- Canada

- /

- Transportation

- /

- TSX:CNR

The Bull Case For Canadian National Railway (TSX:CNR) Could Change Following New CSX Partnership Into Nashville – Learn Why

Reviewed by Sasha Jovanovic

- CSX Corporation announced a partnership with Canadian National Railway to launch a new intermodal rail service into Nashville, Tennessee, aimed at improving freight connectivity and supply-chain reliability across North America.

- This collaboration highlights Canadian National Railway’s ongoing focus on shareholder returns through dividends and share buybacks, emphasizing disciplined capital allocation alongside network expansion.

- We'll look at how the partnership with CSX could further strengthen Canadian National Railway's market position and investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Canadian National Railway Investment Narrative Recap

Owning Canadian National Railway (CN) shares is about believing in long-term gains from North American trade and resilient supply chains. The new intermodal partnership with CSX brings potential for improved connectivity, but it does not materially shift the main short-term catalyst: a rebound in freight volumes. However, the biggest risk, a prolonged period of weak industrial demand and volume pressure, remains front and center for the business overall.

The recent memorandum of understanding with CSX to introduce intermodal service into Nashville stands out. This move directly relates to CN’s efforts to regain volume growth by tapping into new markets and enhancing service reliability, both critical to driving future revenue upside.

On the other hand, investors should also consider the ongoing risk of freight traffic being diverted away from CN’s network if supply chains adjust further...

Read the full narrative on Canadian National Railway (it's free!)

Canadian National Railway's outlook suggests revenues of CA$19.6 billion and earnings of CA$5.6 billion by 2028. This scenario assumes a 4.6% annual revenue growth rate and a CA$1.0 billion increase in earnings from the current CA$4.6 billion.

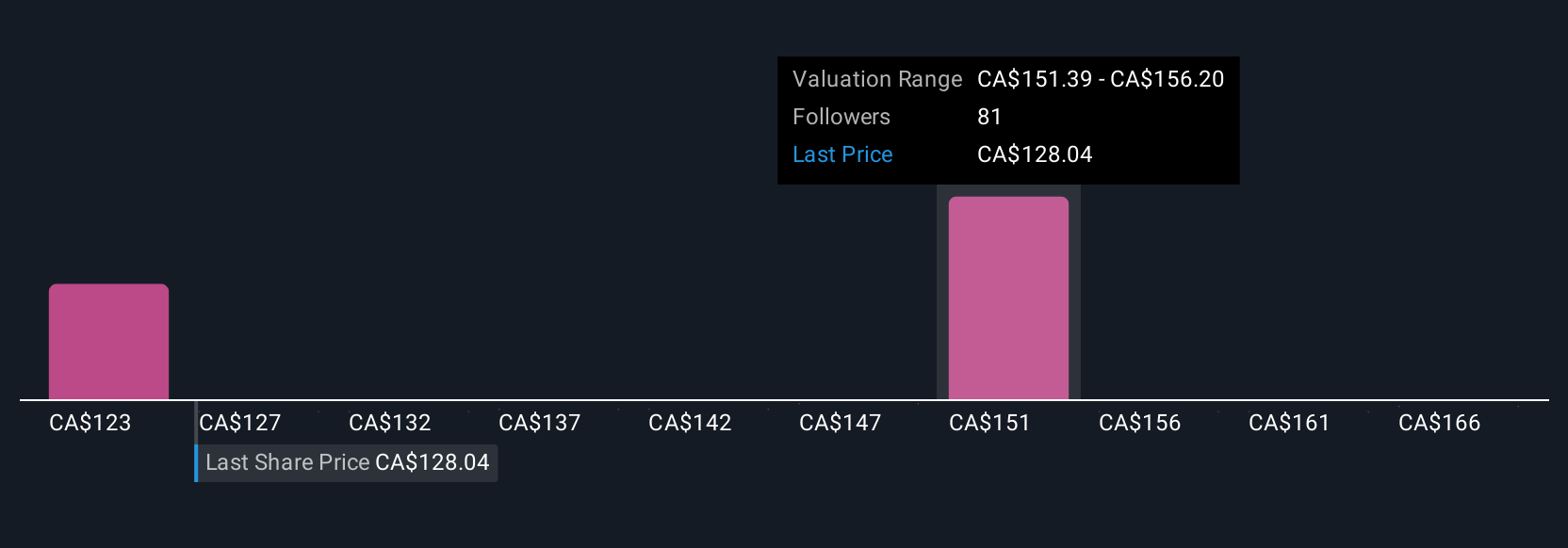

Uncover how Canadian National Railway's forecasts yield a CA$151.33 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Thirteen Simply Wall St Community members estimate CN’s fair value between CA$116.67 and CA$170.48. While views vary, many recognize that sustained volume growth remains pivotal to future performance, encouraging you to explore a range of perspectives.

Explore 13 other fair value estimates on Canadian National Railway - why the stock might be worth 13% less than the current price!

Build Your Own Canadian National Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian National Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian National Railway's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives