Did Debt Redemption and Insider Buying Just Shift Exchange Income’s (TSX:EIF) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Exchange Income Corporation completed the redemption of its 7-year 5.25% convertible unsecured subordinated debentures that were due July 31, 2028, and saw increased analyst optimism amid growth opportunities in aerial surveillance and Northern Canada investments.

- Significant insider buying and the company's strong total shareholder return highlight reinforced management confidence and the considerable role of dividends in overall performance.

- We’ll now consider how the insider buying activity and debt redemption impact Exchange Income’s investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Exchange Income Investment Narrative Recap

Shareholders in Exchange Income are typically betting on the company's ability to drive sustainable growth across aviation and essential infrastructure, supported by recurring contracts and steady dividend payouts. The recent debenture redemption does not materially change the most important near-term catalyst, the integration of Canadian North and securing major contracts for aerial surveillance, or the current biggest risk, which remains elevated maintenance spending and pressure on free cash flow through 2026.

Of the recent announcements, the upsizing and extension of Exchange Income’s credit facility to $3 billion until 2029 is particularly relevant. This move supports flexibility for future growth initiatives but does not eliminate concerns around the substantial capital expenditures required following the Canadian North acquisition and ongoing fleet maintenance.

Yet, in contrast to the growth story, investors should be attentive as rising maintenance costs could limit...

Read the full narrative on Exchange Income (it's free!)

Exchange Income's narrative projects CA$4.2 billion revenue and CA$346.8 million earnings by 2028. This requires 14.7% yearly revenue growth and a CA$215.5 million increase in earnings from CA$131.3 million today.

Uncover how Exchange Income's forecasts yield a CA$81.31 fair value, a 8% upside to its current price.

Exploring Other Perspectives

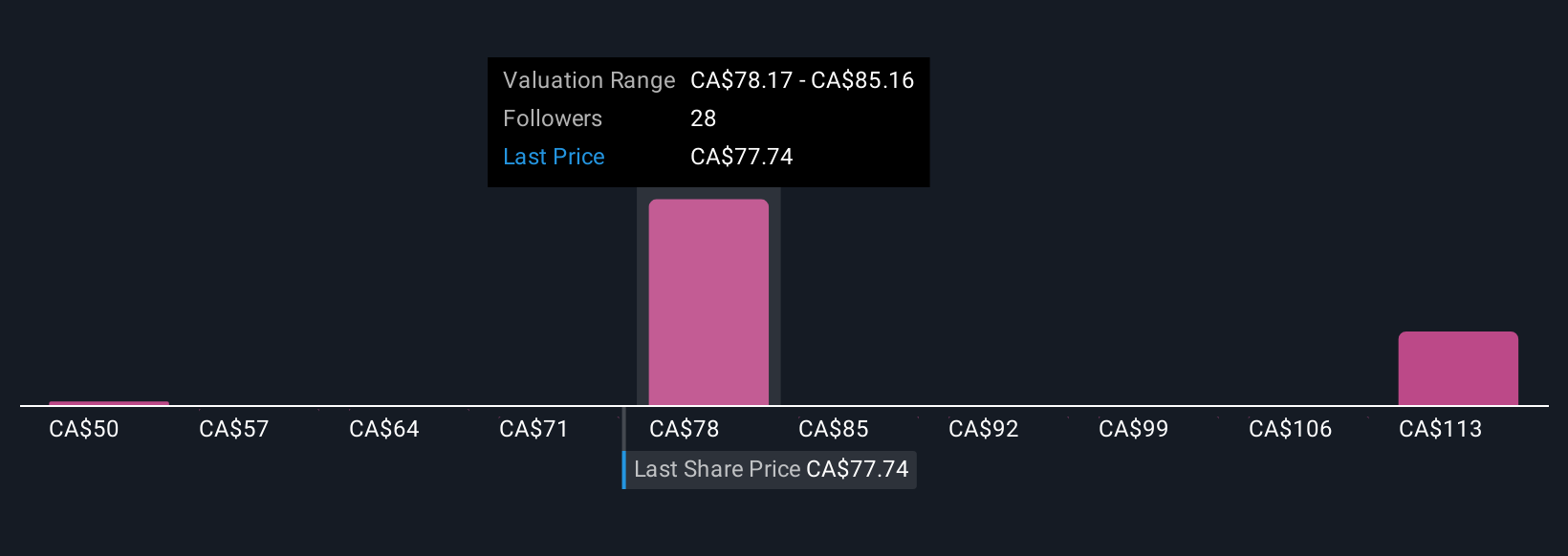

Six fair value estimates from the Simply Wall St Community range from C$50.20 to C$108.21 per share, reflecting substantial differences in investor outlook. While many expect continued growth from government contracts and acquisitions, some warn that sustained high maintenance expenditures may strain margins and affect long term returns.

Explore 6 other fair value estimates on Exchange Income - why the stock might be worth as much as 44% more than the current price!

Build Your Own Exchange Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exchange Income research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Exchange Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exchange Income's overall financial health at a glance.

No Opportunity In Exchange Income?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives