- Canada

- /

- Transportation

- /

- TSX:CP

Can CPKC’s Holiday Train Tour Reflect a Strategic Edge in Community Engagement for TSX:CP?

Reviewed by Sasha Jovanovic

- The Canadian Pacific Kansas City Holiday Train recently traveled through numerous cities across North America, making stops in communities such as Detroit, Windsor, Toronto, and Shreveport to support local food banks and host holiday concerts.

- This annual initiative has generated more than US$26.1 million and 5.4 million pounds of food donations since 1999, highlighting CPKC’s ongoing commitment to community engagement and philanthropy.

- We’ll explore how CPKC’s high-profile Holiday Train tour and food bank partnerships contribute to its investment narrative and broader social impact.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Canadian Pacific Kansas City's Investment Narrative?

For shareholders, the big picture with Canadian Pacific Kansas City hinges on its ability to deliver consistent operational results, manage its sizable debt, and maintain competitive advantages across North America’s integrated rail network. Recent earnings and share buybacks indicate steady execution, but the company's high price-to-earnings ratio and relatively low return on equity are important considerations for anyone following the stock. The Holiday Train’s ongoing food bank partnerships and community visibility signal continued attention to social responsibility, though positive press alone is unlikely to alter immediate catalysts such as volume growth, cost controls, or cross-border trade. Still, these high-profile community efforts might enhance CPKC’s brand perception and could potentially support long-term relationships with customers and key regulators. No material change to short-term business risks or catalysts appears likely from the Holiday Train event, based on recent market performance.

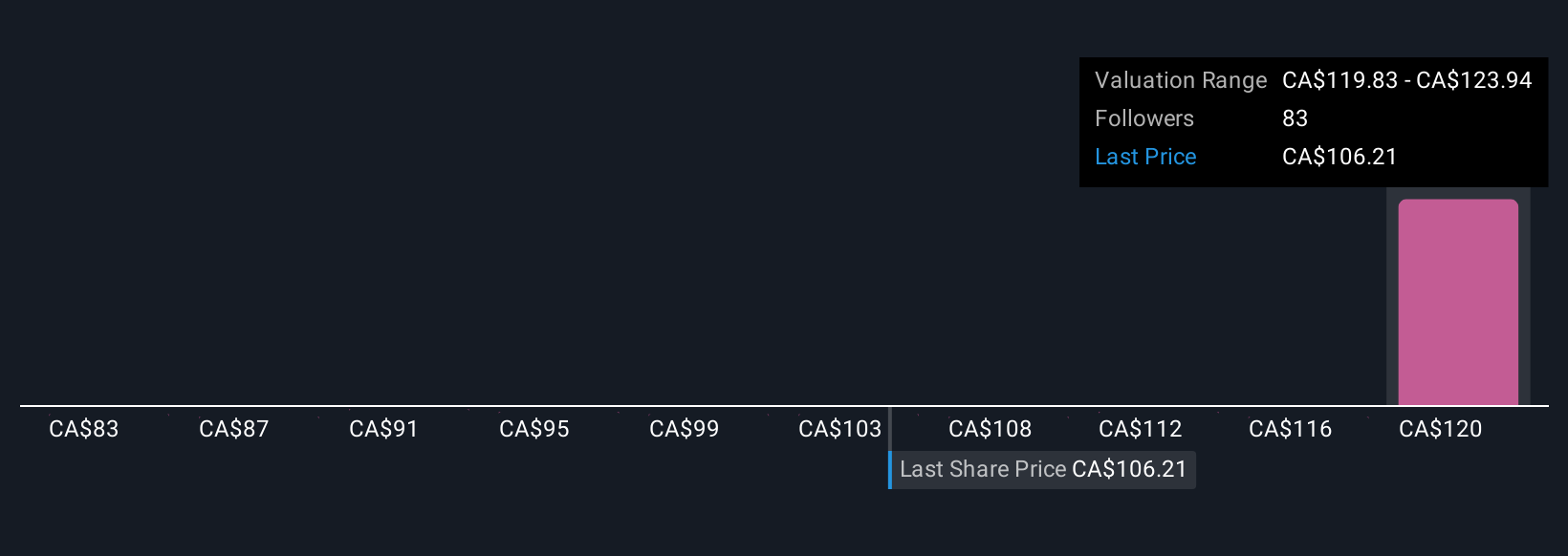

On the other hand, high debt levels remain a factor investors should not overlook. Canadian Pacific Kansas City's shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on Canadian Pacific Kansas City - why the stock might be worth as much as 29% more than the current price!

Build Your Own Canadian Pacific Kansas City Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Pacific Kansas City research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Pacific Kansas City research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Pacific Kansas City's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success