The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Cargojet (TSE:CJT), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Cargojet

How Fast Is Cargojet Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Cargojet grew its EPS from CA$2.68 to CA$16.85, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

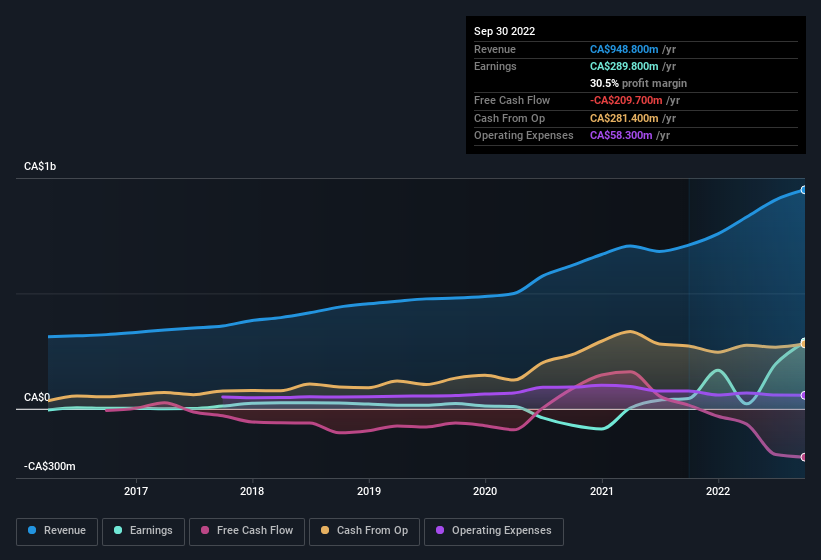

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Cargojet remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 34% to CA$949m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Cargojet's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Cargojet Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While we did see insider selling of Cargojet stock in the last year, one single insider spent plenty more buying. To be exact, Chief Financial Officer Scott Calver put their money where their mouth is, paying CA$500k at an average of price of CA$136 per share That certainly piques our interest.

On top of the insider buying, it's good to see that Cargojet insiders have a valuable investment in the business. As a matter of fact, their holding is valued at CA$58m. This considerable investment should help drive long-term value in the business. Despite being just 2.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Cargojet Worth Keeping An Eye On?

Cargojet's earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Cargojet belongs near the top of your watchlist. It is worth noting though that we have found 3 warning signs for Cargojet (2 are concerning!) that you need to take into consideration.

The good news is that Cargojet is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CJT

Cargojet

Provides time-sensitive overnight air cargo services and carries in Canada.

Solid track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026