We note that a Vecima Networks Inc. (TSE:VCM) insider, Richard Rockwell, recently sold CA$115k worth of stock for CA$10.52 per share. It might not be a huge sale, but it did reduce their holding size 42%, hardly encouraging.

Vecima Networks Insider Transactions Over The Last Year

In fact, the recent sale by Richard Rockwell was the biggest sale of Vecima Networks shares made by an insider individual in the last twelve months, according to our records. That means that an insider was selling shares at around the current price of CA$10.54. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

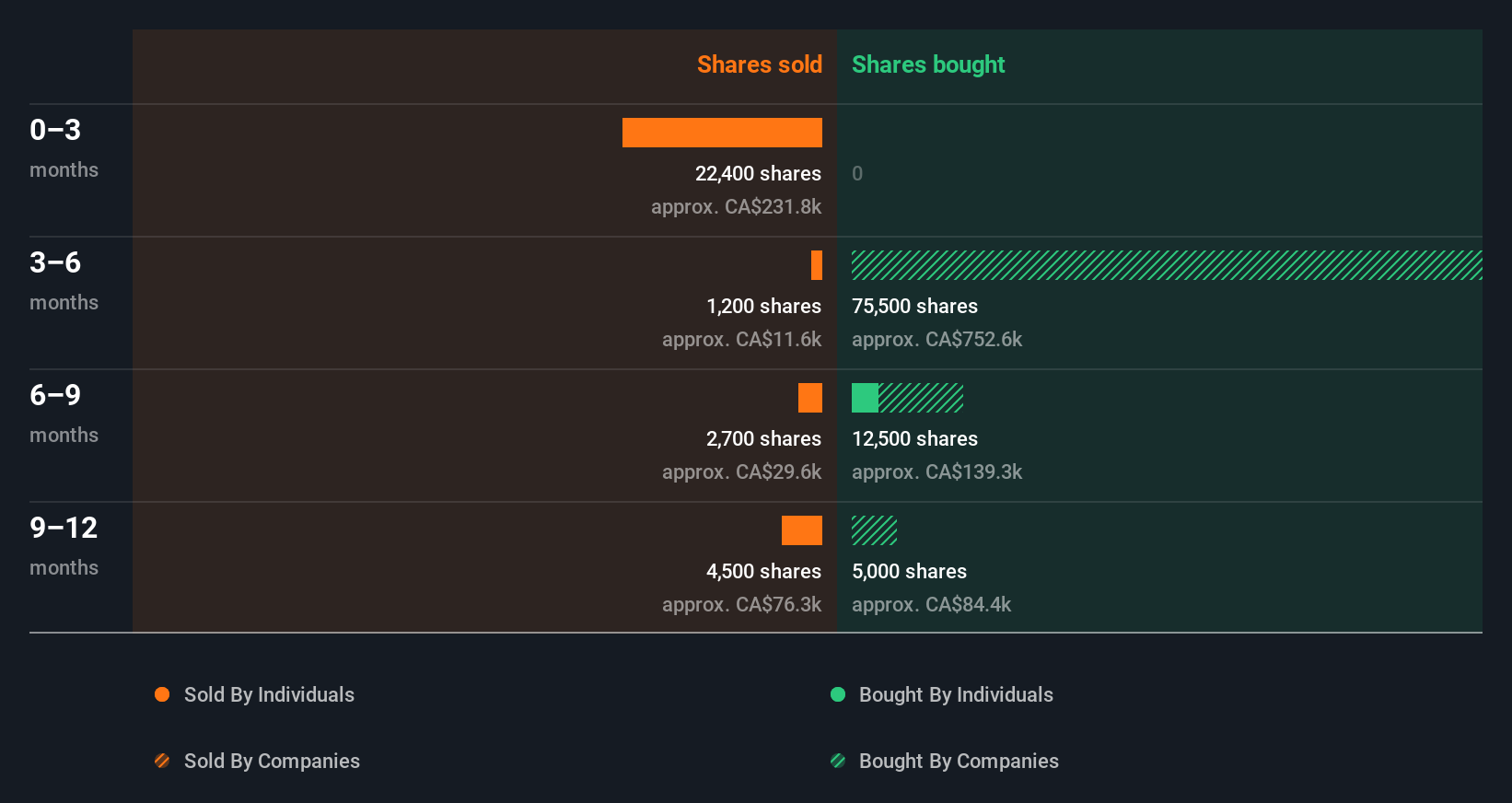

Happily, we note that in the last year insiders paid CA$34k for 3.00k shares. But insiders sold 30.80k shares worth CA$350k. All up, insiders sold more shares in Vecima Networks than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

See our latest analysis for Vecima Networks

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Based on our data, Vecima Networks insiders have about 1.6% of the stock, worth approximately CA$4.1m. But they may have an indirect interest through a corporate structure that we haven't picked up on. I generally like to see higher levels of ownership.

So What Does This Data Suggest About Vecima Networks Insiders?

Insiders sold Vecima Networks shares recently, but they didn't buy any. Despite some insider buying, the longer term picture doesn't make us feel much more positive. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we'd only buy after very careful consideration. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 2 warning signs for Vecima Networks you should know about.

Of course Vecima Networks may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VCM

Vecima Networks

Engages in the development of integrated hardware and software solutions for broadband access, content delivery, and telematics.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.