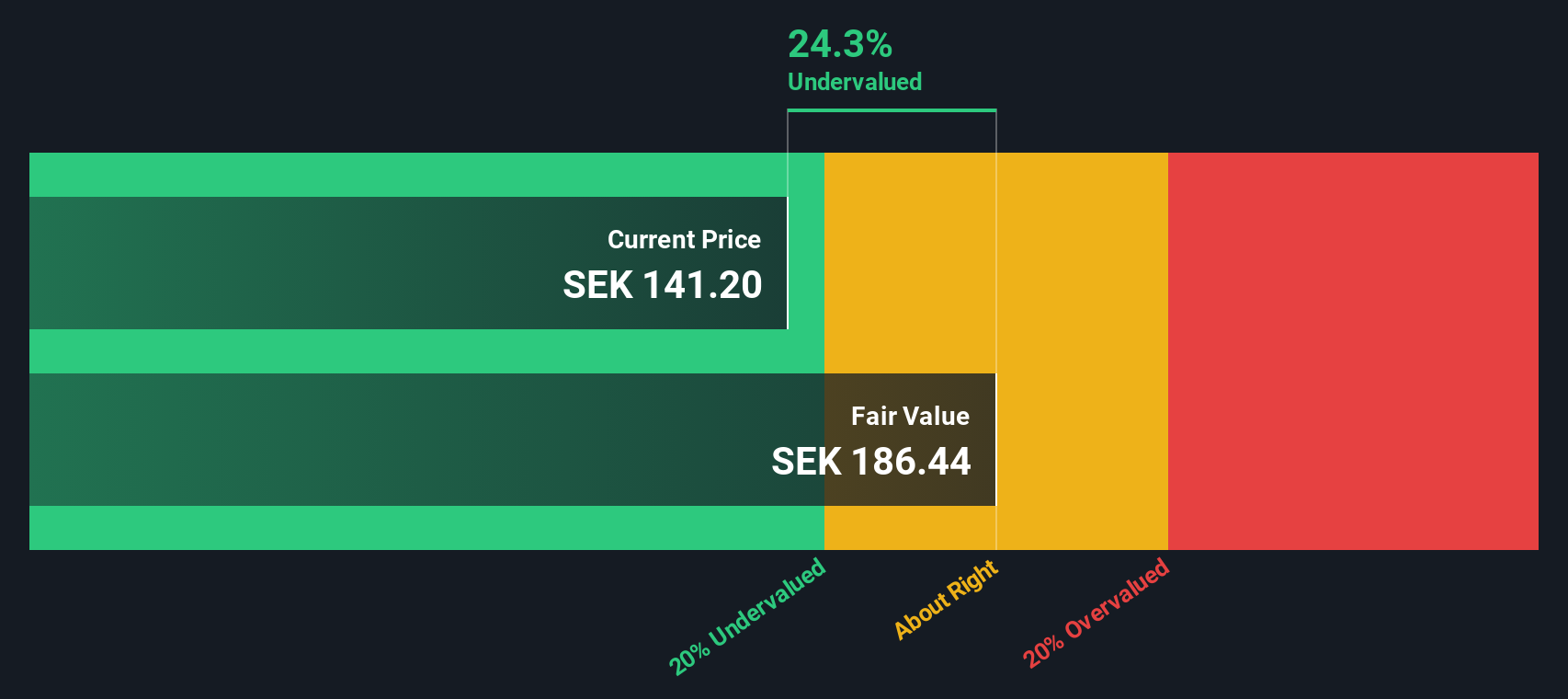

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

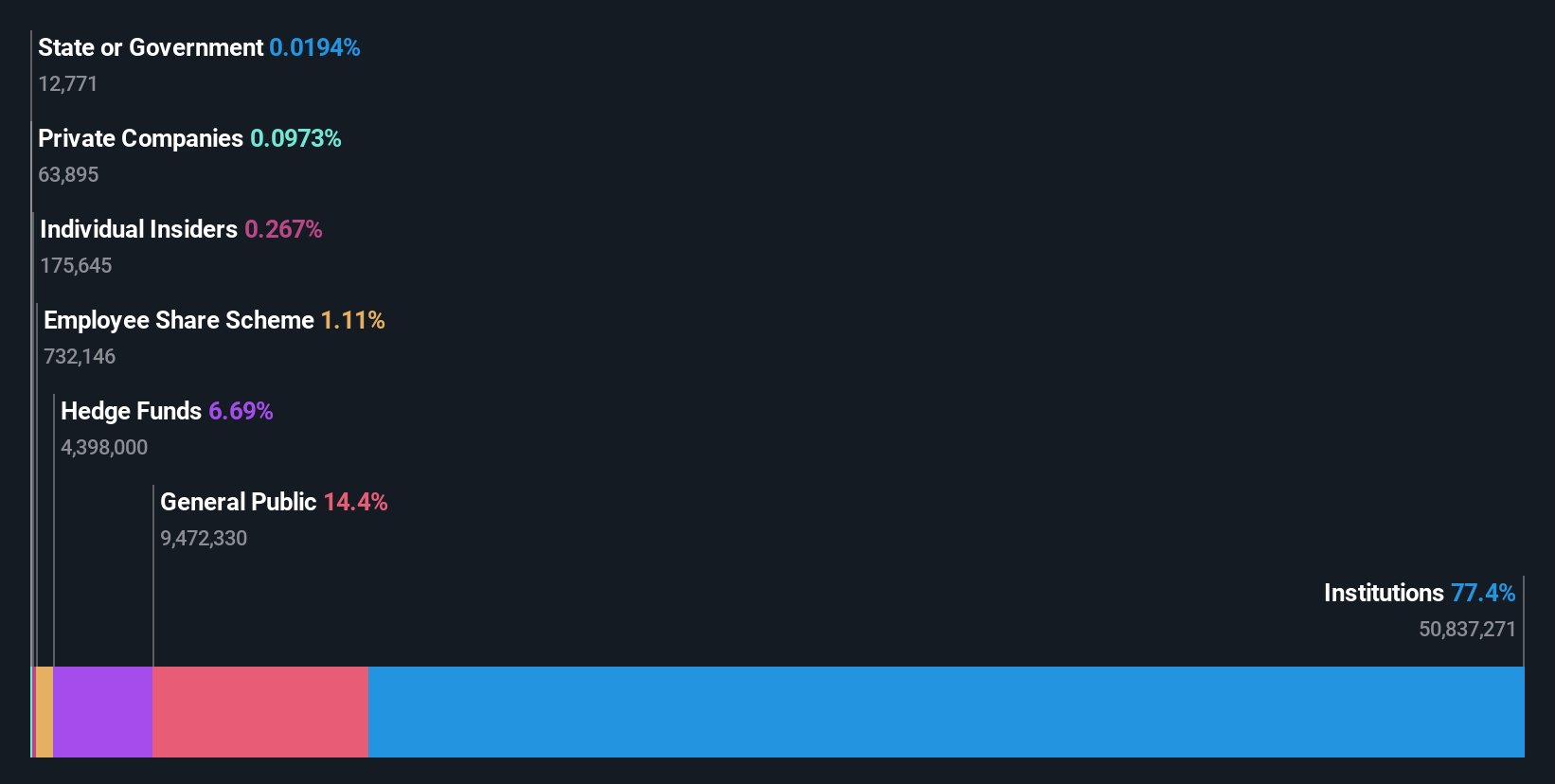

Overview: Alimak Group is a company specializing in vertical access solutions, serving various sectors including wind, industrial, construction, and facade access, with a market capitalization of SEK 7.85 billion.

Operations: The company generates revenue primarily from its Facade Access, Construction, Industrial, HS & PS, and Wind segments. Over the periods observed, the gross profit margin has shown a trend of increase reaching 40.10% by mid-2024. Operating expenses have been significant with notable allocations towards sales and marketing as well as general and administrative functions.

PE: 23.4x

Alimak Group, a smaller company in its sector, has shown steady financial performance with second-quarter sales reaching SEK 1.8 billion and net income of SEK 143 million. Despite external borrowing as its sole funding source, indicating higher risk, the company remains financially sound. Insider confidence is evident with share purchases in recent months, suggesting belief in future growth. Earnings are projected to grow by 15.5% annually, hinting at potential value for investors seeking growth opportunities.

- Click to explore a detailed breakdown of our findings in Alimak Group's valuation report.

Understand Alimak Group's track record by examining our Past report.

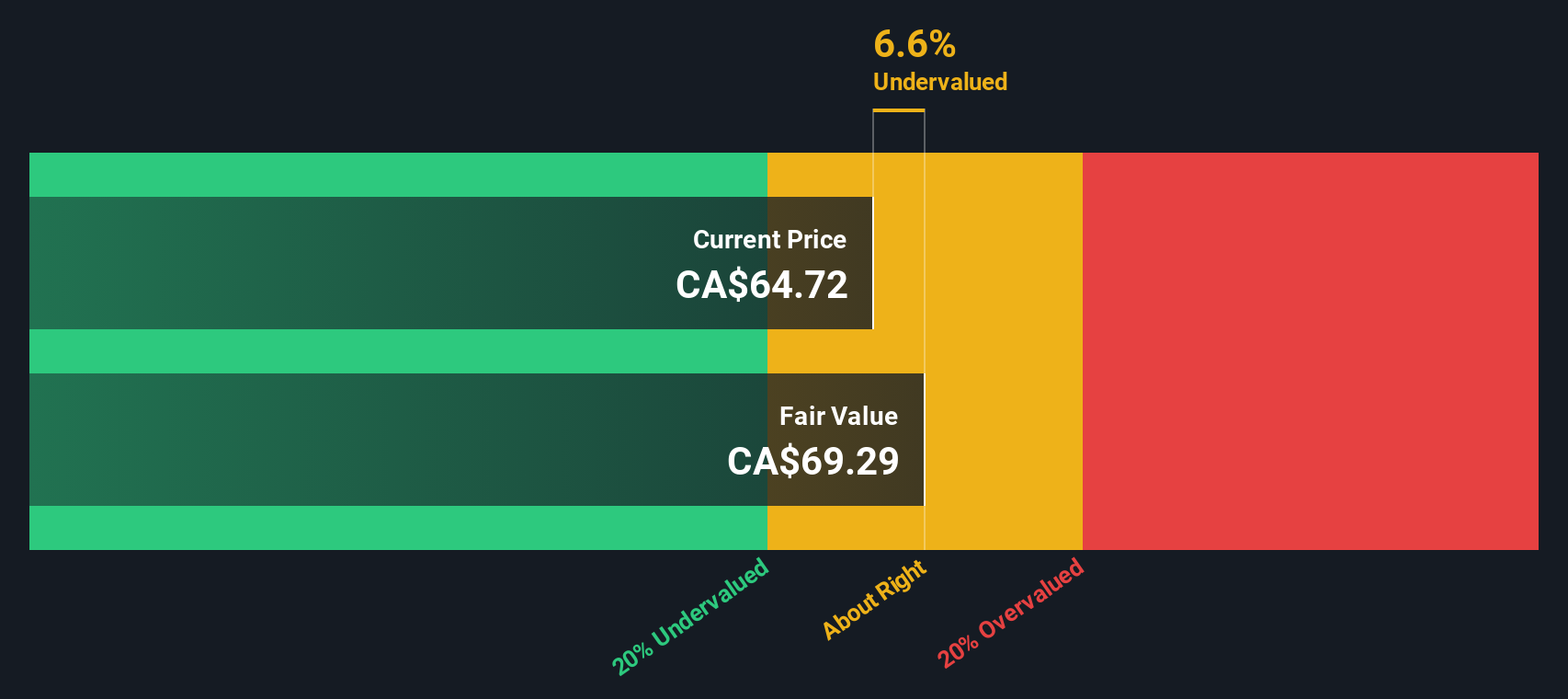

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income is a diversified company with operations in manufacturing and aerospace & aviation, having a market cap of approximately CA$2.47 billion.

Operations: The company generates revenue from two primary segments: Manufacturing and Aerospace & Aviation, with the latter contributing significantly more. Over recent years, gross profit margin has shown a trend of slight fluctuation, reaching 34.72% in mid-2024. Operating expenses have consistently risen alongside revenue growth, impacting net income margins which were at 4.44% as of June 2024.

PE: 22.0x

Exchange Income, a smaller company in its sector, shows potential as an undervalued investment. Despite facing challenges with interest payments not being fully covered by earnings and reliance on external borrowing, the company is forecasted to grow earnings by 25.94% annually. Recent initiatives like the Atik Mason Pilot Pathway highlight its commitment to community engagement and workforce development. Regular dividends of C$0.22 per share reflect consistent shareholder returns amidst fluctuating net income and revenue growth over recent quarters.

- Dive into the specifics of Exchange Income here with our thorough valuation report.

Examine Exchange Income's past performance report to understand how it has performed in the past.

Key Takeaways

- Unlock our comprehensive list of 189 Undervalued Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALIG

Alimak Group

Alimak Group AB (publ) desigs and manufactures vertical access solutions in Europe, Asia, Australia, South and North America, and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives