Investors Still Aren't Entirely Convinced By Kraken Robotics Inc.'s (CVE:PNG) Revenues Despite 26% Price Jump

Despite an already strong run, Kraken Robotics Inc. (CVE:PNG) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

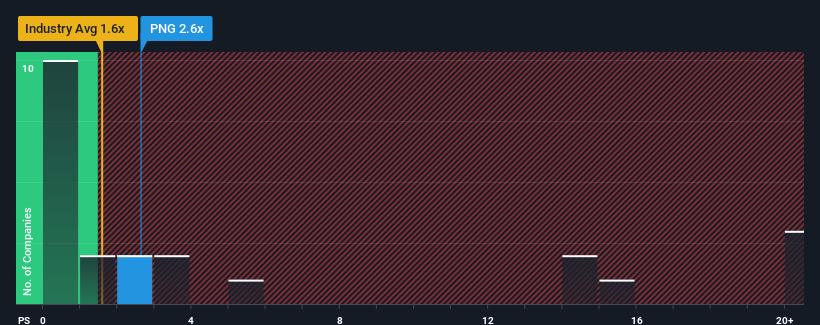

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Kraken Robotics' P/S ratio of 2.6x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Canada is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Kraken Robotics

How Kraken Robotics Has Been Performing

Kraken Robotics could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kraken Robotics.How Is Kraken Robotics' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Kraken Robotics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.2%. The latest three year period has also seen an excellent 101% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 34% per year over the next three years. That's shaping up to be materially higher than the 30% per annum growth forecast for the broader industry.

With this information, we find it interesting that Kraken Robotics is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Kraken Robotics' P/S?

Kraken Robotics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Kraken Robotics' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Kraken Robotics that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion