- Canada

- /

- Wireless Telecom

- /

- TSX:RCI.B

Did Rogers' Cloud Gaming, Satellite, and Rural 5G Push Just Shift Rogers Communications' (TSX:RCI.B) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Rogers Communications has launched Amazon Luna cloud gaming on Rogers Xfinity, expanded Rogers Satellite services for remote consumer and IoT connectivity, and extended its 5G mobile network to 34 additional eastern Ontario communities through the EORN Cell Gap Project.

- Together, these moves show Rogers using its network scale to bundle entertainment, satellite-to-mobile links, and rural 5G coverage into a broader connectivity ecosystem for Canadian households, businesses, and public services.

- Next, we’ll examine how the rollout of Rogers Satellite connectivity could influence Rogers Communications’ existing investment narrative and future growth expectations.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Rogers Communications Investment Narrative Recap

To own Rogers Communications, you need to believe its scale can offset regulatory pressure, slowing wireless growth, and high leverage as earnings are expected to decline despite modest revenue growth. The latest Luna, Rogers Satellite, and rural 5G announcements support the connectivity ecosystem story but do not materially alter the near term focus on balance sheet strength and pricing pressure risk.

Of the recent moves, the expansion of Rogers Satellite connectivity looks most relevant for the existing catalyst that hinges on rural and remote coverage. Turning satellite texting into a broader voice, data, and IoT service could reinforce Rogers’ ability to find new subscribers and use cases in regions where traditional cellular networks struggle, even as ARPU pressure and competition remain front of mind.

But while the connectivity story is expanding, investors still need to be aware that regulatory uncertainty and mandated access could...

Read the full narrative on Rogers Communications (it's free!)

Rogers Communications' narrative projects CA$23.4 billion revenue and CA$2.4 billion earnings by 2028. This requires 4.0% yearly revenue growth and about a CA$0.9 billion earnings increase from CA$1.5 billion today.

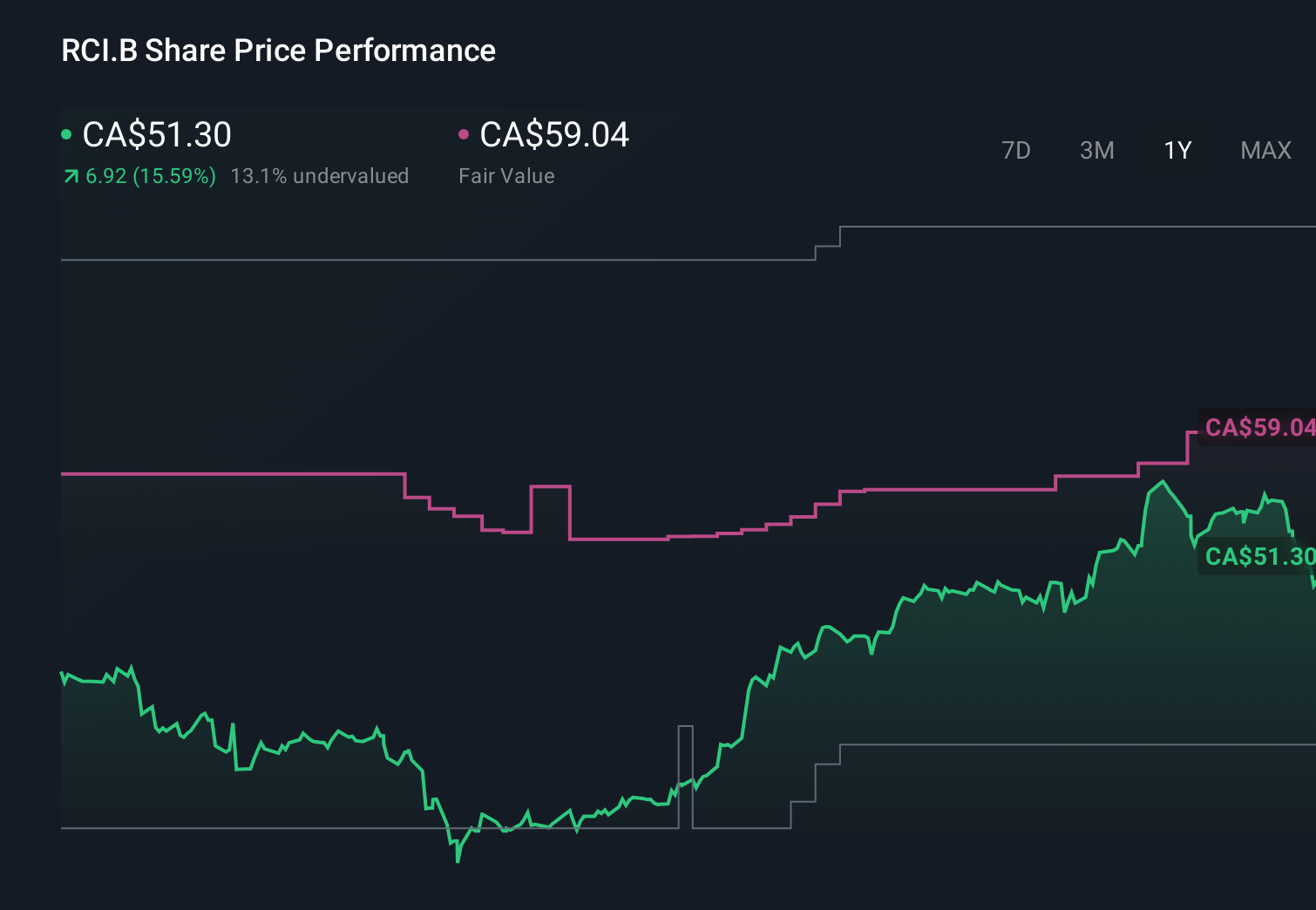

Uncover how Rogers Communications' forecasts yield a CA$59.46 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span about CA$19 to over CA$200, showing how differently you and other investors can view Rogers’ prospects. Set against this dispersion, the risk that earnings are forecast to decline while leverage remains elevated invites you to compare several viewpoints before deciding how much balance sheet and cash flow resilience you want exposure to.

Explore 8 other fair value estimates on Rogers Communications - why the stock might be worth over 3x more than the current price!

Build Your Own Rogers Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rogers Communications research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rogers Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers Communications' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RCI.B

Rogers Communications

Operates as a communications and media company in Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion