We're Hopeful That Aurora Solar Technologies (CVE:ACU) Will Use Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Aurora Solar Technologies (CVE:ACU) stock is up 279% in the last year, providing strong gains for shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it's well worth asking whether Aurora Solar Technologies' cash burn is too risky. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Aurora Solar Technologies

When Might Aurora Solar Technologies Run Out Of Money?

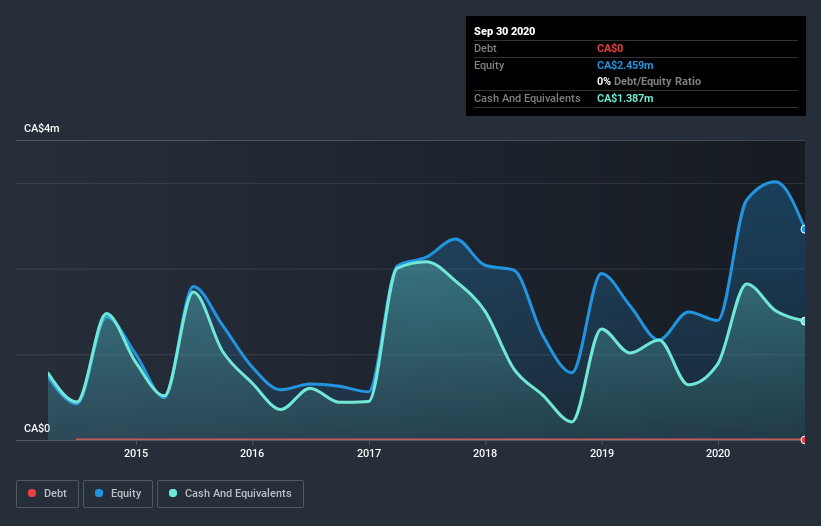

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Aurora Solar Technologies last reported its balance sheet in September 2020, it had zero debt and cash worth CA$1.4m. In the last year, its cash burn was CA$1.2m. So it had a cash runway of approximately 14 months from September 2020. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Aurora Solar Technologies Growing?

Some investors might find it troubling that Aurora Solar Technologies is actually increasing its cash burn, which is up 17% in the last year. But looking on the bright side, its revenue gained by 63%, lending some credence to the growth narrative. The company needs to keep up that growth, if it is to really please shareholders. We think it is growing rather well, upon reflection. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how Aurora Solar Technologies is building its business over time.

How Hard Would It Be For Aurora Solar Technologies To Raise More Cash For Growth?

While Aurora Solar Technologies seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CA$59m, Aurora Solar Technologies' CA$1.2m in cash burn equates to about 2.0% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Aurora Solar Technologies' Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Aurora Solar Technologies' revenue growth was relatively promising. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 4 warning signs for Aurora Solar Technologies that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you decide to trade Aurora Solar Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ACU

Aurora Solar Technologies

Develops, manufactures, and markets material inspection and inline quality control systems for the solar polysilicon, wafer, cell, and module manufacturing industries in China, the United States, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026