- Canada

- /

- Communications

- /

- TSX:ET

Undiscovered Gems In Canada Featuring 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

The Canadian market is currently navigating a period of economic resilience, with the Bank of Canada gradually reducing rates as inflation eases, providing a more favorable environment for small-cap stocks. In this landscape, identifying promising small-cap stocks involves looking for companies that can capitalize on these conditions by demonstrating strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 12.65% | 16.00% | 17.29% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.66% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets worldwide with a market cap of approximately CA$916.94 million.

Operations: The primary revenue stream for Evertz Technologies comes from the Television Broadcast Equipment Market, generating approximately CA$500.44 million.

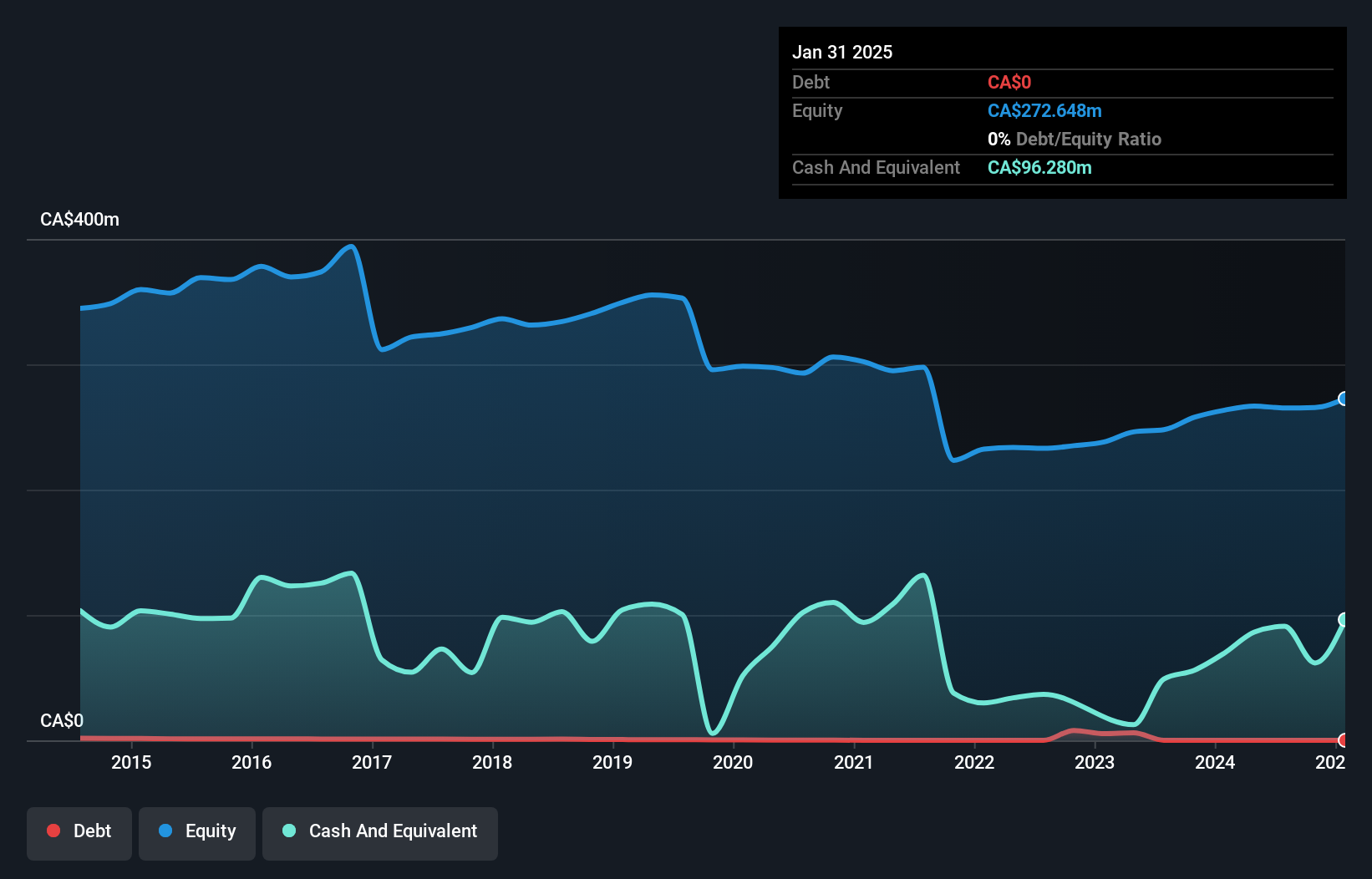

Evertz Technologies, a nimble player in the tech space, is currently trading at a notable 37.1% below its estimated fair value, suggesting potential for upside. Despite facing a challenging year with earnings dipping by 2.3%, it remains debt-free and boasts high-quality past earnings. The company reported first-quarter sales of C$111.64 million, down from C$125.82 million the previous year, while net income was C$9.67 million compared to C$15.59 million last year. Recently, Evertz repurchased 57,510 shares for approximately C$0.75 million and appointed Don Carson as director at its AGM on October 2, 2024.

- Click to explore a detailed breakdown of our findings in Evertz Technologies' health report.

Evaluate Evertz Technologies' historical performance by accessing our past performance report.

Real Matters (TSX:REAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Real Matters Inc. is a technology and network management company operating in Canada and the United States with a market capitalization of CA$498.09 million.

Operations: Real Matters generates revenue primarily from its U.S. Appraisal segment, contributing $128.03 million, followed by Canada at $32.73 million and U.S. Title at $8.53 million.

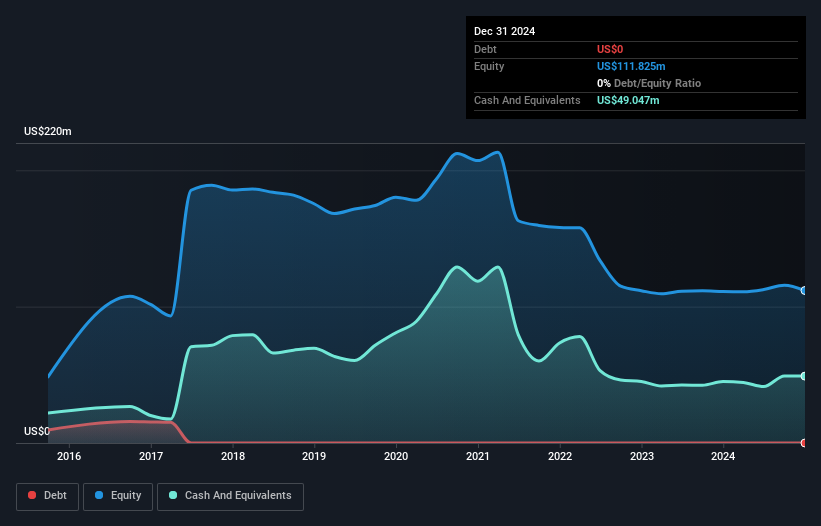

Real Matters, a Canadian company in the real estate appraisal sector, recently reported annual sales of US$172.72 million, up from US$163.91 million last year, marking a notable turnaround with net income of US$0.018 million compared to a prior net loss of US$6.17 million. The firm has no debt and trades at 64% below its estimated fair value, highlighting its potential undervaluation in the market. Despite being dropped from the S&P Global BMI Index recently, Real Matters is poised for significant growth with earnings forecasted to increase by 169% annually as it continues to capitalize on its high-quality earnings and industry position.

- Click here and access our complete health analysis report to understand the dynamics of Real Matters.

Review our historical performance report to gain insights into Real Matters''s past performance.

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in the refining, packaging, marketing, and distribution of sugar and maple products across Canada, the United States, Europe, and other international markets with a market capitalization of CA$734.24 million.

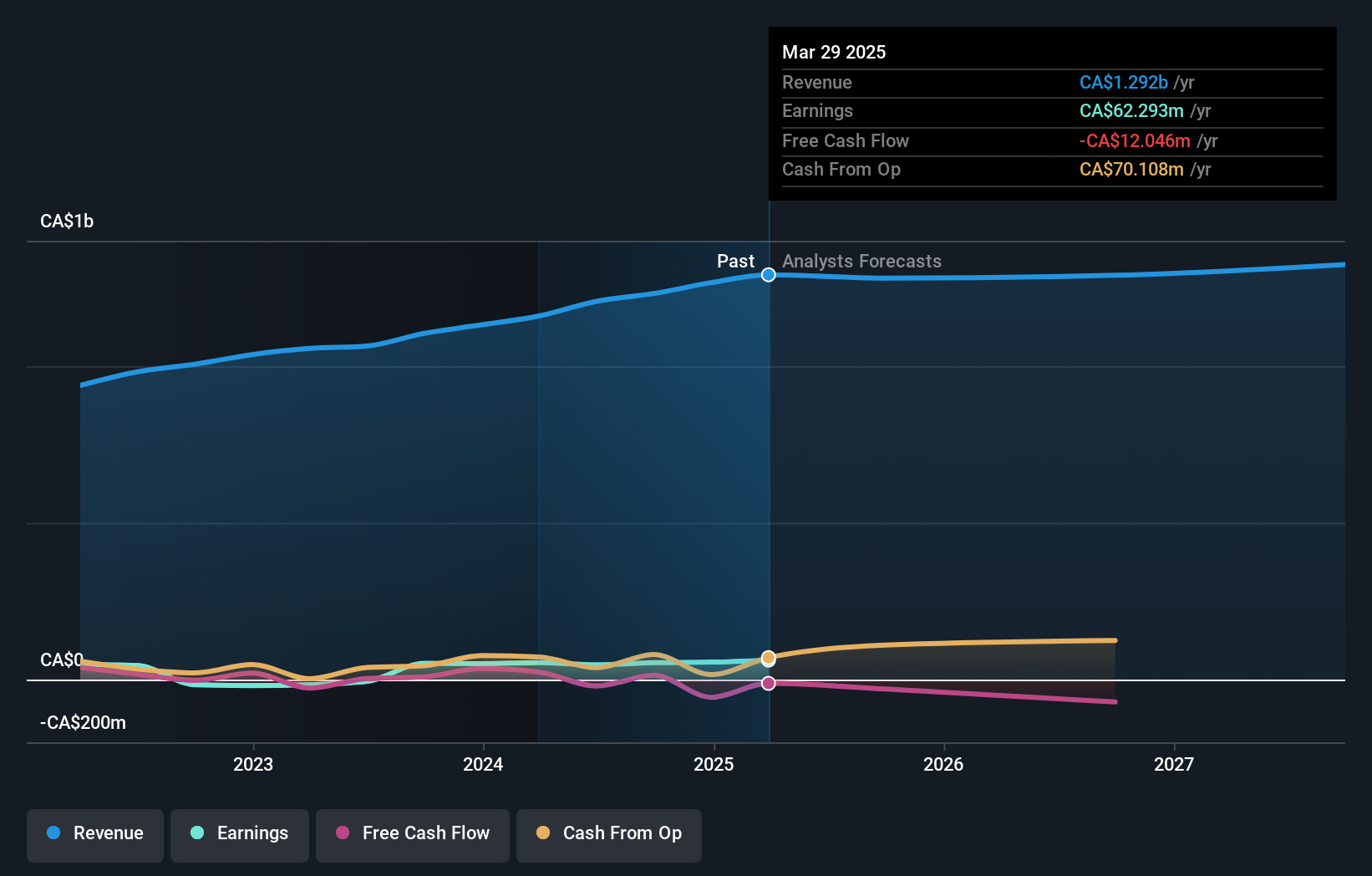

Operations: Rogers Sugar generates revenue primarily from its sugar segment, contributing CA$981.45 million, and maple products segment, adding CA$225.32 million.

Rogers Sugar, a notable player in the Canadian market, has recently turned profitable, contrasting with the food industry's -2.1% growth. Its debt to equity ratio improved from 100.6% to 93.1% over five years, though net debt remains high at 91%. Trading at nearly half its estimated fair value suggests potential undervaluation for investors seeking opportunities in smaller companies. The company’s interest payments are well covered by EBIT at a multiple of 3.6x, indicating solid financial management despite challenges in free cash flow positivity and operating cash flow coverage of debt obligations.

- Navigate through the intricacies of Rogers Sugar with our comprehensive health report here.

Understand Rogers Sugar's track record by examining our Past report.

Seize The Opportunity

- Discover the full array of 48 TSX Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Evertz Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet established dividend payer.