- Canada

- /

- Commercial Services

- /

- TSX:BYD

TSX Stocks That May Be Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

As the Canadian market continues to reach new heights, buoyed by optimism surrounding central bank policies and robust corporate earnings, investors are keenly observing how these factors interplay with potential election-driven volatility. In this environment of cautious optimism, identifying stocks that may be trading below their estimated value can present unique opportunities for those looking to align their portfolios with solid fundamentals amidst broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.41 | CA$22.00 | 48.1% |

| goeasy (TSX:GSY) | CA$183.37 | CA$362.97 | 49.5% |

| Savaria (TSX:SIS) | CA$22.35 | CA$41.08 | 45.6% |

| Real Matters (TSX:REAL) | CA$9.05 | CA$17.71 | 48.9% |

| Endeavour Mining (TSX:EDV) | CA$31.96 | CA$62.41 | 48.8% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kinaxis (TSX:KXS) | CA$158.50 | CA$280.37 | 43.5% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.63 | CA$10.64 | 37.7% |

| Blackline Safety (TSX:BLN) | CA$5.91 | CA$11.02 | 46.4% |

| Boyd Group Services (TSX:BYD) | CA$206.87 | CA$337.90 | 38.8% |

We'll examine a selection from our screener results.

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc. operates non-franchised collision repair centers across North America and has a market cap of CA$4.40 billion.

Operations: The company generates revenue of $3.04 billion from its automotive collision repair and related services segment in North America.

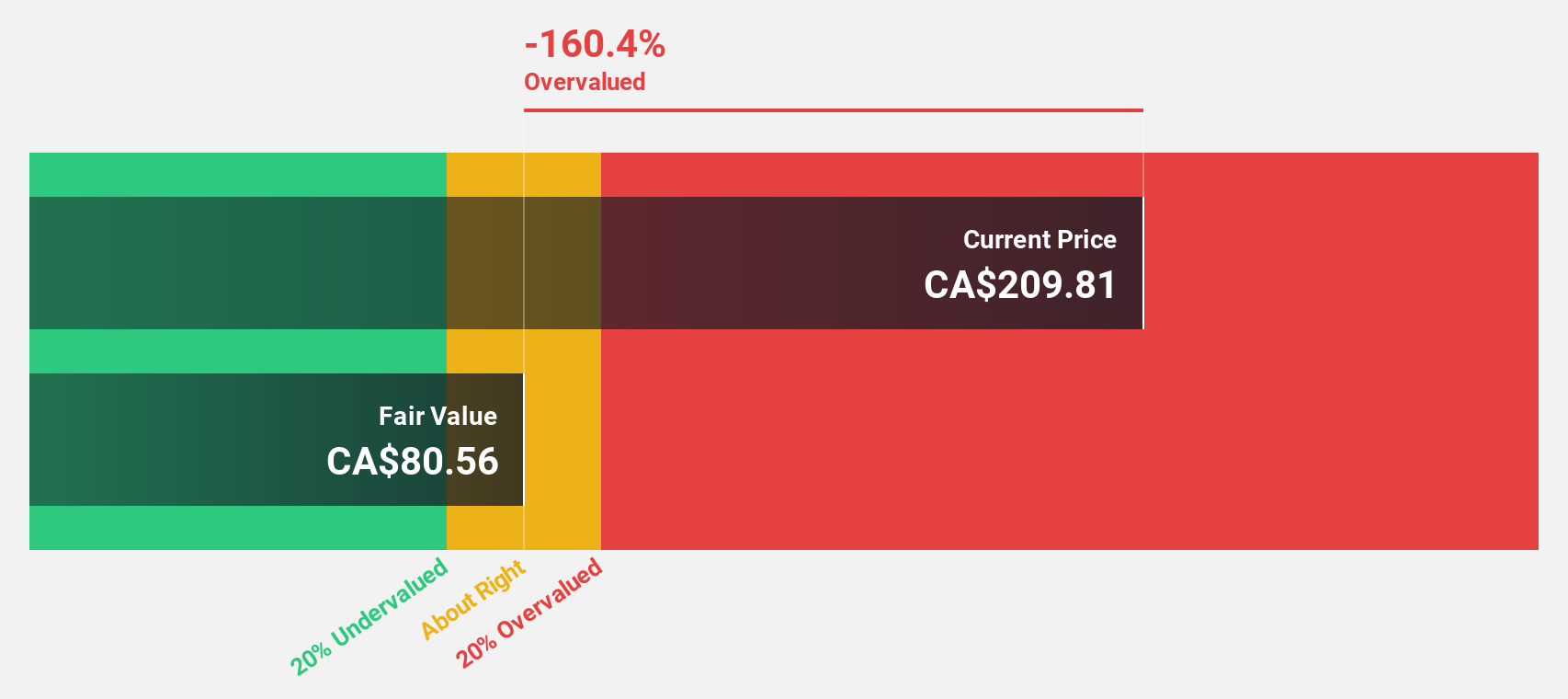

Estimated Discount To Fair Value: 38.8%

Boyd Group Services is trading at CA$206.87, significantly below its estimated fair value of CA$337.9, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue growth of 9.8% annually, earnings are expected to grow substantially at 44.6% per year, outpacing the Canadian market's average growth rate. However, recent financial results show declining net income and earnings per share compared to last year, which might concern potential investors looking for stability in cash flow metrics.

- In light of our recent growth report, it seems possible that Boyd Group Services' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Boyd Group Services' balance sheet health report.

Computer Modelling Group (TSX:CMG)

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$911.01 million.

Operations: The company's revenue is derived from CA$90.29 million in reservoir simulation and seismic interpretation software licensing and related services.

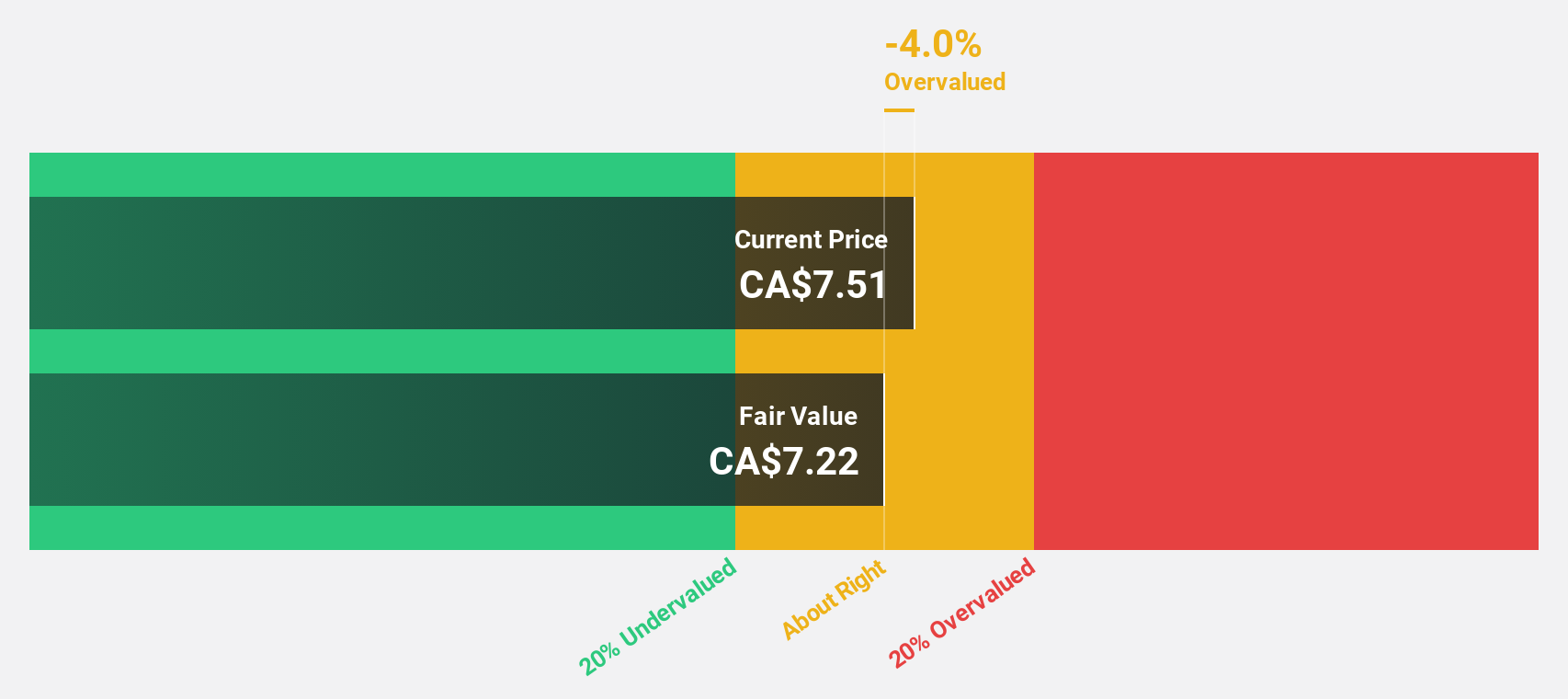

Estimated Discount To Fair Value: 48.1%

Computer Modelling Group (CMG) is trading at CA$11.41, significantly below its estimated fair value of CA$22, indicating potential undervaluation based on cash flows. Despite a forecasted revenue growth of 11.5% annually, slower than 20%, earnings are expected to grow significantly at 24.56% per year, surpassing the Canadian market's average growth rate. However, recent financial results reveal declining net income and profit margins over the past year alongside significant insider selling and an unstable dividend track record.

- Insights from our recent growth report point to a promising forecast for Computer Modelling Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Computer Modelling Group.

goeasy (TSX:GSY)

Overview: goeasy Ltd. offers non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands to Canadian consumers, with a market cap of CA$3.03 billion.

Operations: The company's revenue is derived from its Easyhome segment, contributing CA$154.10 million, and the Easyfinancial segment, generating CA$1.24 billion.

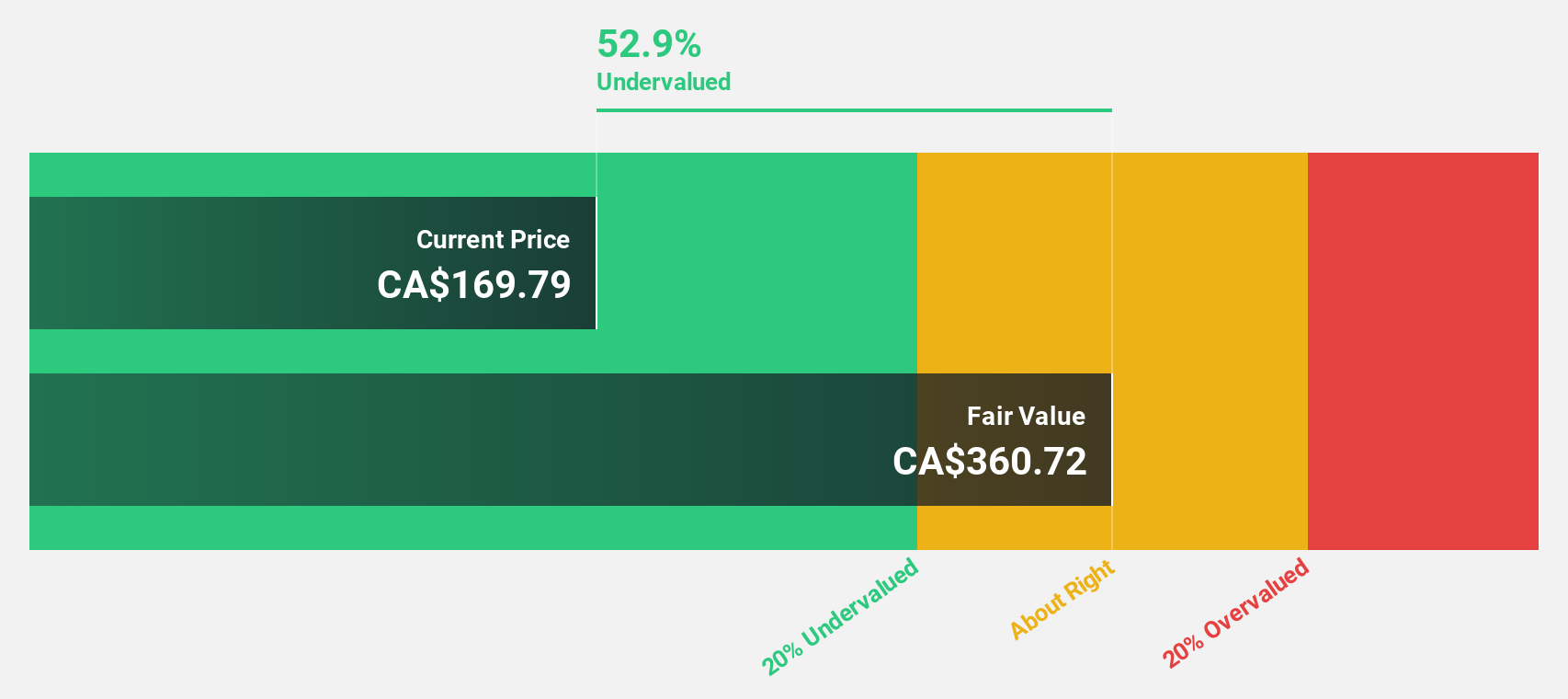

Estimated Discount To Fair Value: 49.5%

goeasy, trading at CA$183.37, is significantly undervalued based on cash flows with an estimated fair value of CA$362.97. The company forecasts robust revenue growth of 31.6% annually, outpacing the Canadian market's average. However, debt coverage by operating cash flow remains a concern and insider selling has been significant recently. Despite these challenges, analysts predict a 28.8% rise in stock price while earnings are projected to grow faster than the market at 17.1% annually.

- Our growth report here indicates goeasy may be poised for an improving outlook.

- Navigate through the intricacies of goeasy with our comprehensive financial health report here.

Next Steps

- Dive into all 24 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boyd Group Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BYD

Boyd Group Services

Operates non-franchised collision repair centers in North America.

Reasonable growth potential and fair value.