- Canada

- /

- Construction

- /

- TSX:BDGI

Canadian Small Caps With Insider Buying Highlighting Undervalued Opportunities

Reviewed by Simply Wall St

The Canadian market has been riding a wave of optimism, with the TSX reaching all-time highs amid broader economic expansion and rising corporate earnings. As central banks ease policy and election-driven volatility subsides, investors are increasingly focused on fundamental strengths that can signal potential opportunities in small-cap stocks.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 3.7x | 3.7x | 22.06% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 48.52% | ★★★★★☆ |

| Foraco International | 5.4x | 0.5x | -23.40% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.09% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.2x | 3.3x | 49.06% | ★★★★☆☆ |

| Sagicor Financial | 1.4x | 0.3x | -44.14% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -71.04% | ★★★★☆☆ |

| Trican Well Service | 8.1x | 1.0x | 8.47% | ★★★☆☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -60.82% | ★★★☆☆☆ |

| Metalla Royalty & Streaming | NA | 62.1x | -123.38% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

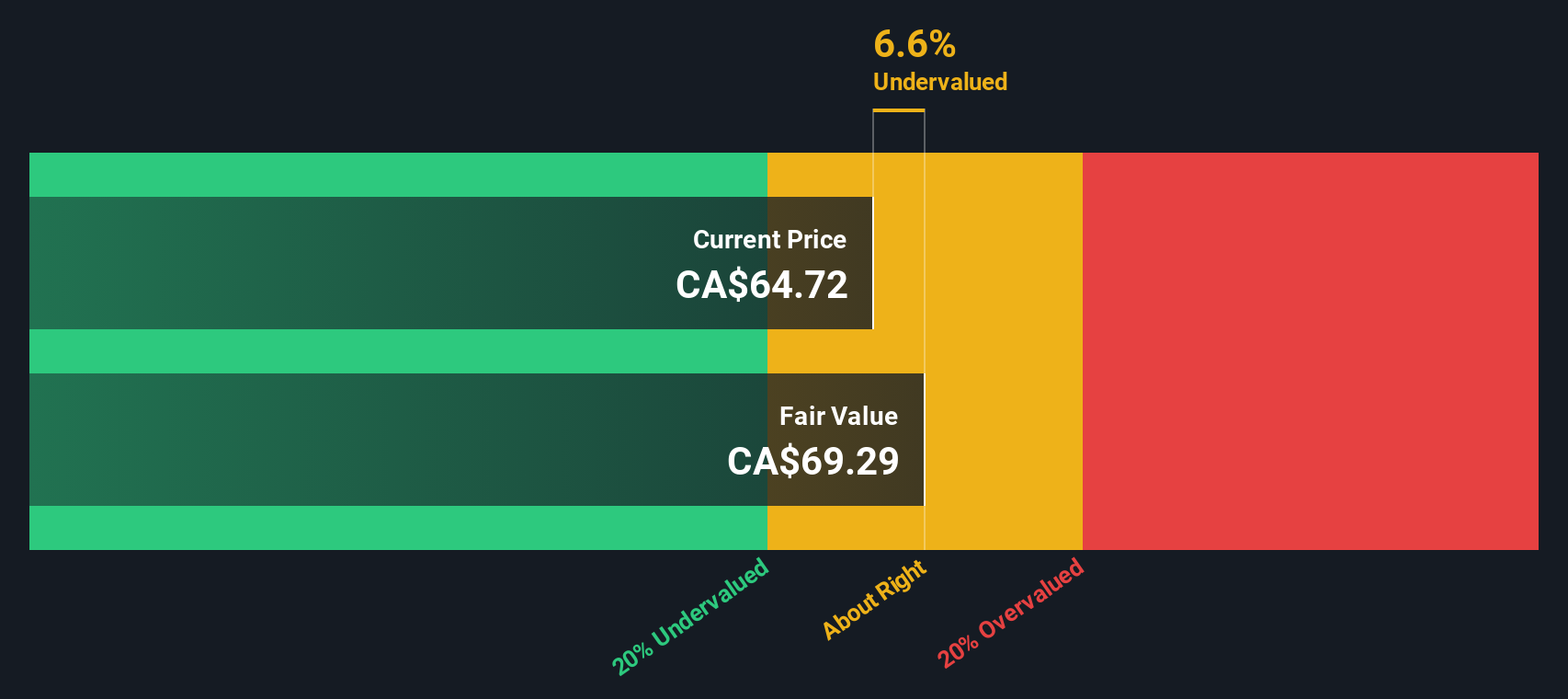

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Badger Infrastructure Solutions specializes in providing non-destructive excavating services and has a market capitalization of approximately $1.13 billion CAD.

Operations: The company generates revenue primarily from its Non-Destructive Excavating Services, with recent figures showing a gross profit margin of 28.29%. Operating expenses, including general and administrative costs, contribute significantly to the cost structure, impacting net income margins which recently stood at 5.81%.

PE: 24.0x

Badger Infrastructure Solutions, a Canadian small cap, shows potential with earnings projected to grow 36% annually. Despite relying solely on external borrowing for funding, it reported a rise in Q2 sales to US$186.84 million from US$171.89 million last year and net income of US$11.91 million. The company declared a quarterly dividend of C$0.18 per share and is considering a share repurchase program, indicating insider confidence in future prospects despite its high-risk funding structure.

- Click here to discover the nuances of Badger Infrastructure Solutions with our detailed analytical valuation report.

Learn about Badger Infrastructure Solutions' historical performance.

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income operates in the manufacturing and aerospace & aviation sectors, with a market cap of approximately CA$2.43 billion.

Operations: The company generates revenue primarily from its Manufacturing and Aerospace & Aviation segments, with recent figures showing CA$2.61 billion in total revenue. The cost of goods sold (COGS) was CA$1.70 billion, leading to a gross profit of CA$905.09 million and a gross profit margin of 34.72%. Operating expenses amounted to CA$614.63 million, while non-operating expenses were reported at CA$174.73 million for the same period.

PE: 21.7x

Exchange Income, a smaller Canadian company, has shown insider confidence with purchases in recent months. Despite the absence of share buybacks, they maintain regular dividends of C$0.22 per share monthly, reflecting steady income distribution. Recent earnings reported a rise in sales to C$426.92 million for Q2 2024 from C$372.36 million last year, although net income saw a decline to C$32.65 million from C$36.9 million previously due to higher-risk funding reliance on external borrowing rather than customer deposits.

- Navigate through the intricacies of Exchange Income with our comprehensive valuation report here.

Explore historical data to track Exchange Income's performance over time in our Past section.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is a company engaged in the exploration and production of oil and gas, with operations generating CA$1.81 billion in revenue.

Operations: The company generates revenue primarily from oil and gas exploration and production, with a recent quarterly revenue of CA$1.81 billion. Over the analyzed periods, gross profit margins have shown variability, reaching as high as 82.55% in Q3 2022 before declining to 65.72% in mid-2024. Operating expenses have fluctuated significantly, impacting net income margins which turned negative in the most recent quarters of 2024.

PE: -2.7x

Vermilion Energy, a Canadian energy company, is currently perceived as undervalued within its sector. Recent insider confidence is evident through significant share purchases over the past year. The company has strategically reduced risk by farming down its working interest in German gas projects and deferring some drilling activities to optimize capital allocation. Despite reporting a net loss of C$82 million for Q2 2024, Vermilion continues to enhance operational efficiency with cost savings in Canadian operations and plans for future production growth in Europe.

- Click here and access our complete valuation analysis report to understand the dynamics of Vermilion Energy.

Understand Vermilion Energy's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 18 Undervalued TSX Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Good value with reasonable growth potential.