Canadian Imperial Bank of Commerce And 2 Other Top TSX Dividend Stocks

Reviewed by Simply Wall St

The Canadian market has shown promising growth, climbing 1.4% in the last 7 days and an impressive 19% over the past year, with earnings expected to grow by 15% annually in the coming years. In this thriving environment, dividend stocks like Canadian Imperial Bank of Commerce and two other top TSX picks stand out as solid choices for investors seeking reliable income and potential capital appreciation.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.98% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.34% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.10% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.25% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.32% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.59% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.45% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.20% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.19% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.40% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

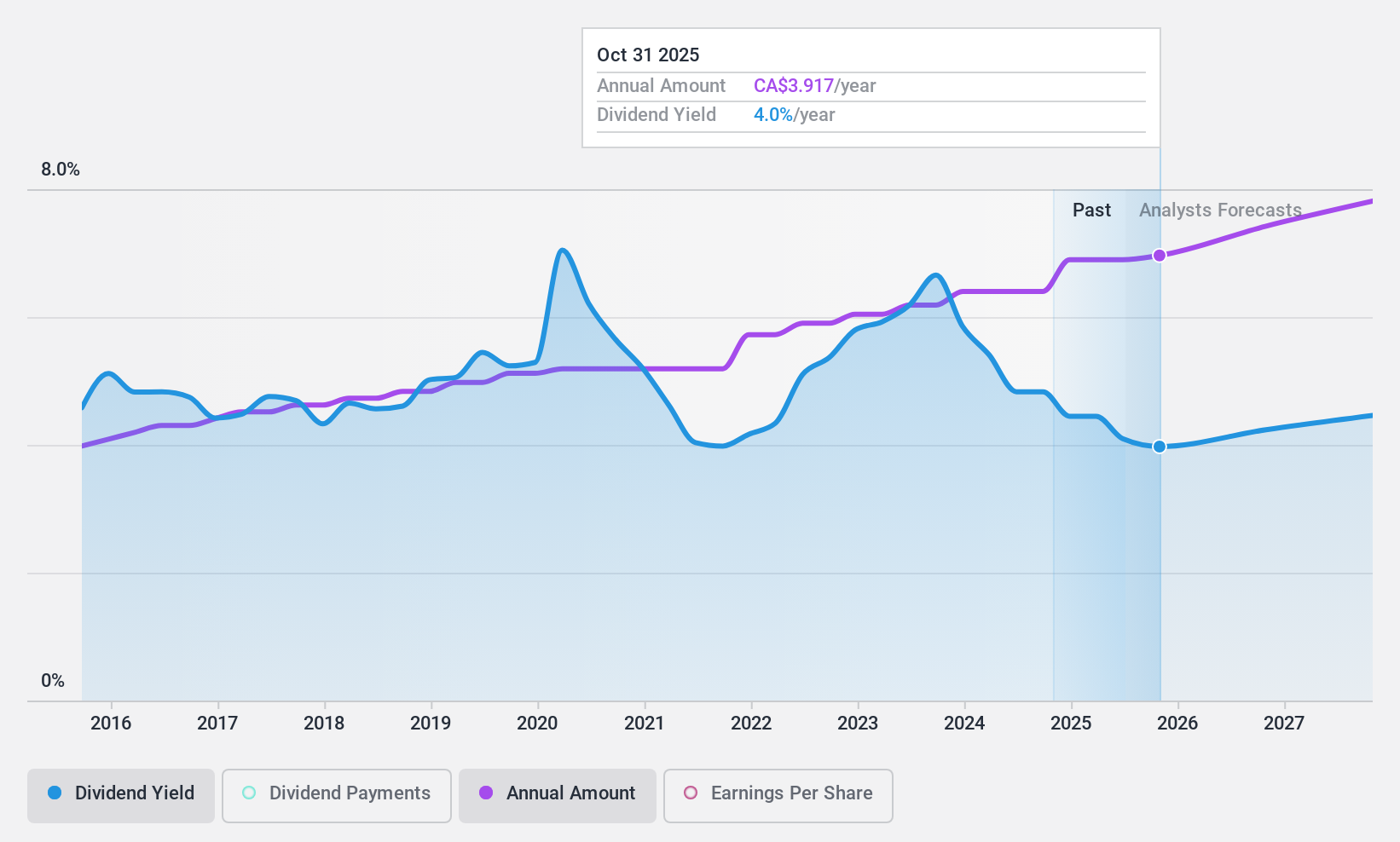

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce, a diversified financial institution with a market cap of CA$78.34 billion, offers various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Operations: Canadian Imperial Bank of Commerce generates revenue from several key segments: CA$8.80 billion from Canadian Personal and Business Banking, CA$5.61 billion from Capital Markets and Direct Financial Services, CA$2.02 billion from U.S. Commercial Banking and Wealth Management, and CA$5.46 billion from Canadian Commercial Banking and Wealth Management.

Dividend Yield: 4.3%

Canadian Imperial Bank of Commerce (CIBC) offers a reliable dividend, currently covered by earnings with a payout ratio of 51.7%, and forecasted to remain sustainable at 48.2% in three years. The bank's dividends have been stable and growing over the past decade, though its yield of 4.3% is lower than the top quartile in Canada. Recent fixed-income offerings totaling $1 billion indicate robust capital management, while leadership changes aim to enhance strategic growth and client-focused initiatives.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Imperial Bank of Commerce.

- Our expertly prepared valuation report Canadian Imperial Bank of Commerce implies its share price may be lower than expected.

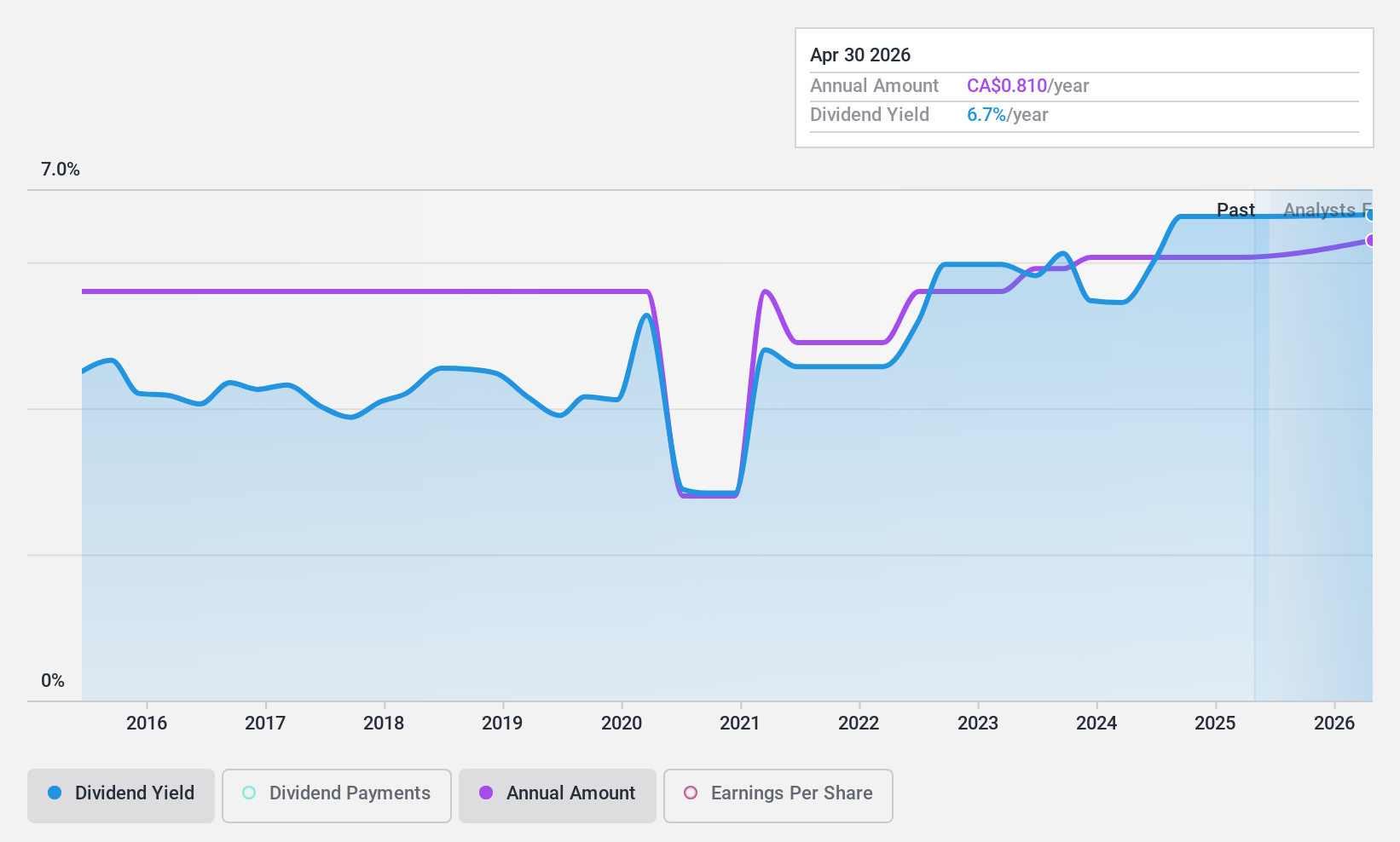

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$901.49 million.

Operations: Evertz Technologies Limited generates CA$500.44 million in revenue from the television broadcast equipment market.

Dividend Yield: 6.5%

Evertz Technologies' dividend yield of 6.5% ranks in the top 25% of Canadian payers, but its sustainability is questionable due to a high payout ratio (92.4%) and volatile past payments. Although dividends are covered by cash flows (60.2%), recent earnings reports show declining sales and net income, impacting future payouts. The company declared a quarterly dividend of CAD 0.195 per share, payable on September 25, 2024, despite these financial challenges.

- Take a closer look at Evertz Technologies' potential here in our dividend report.

- The valuation report we've compiled suggests that Evertz Technologies' current price could be quite moderate.

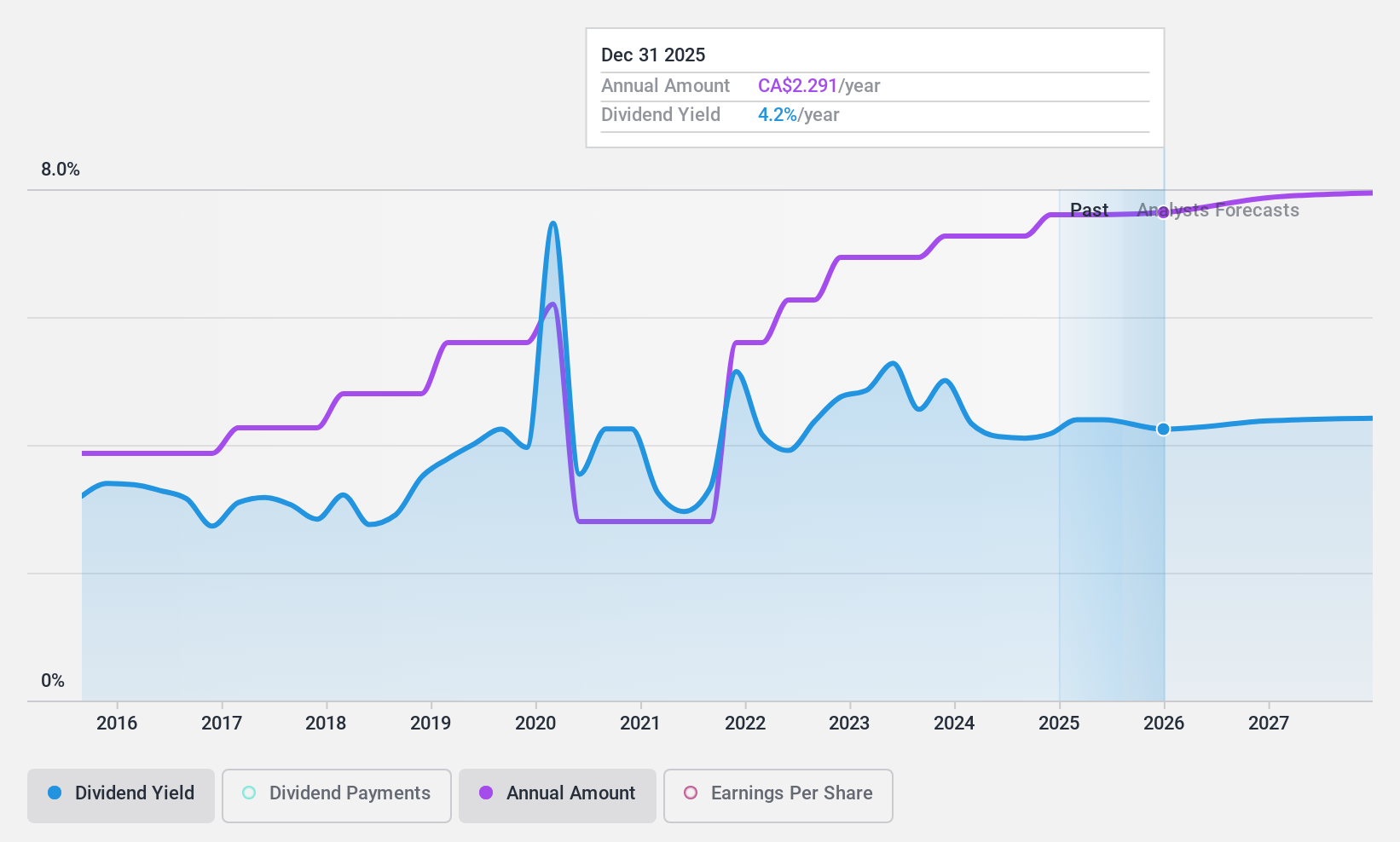

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, and has a market cap of CA$63.98 billion.

Operations: Suncor Energy Inc. generates revenue from its Oil Sands operations (CA$24.61 billion), Refining and Marketing segment (CA$32.29 billion), and Exploration and Production activities (CA$2.03 billion).

Dividend Yield: 4.3%

Suncor Energy's dividend yield of 4.26% is lower than the top 25% of Canadian payers, but its payout ratio (36.9%) and cash payout ratio (32.1%) indicate strong coverage by earnings and cash flows. Despite a volatile dividend history over the past decade, recent quarterly dividends remain consistent at CAD 0.545 per share, payable on September 25, 2024. However, forecasted earnings declines and recent buybacks may affect future payouts and stability.

- Dive into the specifics of Suncor Energy here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Suncor Energy is trading behind its estimated value.

Key Takeaways

- Reveal the 31 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.