- Canada

- /

- Transportation

- /

- TSX:CP

Insider Buying: The Canadian Pacific Railway Limited (TSE:CP) President Just Bought CA$2.8m Worth Of Shares

Canadian Pacific Railway Limited (TSE:CP) shareholders (or potential shareholders) will be happy to see that the President, Keith Creel, recently bought a whopping CA$2.8m worth of stock, at a price of CA$293. That purchase boosted their holding by 341%, which makes us wonder if the move was inspired by quietly confident deeply-felt optimism.

Check out our latest analysis for Canadian Pacific Railway

The Last 12 Months Of Insider Transactions At Canadian Pacific Railway

Over the last year, we can see that the biggest insider sale was by the Senior VP & Chief Risk Officer, Laird Pitz, for CA$3.7m worth of shares, at about CA$315 per share. That means that an insider was selling shares at around the current price of CA$267. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

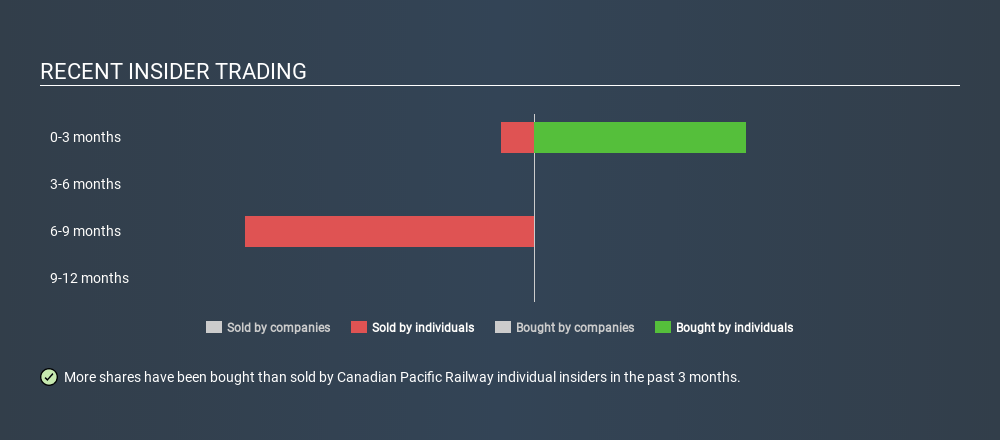

In the last twelve months insiders purchased 9.78k shares for CA$2.9m. On the other hand they divested 14830 shares, for CA$4.7m. Over the last year we saw more insider selling of Canadian Pacific Railway shares, than buying. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Canadian Pacific Railway

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From looking at our data, insiders own CA$6.3m worth of Canadian Pacific Railway stock, about 0.02% of the company. I generally like to see higher levels of ownership.

So What Do The Canadian Pacific Railway Insider Transactions Indicate?

The recent insider purchases are heartening. However, the longer term transactions are not so encouraging. The transactions over the last year don't give us confidence, and nor does the fairly low insider ownership, but at least the recent buying is a positive. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 2 warning signs for Canadian Pacific Railway you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives