- Canada

- /

- Wireless Telecom

- /

- TSX:RCI.B

Rogers Communications (TSX:RCI.B) One-Off CA$541M Loss Challenges Bullish Margin Recovery Narratives

Reviewed by Simply Wall St

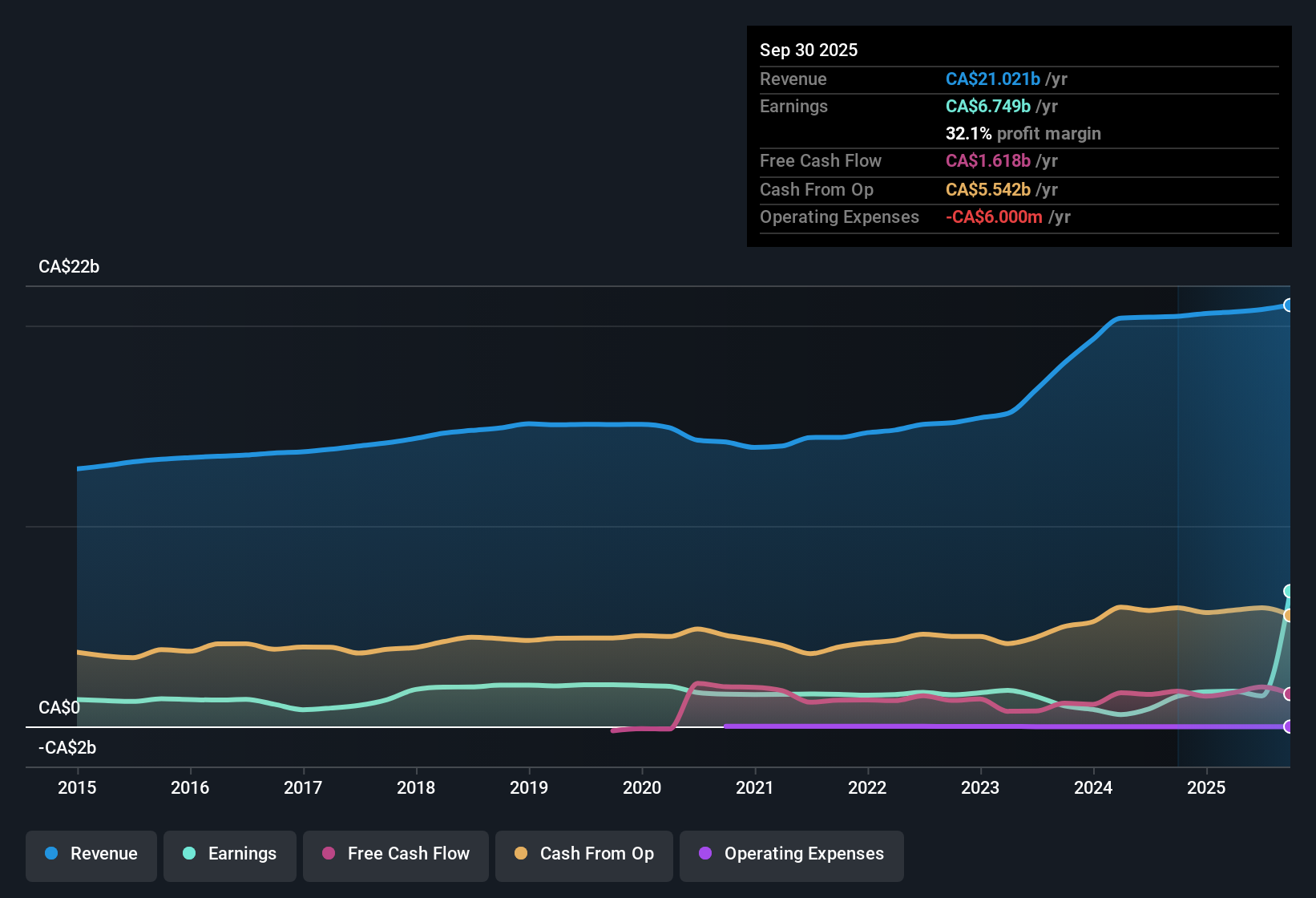

Rogers Communications (TSX:RCI.B) has reported net profit margin improvement to 7.3% from 4.3% last year, while posting a 73% earnings growth that reverses the company’s five-year average annual earnings decline of 4.9%. Looking forward, earnings are forecast to grow 17.9% per year, outpacing the Canadian market forecast of 12.2%. However, revenue growth is expected to trail at 3% per year compared to the market’s 5%. Amid rising profits, investors will be watching quality-of-earnings risks tied to a CA$541 million one-off loss and the context of long-term earnings headwinds.

See our full analysis for Rogers Communications.To put these numbers in perspective, the next section compares the latest results against the dominant narratives that investors follow for Rogers Communications. This will show where the market’s thinking is confirmed, and where the new data challenges old assumptions.

See what the community is saying about Rogers Communications

Large One-Off Loss Raises Red Flags

- The most recent filing shows a CA$541 million one-off loss, which stands out against the positive momentum in net profit margin and overall earnings growth.

- Consensus narrative flags quality-of-earnings risks, emphasizing that major one-time hits like this could mask underlying profitability trends and disrupt future margin gains.

- Analysts point out that despite efficient cost measures and solid infrastructure investments, any sizable, recurring non-core items could erode the margin gains that bulls expect to continue.

- There is tension between margin optimism and hidden costs, as recurring exceptional losses may drain earnings capacity even as base profitability improves.

Valuation Gap Versus Peers and Industry

- Rogers trades at 19.2x Price-to-Earnings, substantially lower than the peer average of 33.6x, yet modestly above the global wireless telecom industry average of 18.6x.

- According to the analysts’ consensus view, bulls argue this discount to immediate peers suggests room for share price upside, but the premium over global telecom averages and the market’s risk reminders could temper how much value investors are willing to assign.

- The 19.2x P/E looks attractive on a Canada-specific basis, supporting the thesis that Rogers is undervalued relative to local competitors.

- However, persistent leverage and regulatory challenges mean the valuation gap alone may not be enough to drive a re-rating without stronger top-line or margin outperformance.

Bulls Eye Margin Expansion to 10.4%

- Analysts expect Rogers' profit margin to climb from the current 7.3% to 10.4% over the next three years, a sizable expansion on par with disciplined cost-cutting and integration efforts highlighted in the consensus narrative.

- Consensus narrative notes that Rogers’ new investments in rural coverage and advanced wireless networks, together with continued cost efficiency, are expected to underpin this margin expansion and future earnings growth.

- Margin improvement is seen as a foundation for funding further growth, despite Canadian market maturation risks and ARPU pressures noted in the narrative.

- Successful execution on tech innovation and cost control is viewed as essential for delivering on these high earnings targets relative to national peers.

Analysts watching these trends believe the margin recovery and valuation discount could set up the next chapter for Rogers. See how consensus weighs competing risks and rewards in the company’s full story with the link below. 📊 Read the full Rogers Communications Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rogers Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticed something in the data that stands out to you? Share your perspective in just a few minutes and shape your own narrative: Do it your way

A great starting point for your Rogers Communications research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Rogers shows margin gains, concerns about recurring non-core losses and persistent leverage highlight ongoing risks to sustaining profit growth and financial health.

If you want to focus on companies with stronger fundamentals and better financial resilience, find candidates screened for lower debt and healthier balance sheets with solid balance sheet and fundamentals stocks screener (1974 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RCI.B

Rogers Communications

Operates as a communications and media company in Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion