- Canada

- /

- Communications

- /

- TSXV:CMI

Tree Island Steel And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Canadian economy navigates a cooling labor market and potential rate cuts from the Bank of Canada, investors are keeping a close eye on opportunities that may arise in this shifting landscape. Penny stocks, though often considered niche investments, can offer unique growth prospects when backed by strong financial health. In this article, we explore three Canadian penny stocks that stand out with their potential for stability and upside in today's evolving market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$182.69M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$118.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.32M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$231.56M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.21 | CA$135.82M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Tree Island Steel (TSX:TSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tree Island Steel Ltd. manufactures and sells steel wire and fabricated steel wire products in Canada, the United States, and internationally, with a market cap of CA$71.58 million.

Operations: Tree Island Steel Ltd. does not report specific revenue segments, but it operates in Canada, the United States, and internationally.

Market Cap: CA$71.58M

Tree Island Steel Ltd., with a market cap of CA$71.58 million, operates without debt, which eliminates concerns about interest coverage and debt repayment. The company's short-term assets significantly exceed both its short-term and long-term liabilities, indicating strong liquidity. Despite being unprofitable with a negative return on equity of -2.07%, Tree Island Steel has managed to reduce its losses by 10.3% annually over the past five years. Recent earnings reports show declining sales and profitability compared to the previous year, but the company is actively engaging in share repurchases, reflecting management's confidence in future prospects despite current challenges.

- Navigate through the intricacies of Tree Island Steel with our comprehensive balance sheet health report here.

- Explore historical data to track Tree Island Steel's performance over time in our past results report.

C-Com Satellite Systems (TSXV:CMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C-Com Satellite Systems Inc. develops and deploys commercial-grade mobile auto-deploying satellite-based technology for delivering two-way high-speed Internet, VoIP, and video services to vehicles across various international markets, with a market cap of CA$50.29 million.

Operations: The company generates revenue of CA$10.34 million from its segment focused on the design and manufacture of auto-deploying mobile satellite antennas.

Market Cap: CA$50.29M

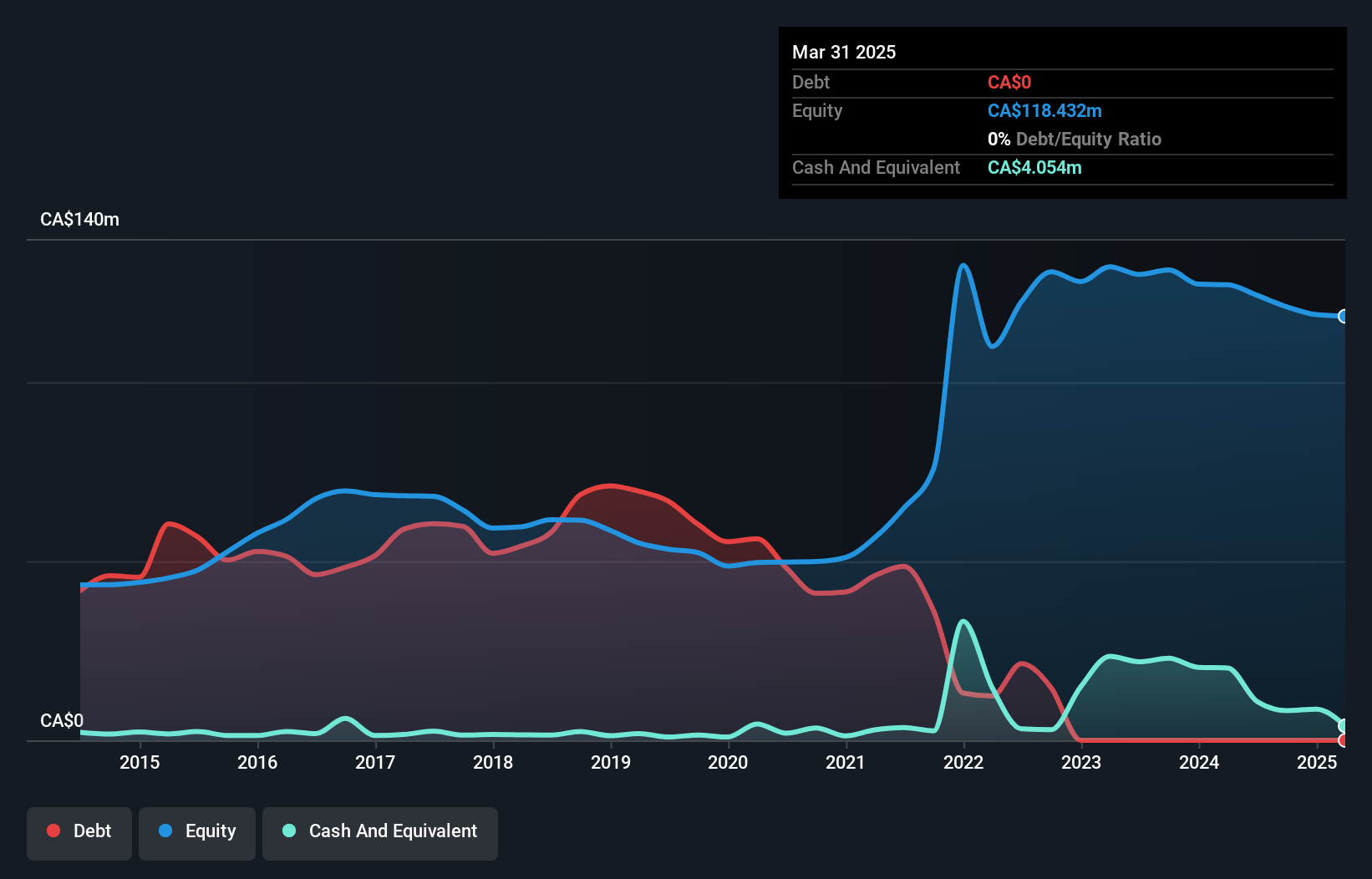

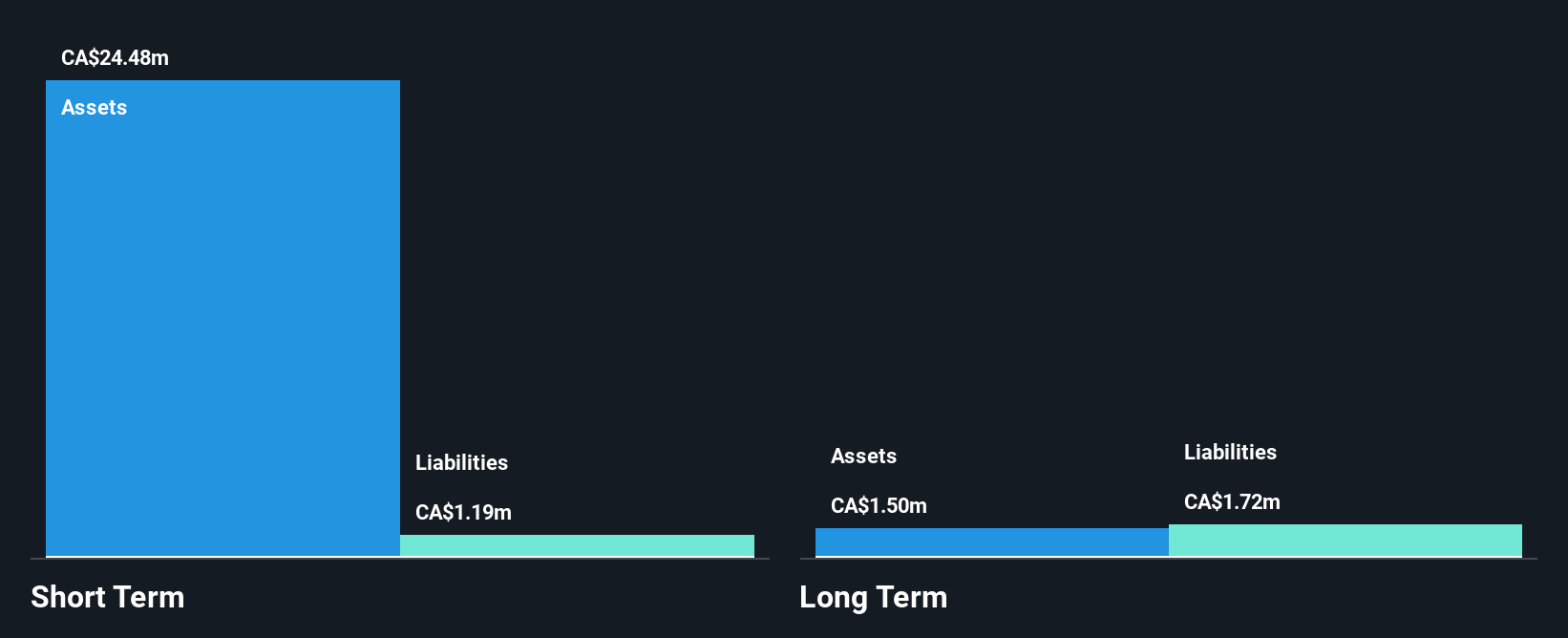

C-Com Satellite Systems Inc., with a market cap of CA$50.29 million, has turned profitable recently and reported third-quarter sales of CA$1.32 million, up from the previous year. Despite earnings growth challenges over the past five years, the company maintains high-quality earnings and operates debt-free, which simplifies financial management. Its short-term assets significantly exceed liabilities, showcasing robust liquidity. However, its return on equity is relatively low at 8.1%, and while dividends are offered at CA$0.0125 per share, they are not well covered by earnings. The experienced management team and board add stability to its operations amidst volatility in earnings growth rates.

- Unlock comprehensive insights into our analysis of C-Com Satellite Systems stock in this financial health report.

- Assess C-Com Satellite Systems' previous results with our detailed historical performance reports.

TAG Oil (TSXV:TAO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TAG Oil Ltd., along with its subsidiaries, focuses on the exploration, development, and production of oil and gas in Canada, the Middle East, and North Africa with a market cap of CA$26.84 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: CA$26.84M

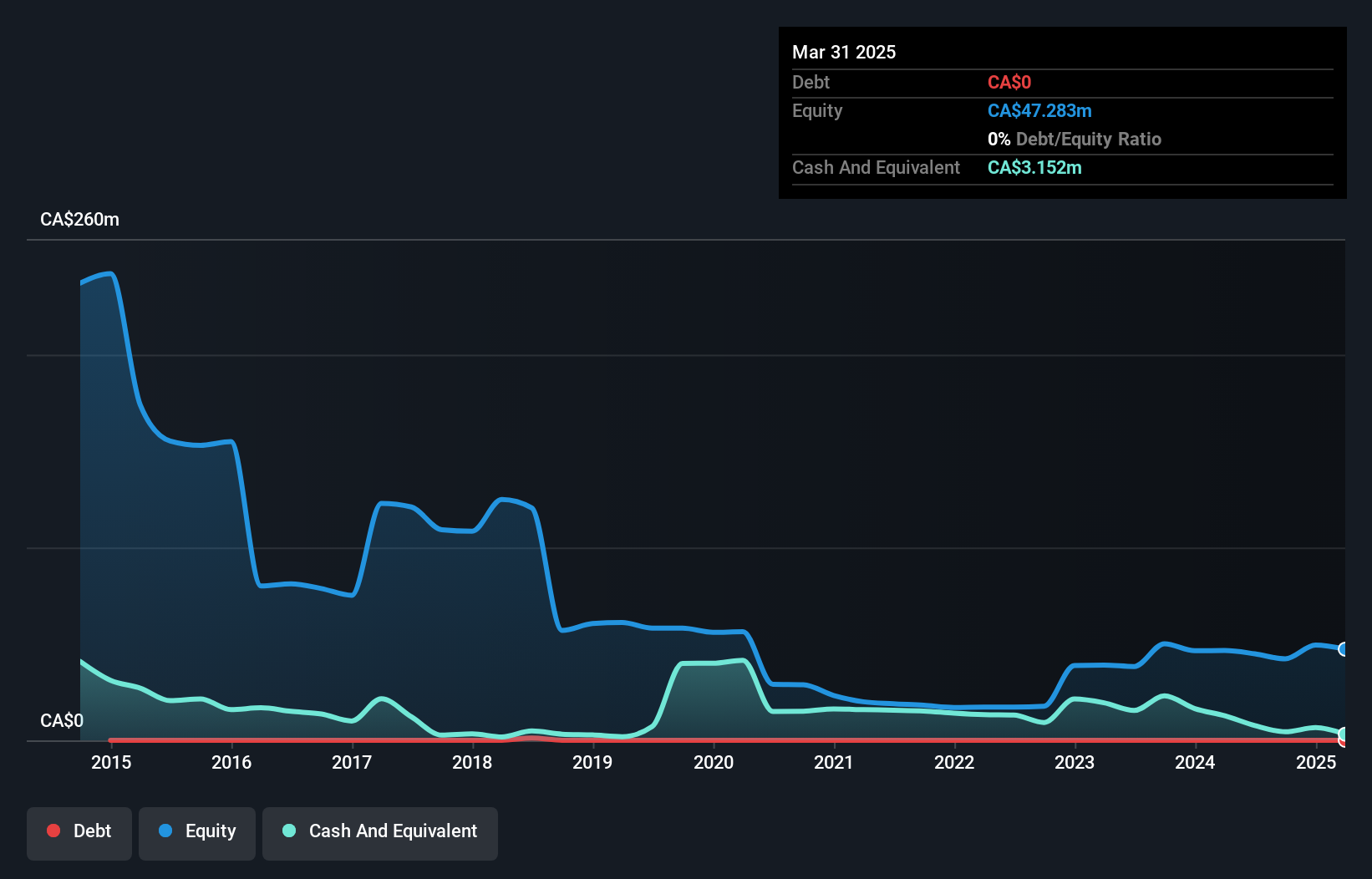

TAG Oil Ltd., with a market cap of CA$26.84 million, is pre-revenue, generating less than US$1 million annually. The company recently raised CA$10 million through a public offering to fund exploration in Egypt’s Western Desert, aiming to capitalize on unconventional oil resources in the Badr Oil Field. Despite being unprofitable and having negative return on equity, TAG Oil remains debt-free and has reduced losses over five years by 11.6% annually. Its seasoned management team and board provide stability as it seeks further acquisitions in the Middle East and North Africa while managing short-term liabilities effectively with assets of CA$14.8 million surpassing liabilities of CA$7.5 million.

- Get an in-depth perspective on TAG Oil's performance by reading our balance sheet health report here.

- Examine TAG Oil's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Click here to access our complete index of 963 TSX Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CMI

C-Com Satellite Systems

Designs, develops, manufactures, and sells transportable and mobile satellite-based antenna systems in Canada, Indonesia, Brazil, the United States, Bangladesh, Kazakhstan, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives