- Canada

- /

- Transportation

- /

- TSX:CNR

Canadian National Railway (TSX:CNR) Valuation Spotlight After Intermodal Expansion and Renewed Shareholder Focus

Reviewed by Kshitija Bhandaru

Canadian National Railway (TSX:CNR) has teamed up with CSX Corporation to launch an intermodal rail service into Nashville, aiming to streamline supply chains. The company is also prioritizing dividends and share buybacks, which highlights solid capital management.

See our latest analysis for Canadian National Railway.

Canadian National Railway’s recent push to boost supply chain efficiency and reward shareholders stands out, but the market response has been muted so far, with a 1-year total shareholder return of -0.1%. Momentum remains mixed, and there are signs of cautious optimism about future growth as investor attention shifts to ongoing partnerships and disciplined capital management.

If you’re eyeing fresh opportunities beyond the rails, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

Given Canadian National Railway’s disciplined execution and recent partnership, investors may be wondering if its softer performance has created a value opportunity or if the market is already reflecting future growth in the price.

Most Popular Narrative: 11.1% Undervalued

Canadian National Railway’s last close sat at CA$134.49, yet the most influential narrative pins fair value at CA$151.33, signalling a significant gap. This dynamic has made analysts reassess whether improved profitability and capital discipline justify a higher target, even while market momentum remains cautious.

“Rigorous cost discipline, including flexible workforce management and automation-driven operational efficiency, is enabling CN to maintain and even expand net margins and operating ratio. This sets up the business for accelerated earnings growth once volume headwinds normalize. Strategic capital allocation is increasingly focused on targeted, high-return projects and productivity, especially in maintenance and technology. This lays the foundation for better free cash flow conversion and long-term EPS growth as long-term positive industry trends play out.”

Want to see what’s really behind that fair value gap? The narrative is built on sharper margins, bigger earnings, and a future profit multiple that hints at shifting industry expectations. Find out which projections are fueling this bullish target. Only the full narrative connects every dot.

Result: Fair Value of $151.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and flat volume growth may limit Canadian National Railway’s ability to fully realize those bullish long-term projections.

Find out about the key risks to this Canadian National Railway narrative.

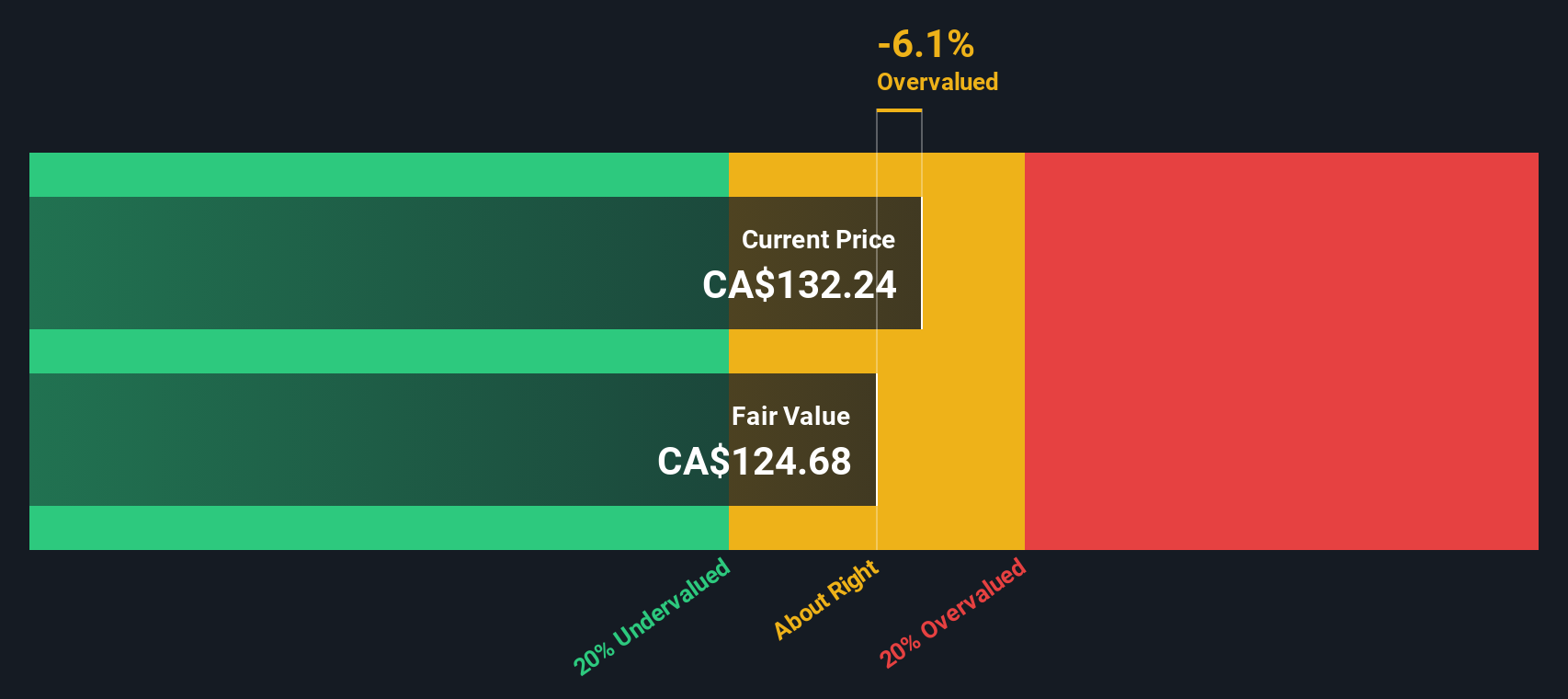

Another View: SWS DCF Model Weighs In

While many investors focus on earnings ratios, our SWS DCF model suggests a more cautious approach. According to this cash flow-based estimate, Canadian National Railway's current price of CA$134.49 is actually above its fair value of CA$122.15. This may indicate potential overvaluation. What if market optimism is already priced in and future growth falls short?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canadian National Railway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Canadian National Railway Narrative

If you see the numbers differently or want to dig deeper, building your own narrative takes just a few minutes and gives a fresh perspective. Do it your way

A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by targeting companies with the strongest potential. Don’t let opportunity pass by without considering these proven strategies.

- Capture the next wave of value by checking out these 887 undervalued stocks based on cash flows with impressive cash flow metrics and overlooked growth prospects.

- Bank on the future of medicine by researching these 32 healthcare AI stocks where AI-driven healthcare innovators are redefining what is possible for patient care and diagnostics.

- Unlock passive income streams and long-term yield by exploring these 19 dividend stocks with yields > 3% that deliver consistent returns through generous dividends exceeding 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives