- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

West Fraser Timber (TSX:WFG) Faces Q3 Losses Amid Buyback Completion and Promising Growth Outlook

Reviewed by Simply Wall St

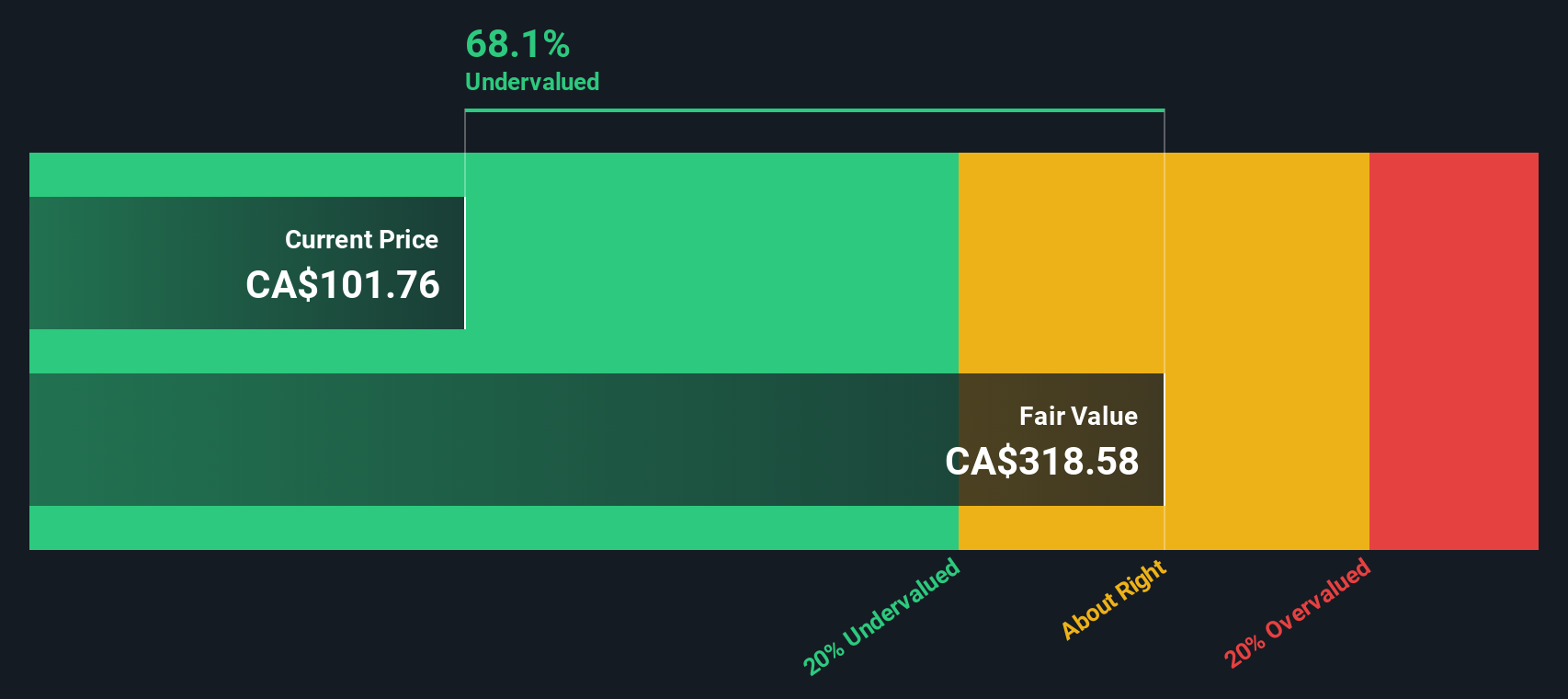

West Fraser Timber (TSX:WFG) recently announced its third-quarter earnings, highlighting a net loss of USD 83 million compared to a net income of USD 159 million the previous year, reflecting ongoing financial challenges. Despite these setbacks, the company is poised for future growth with earnings expected to increase by 55.43% annually, offering potential for significant price appreciation as it trades well below its estimated fair value. Readers should anticipate an in-depth analysis of West Fraser Timber's strategic initiatives to navigate market complexities and capitalize on emerging opportunities.

Click to explore a detailed breakdown of our findings on West Fraser Timber.

Core Advantages Driving Sustained Success for West Fraser Timber

Leadership plays a pivotal role in strategic direction, with the management team boasting an average tenure of 2.9 years. This experience facilitates effective decision-making and strategic planning, crucial for navigating market complexities. The company's strong financial position is underscored by having more cash than total debt, ensuring stability and flexibility in operations. Additionally, WFG's commitment to shareholder value is evident in its consistent dividend increases over the past decade. The company is trading at CA$128.35, significantly below its estimated fair value of CA$418.13, suggesting it may be undervalued, offering potential for price appreciation and highlighting its market positioning.

To dive deeper into how West Fraser Timber's valuation metrics are shaping its market position, check out our detailed analysis of West Fraser Timber's Valuation.Internal Limitations Hindering West Fraser Timber's Growth

Financial challenges are evident, with the company currently unprofitable and a negative return on equity of -1.35%. Over the past five years, losses have increased at a rate of 4.5% annually, indicating persistent profitability issues. Moreover, WFG's revenue growth forecast of 4.8% per year lags behind the Canadian market's 7%, potentially impacting its competitive edge. The dividend yield of 1.39% is also low compared to the top 25% of Canadian dividend payers, reflecting volatility and unreliability in dividend payments over the past decade. These factors may deter potential investors and highlight areas needing strategic focus.

Learn about West Fraser Timber's dividend strategy and how it impacts shareholder returns and financial stability.Emerging Markets Or Trends for West Fraser Timber

Opportunities for growth are promising, with earnings forecasted to grow at an impressive rate of 55.43% per year, indicating potential for future profitability. The expectation of becoming profitable over the next three years aligns with above-average market growth, suggesting a positive outlook. Trading significantly below its fair value presents a compelling case for investment, as it indicates potential for substantial price appreciation. Capitalizing on these opportunities through strategic alliances and product-related announcements could enhance market position and drive long-term success.

To gain deeper insights into West Fraser Timber's historical performance, explore our detailed analysis of past performance.Market Volatility Affecting West Fraser Timber's Position

External challenges include slower-than-desired revenue growth, forecasted to be below 20% annually, which may impact competitive positioning. The company's past unprofitability complicates comparisons with the Forestry industry, potentially affecting investor confidence. Additionally, the volatility and unreliability of dividend payments could deter investment, necessitating strategic adjustments to mitigate these risks and sustain growth.

See what the latest analyst reports say about West Fraser Timber's future prospects and potential market movements.Conclusion

West Fraser Timber's experienced leadership and strong financial foundation, marked by more cash than debt, provide a solid base for navigating market complexities and ensuring operational stability. The company's potential for substantial earnings growth at 55.43% annually presents a promising outlook. The current trading price of CA$128.35, significantly below its estimated fair value of CA$418.13, suggests a potential for price appreciation, making it an attractive investment opportunity. Strategic alliances and product innovations could further enhance its market position, addressing external challenges and supporting long-term growth.

Turning Ideas Into Actions

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives