TELUS (TSX:T) Launches GameRx To Promote Wellbeing Through Gaming In Canada

Reviewed by Simply Wall St

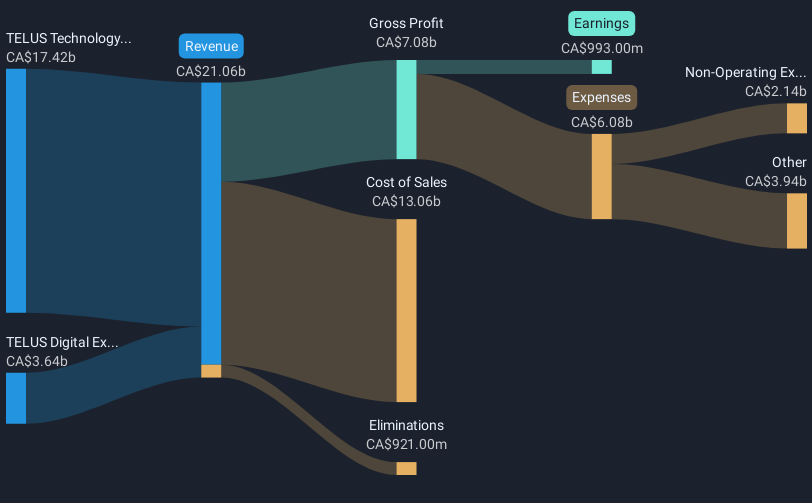

TELUS (TSX:T) recently launched GameRx™, an online platform designed to integrate gaming with wellbeing, addressing mental health challenges for Canadians. This innovation aligns with the broader market recovery seen in the past week, as major indexes experienced gains amidst tariff news and economic data. Additionally, TELUS's Q4 2024 earnings saw year-over-year growth in revenue and net income, providing a strong backdrop for its share price movement. The company's strategic announcements, including partnerships and advancements in AI, may have complemented the 2.39% price increase over the last quarter, mirroring overall market resilience.

TELUS's launch of GameRx™ aims to blend gaming with wellbeing, targeting the rising mental health needs of Canadians. This move could enhance TELUS's reputation as an innovative company in the telecommunications sector, possibly aiding in customer retention and acquisition. Such initiatives may strengthen its revenue and earnings forecasts, supporting its goal of 3.2% annual revenue growth and an increase in profit margins over the next three years.

Over the past five years, TELUS's total shareholder return was 17.82%, reflecting steady long-term growth. However, in the shorter term, TELUS underperformed compared to the broader Canadian market, which saw a 1.2% return over the past year, though it outpaced the Canadian Telecom industry's decline of 18.7% in the same period.

With the current share price of CA$19.68 and a consensus price target of CA$22.99, the stock is trading at a 14.4% discount to the target. Analysts anticipate strong future performance based on revenue, margin improvements, and strategic investments. Yet, achieving and surpassing this price target depends on successful execution of these growth plans and maintaining competitive pressures at bay.

Upon reviewing our latest valuation report, TELUS' share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade TELUS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives