- Canada

- /

- Transportation

- /

- TSX:CNR

Canadian National Railway Company's (TSE:CNR) Price Is Out Of Tune With Earnings

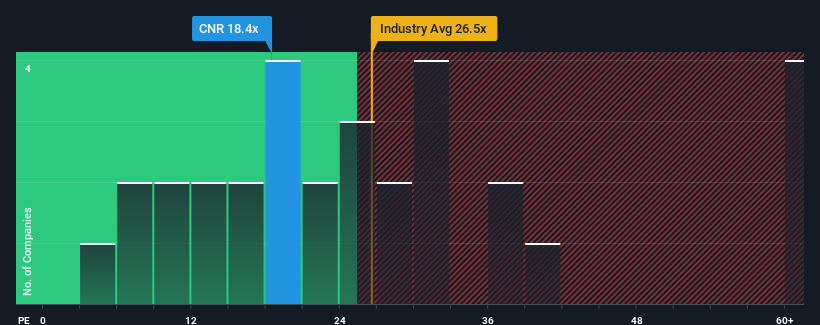

Canadian National Railway Company's (TSE:CNR) price-to-earnings (or "P/E") ratio of 18.4x might make it look like a sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 15x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Canadian National Railway has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Canadian National Railway

Is There Enough Growth For Canadian National Railway?

The only time you'd be truly comfortable seeing a P/E as high as Canadian National Railway's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.1%. Pleasingly, EPS has also lifted 53% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 6.0% per year as estimated by the analysts watching the company. With the market predicted to deliver 9.0% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Canadian National Railway is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Canadian National Railway's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Canadian National Railway's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Canadian National Railway, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Canadian National Railway, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives