TELUS (TSX:T) Unveils $1.6B Debt Offering And AI Factories In Canada

Reviewed by Simply Wall St

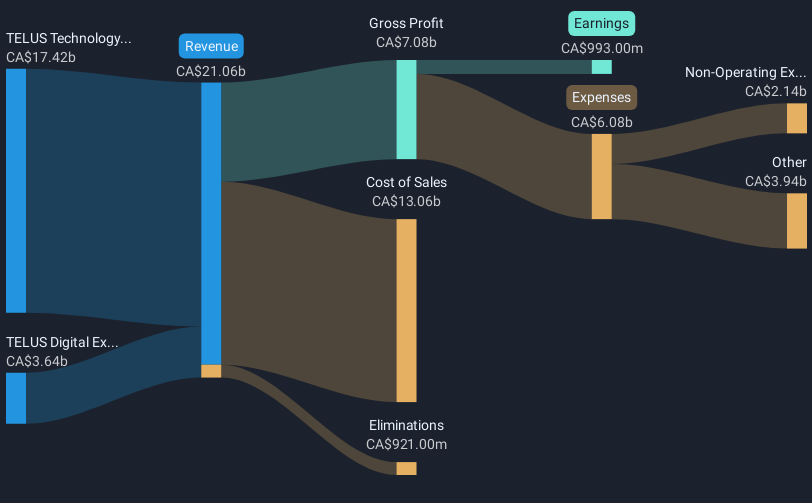

TELUS (TSX:T) recently announced the issuance of $1.6 billion in junior subordinated notes and the launch of its Sovereign AI Factories initiative in Rimouski and Kamloops, underscoring the company's commitment to financial strengthening and technological advancement. These developments come at a time when the market has experienced significant volatility due to geopolitical tensions, as seen with tech stocks declining amidst U.S.-China trade issues. Despite the broader market's flat performance, TELUS's share price rose 4%, which could be attributed to investor confidence in its growth initiatives and sustainability focus. Such moves, however, coincided with overall positive sentiment in the market.

We've spotted 3 risks for TELUS you should be aware of, and 2 of them are a bit concerning.

Rare earth metals are the new gold rush. Find out which 22 stocks are leading the charge.

The recent issuance of $1.6 billion in junior subordinated notes and the launch of TELUS's Sovereign AI Factories initiative may bolster investor confidence, reflecting its efforts in financial strengthening and technological expansion. These steps align with the company's narrative of driving future revenue and earnings growth, supported by robust customer growth in mobility and fixed services, as well as diversification into the health and agriculture sectors. However, the high competitive pressure and ongoing deleveraging strategies could impact its financial targets and add uncertainty to its earnings forecasts.

Over the past five years, TELUS achieved a total shareholder return of 22.75%, indicating solid long-term performance. In the context of the more recent market environment, TELUS underperformed compared to the Canadian market, which saw an 8.7% return over the past year, but outperformed the Canadian Telecom industry that declined by 16.5%. From a current valuation standpoint, TELUS's share price of CA$19.68 remains approximately 14.4% below the consensus price target of CA$22.99. This suggests that while the company's strategic initiatives are being positively received, there remains potential for price adjustment aligned with the target, depending on its ability to meet revenue and earnings expectations.

Get an in-depth perspective on TELUS' performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives