- Canada

- /

- Construction

- /

- TSX:WSP

WSP Global (TSX:WSP) Eyes Profitability with Strategic Acquisitions and Strong Governance Initiatives

Reviewed by Simply Wall St

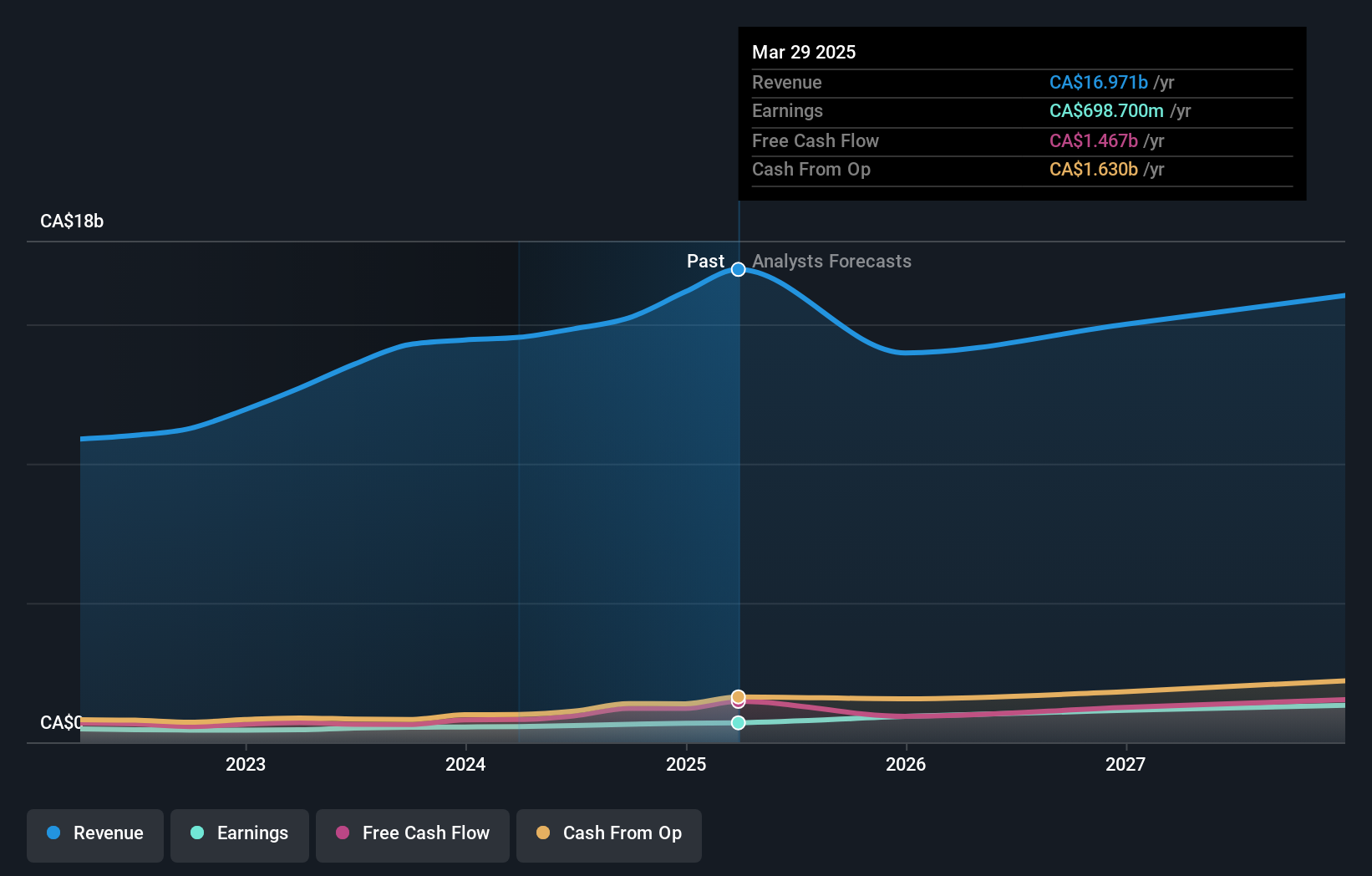

WSP Global (TSX:WSP) has recently announced a significant debt financing initiative, pricing $1 billion in senior unsecured notes to fund strategic acquisitions and enhance corporate operations. Despite a strong earnings growth forecast of 25.1% annually, the company faces challenges such as a high P/E ratio and substantial debt levels, underscoring the need for strategic financial management. Readers should expect a detailed analysis of WSP's competitive advantages, growth opportunities, and financial challenges in the discussion that follows.

Get an in-depth perspective on WSP Global's performance by reading our analysis here.

Competitive Advantages That Elevate WSP Global

Earnings are projected to grow at 25.1% annually, outpacing the Canadian market. This growth is bolstered by a 17.3% increase in earnings over the past year, surpassing the Construction industry average. With a current net profit margin of 4%, an improvement from the previous year's 3.8%, WSP demonstrates high-quality past earnings. The board of directors, with an average tenure of 7.5 years, provides stability and strategic guidance, enhancing corporate governance. This seasoned leadership is crucial for navigating complex market dynamics and executing strategic initiatives like mergers and acquisitions, as highlighted by CEO Alexandre L'Heureux's enthusiasm for M&A opportunities.

To gain deeper insights into WSP Global's historical performance, explore our detailed analysis of past performance.Critical Issues Affecting the Performance of WSP Global and Areas for Growth

WSP's Price-To-Earnings Ratio of 54.7x is significantly higher than both peer and industry averages, indicating potential overvaluation. Additionally, a Return on Equity of 9% falls below the desired 20% threshold, suggesting room for financial improvement. Revenue growth is expected to be sluggish at 0.8% per year, trailing the Canadian market. Shareholder dilution, with a 4.6% increase in shares outstanding, and a high net debt to equity ratio of 50.7% further highlight financial challenges. These factors underscore the need for strategic adjustments to enhance financial performance and market competitiveness.

To dive deeper into how WSP Global's valuation metrics are shaping its market position, check out our detailed analysis of WSP Global's Valuation.Growth Avenues Awaiting WSP Global

Significant earnings growth forecasted over the next three years presents opportunities for increased profitability. The company's focus on strategic acquisitions and improving profit margins could strengthen its market position. Product-related announcements and strategic alliances may further capitalize on emerging opportunities, enhancing WSP's competitive edge.

Competitive Pressures and Market Risks Facing WSP Global

The high level of debt poses a financial risk, potentially deterring investors. Economic headwinds and regulatory challenges add to the complexity, requiring vigilant management. Competitive pressures in key markets necessitate differentiation and innovation to maintain market share. WSP's proactive strategies and strong leadership position it to navigate these challenges effectively.

See what the latest analyst reports say about WSP Global's future prospects and potential market movements. Explore the current health of WSP Global and how it reflects on its financial stability and growth potential.Conclusion

WSP Global's projected earnings growth of 25.1% annually and improved net profit margins underscore its potential for profitability, driven by strategic acquisitions and strong governance. However, the company's Price-To-Earnings Ratio of 54.7x, well above industry norms, suggests that the stock may be priced higher than its intrinsic value, posing a challenge for investor confidence. The combination of a high debt-to-equity ratio and a Return on Equity of only 9% highlights the need for financial optimization to sustain growth and market competitiveness. WSP's proactive strategies and experienced leadership provide a solid foundation to capitalize on growth opportunities and navigate market risks effectively.

Make It Happen

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if WSP Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:WSP

WSP Global

Operates as a professional services consulting firm in the United States, Canada, the United Kingdom, Sweden, Australia, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives