TELUS (TSX:T) Expands Entertainment Offering With New All-In-One Streaming Bundles

Reviewed by Simply Wall St

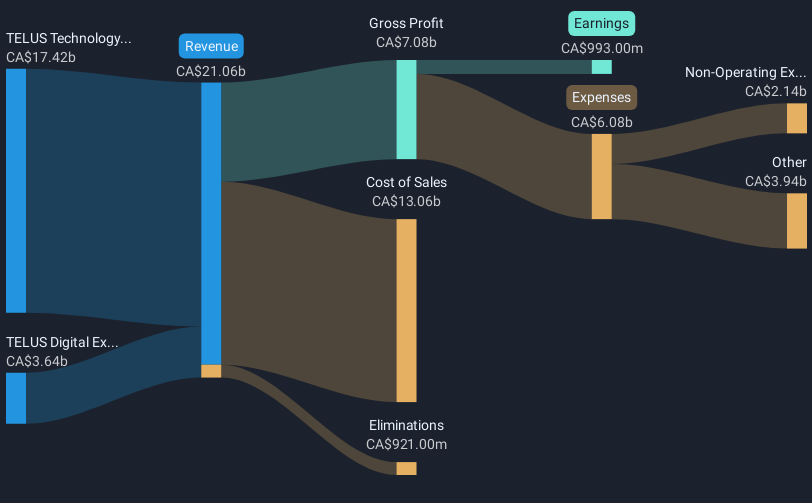

TELUS (TSX:T) recently launched a new streaming and TV experience in Ontario and Quebec, enhancing its entertainment offerings and consolidating various streaming services. This launch, amid a 5.69% rise in TELUS's stock price over the last month, is part of broader developments such as its Q1 earnings report that showed increased revenue. Additionally, TELUS announced a 7% dividend hike, strengthening investor confidence. The overall market rose by 5.1% during the same period, suggesting TELUS's moves, like the dividend increase and new product offerings, complemented rather than solely influenced its performance in the wider market context.

You should learn about the 2 risks we've spotted with TELUS.

The recent expansion of TELUS's streaming and TV services in Ontario and Quebec, coupled with a dividend increase, suggests a focus on expanding customer reach and enhancing shareholder value. This aligns with their narrative of strong customer growth and diversification into health and agriculture, aiming to bolster long-term profitability. Over the past five years, TELUS's total shareholder return, including share price appreciation and dividends, was 26.31%. Although this represents a steady long-term performance, the company has faced challenges in keeping up with short-term market movements. Over the past year, TELUS's stock outperformed the Canadian Telecom industry which saw a decline of 17.2%, but underperformed the broader market with its 10.1% return.

The new service offerings could support TELUS's revenue and earnings forecasts by attracting new subscribers and enhancing engagement. Analysts predict revenue growth of approximately 3% annually, while earnings are forecasted to increase by around 20.26% per year. However, TELUS's current share price of CA$20.99 reflects only a minor discount to the consensus price target of CA$22.78, indicating a belief among analysts that the stock's price is near its fair value. This moderate gap highlights the market's cautious optimism about TELUS's growth prospects amidst ongoing competitive pressures and debt challenges. Investors should evaluate these developments within the broader context of TELUS's strategic initiatives and market conditions.

Jump into the full analysis health report here for a deeper understanding of TELUS.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives