- Canada

- /

- Transportation

- /

- TSX:CNR

What Canadian National Railway (TSX:CNR)'s Intermodal Expansion and Wildfire Upgrades Mean for Shareholders

Reviewed by Simply Wall St

- Earlier this month, CN and CSX announced a Memorandum of Understanding to launch an intermodal service into Nashville, providing a seamless rail alternative for international containers moving from Canada’s West Coast through Memphis, while CN also expanded its wildfire response with new firefighting railcars and equipment upgrades across its network.

- This dual focus on operational resiliency and cross-border network expansion could enhance both supply chain reliability and long-term growth prospects for Canadian National Railway.

- We'll examine how CN's expanded wildfire response capability could impact its investment narrative around network resiliency and growth opportunities.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Canadian National Railway Investment Narrative Recap

To be a shareholder of Canadian National Railway, an investor needs to believe in the long-term value of its tri-coastal network, resilient operational model, and ability to deliver volume and margin growth as North American supply chains evolve. The recent CN-CSX intermodal partnership adds a competitive route into Nashville, but does not meaningfully shift the needle on near-term catalysts or the largest immediate risk: soft demand and uncertainty around tariffs continue to weigh on volume and revenue visibility.

The expansion of CN’s wildfire suppression fleet, introducing large-capacity firefighting railcars and piloting mobile response trailers, aligns closely with current concerns about network resiliency and operational disruptions. These upgrades are important in the context of recent service interruptions and reinforce the narrative that CN is committed to minimizing environmental and supply chain risks even as trade uncertainties persist.

However, even as new growth routes are developed, investors should be aware that ongoing macroeconomic headwinds and shifting customer supply chains could ...

Read the full narrative on Canadian National Railway (it's free!)

Canadian National Railway's outlook anticipates CA$19.6 billion in revenue and CA$5.6 billion in earnings by 2028. This scenario assumes a 4.6% annual revenue growth rate and a CA$1.0 billion earnings increase from the current CA$4.6 billion.

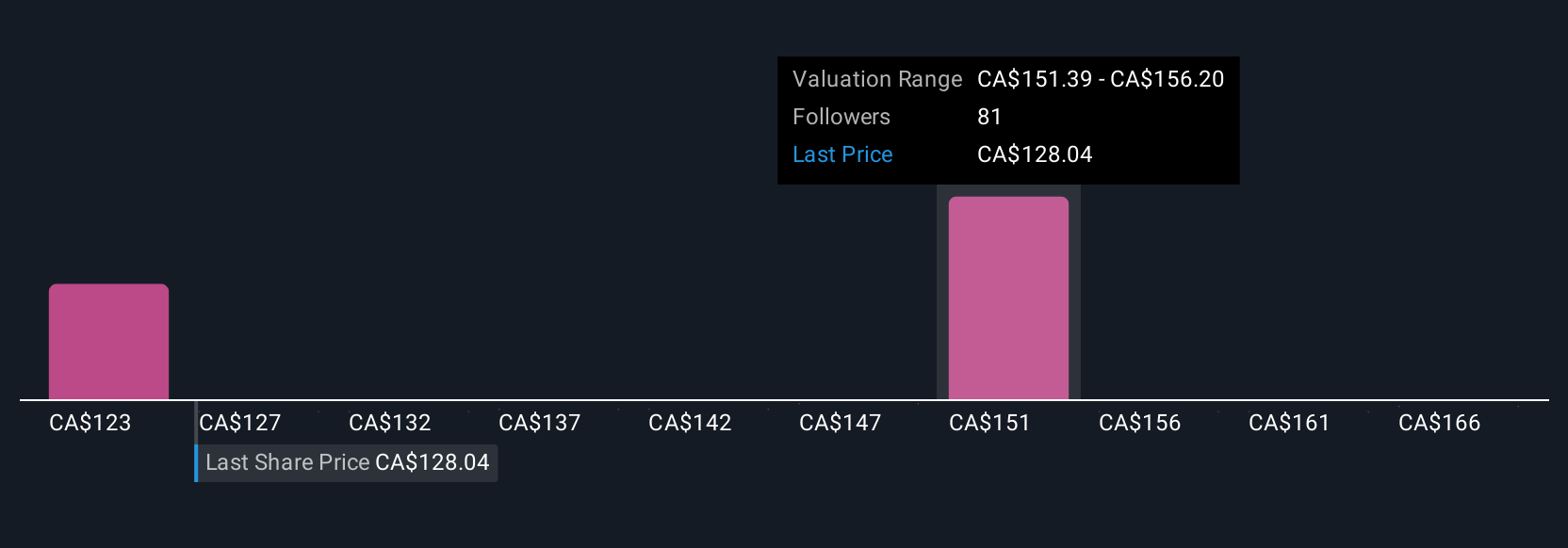

Uncover how Canadian National Railway's forecasts yield a CA$152.76 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Canadian National Railway between CA$119.75 and CA$170.48, with 11 independent views shaping this wide spread. While supply chain growth potential is often cited, shifting global trade routes remain a core challenge for future performance. Explore additional perspectives to see how your views compare.

Explore 11 other fair value estimates on Canadian National Railway - why the stock might be worth as much as 32% more than the current price!

Build Your Own Canadian National Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian National Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian National Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives