- Canada

- /

- Oil and Gas

- /

- TSX:SU

3 TSX Dividend Stocks Yielding Up To 6.5%

Reviewed by Simply Wall St

As the Canadian TSX navigates a volatile start to the fourth quarter, driven by uncertainties in global politics and economic forecasts, investors are keenly observing how these factors impact market dynamics. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance risk with steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.68% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 7.83% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.18% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.19% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.61% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.28% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.11% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.10% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.42% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.35% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

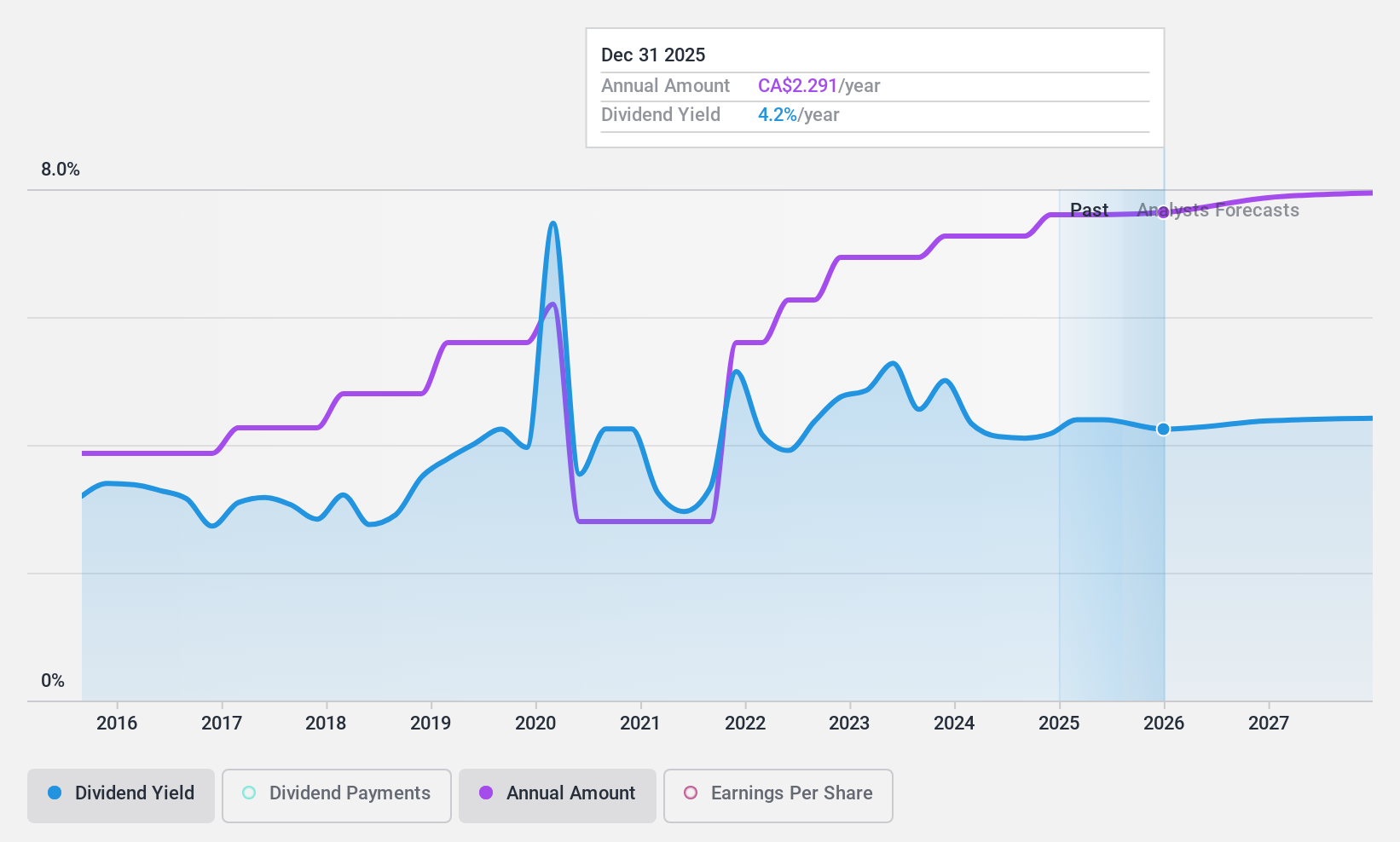

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients across Canada, the United States, and internationally, with a market cap of CA$77.21 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue from several segments, including Canadian Personal and Business Banking (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion).

Dividend Yield: 4.4%

Canadian Imperial Bank of Commerce has maintained reliable and stable dividend payments over the past decade, supported by a reasonable payout ratio of 51.7%. Despite being lower than the top 25% of Canadian dividend payers, its 4.4% yield remains attractive for income-focused investors. Recent earnings growth, highlighted by a net income increase to C$1.79 billion in Q3 2024, supports future dividend sustainability. However, shareholder dilution and insider selling may be concerns for potential investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Canadian Imperial Bank of Commerce.

- According our valuation report, there's an indication that Canadian Imperial Bank of Commerce's share price might be on the cheaper side.

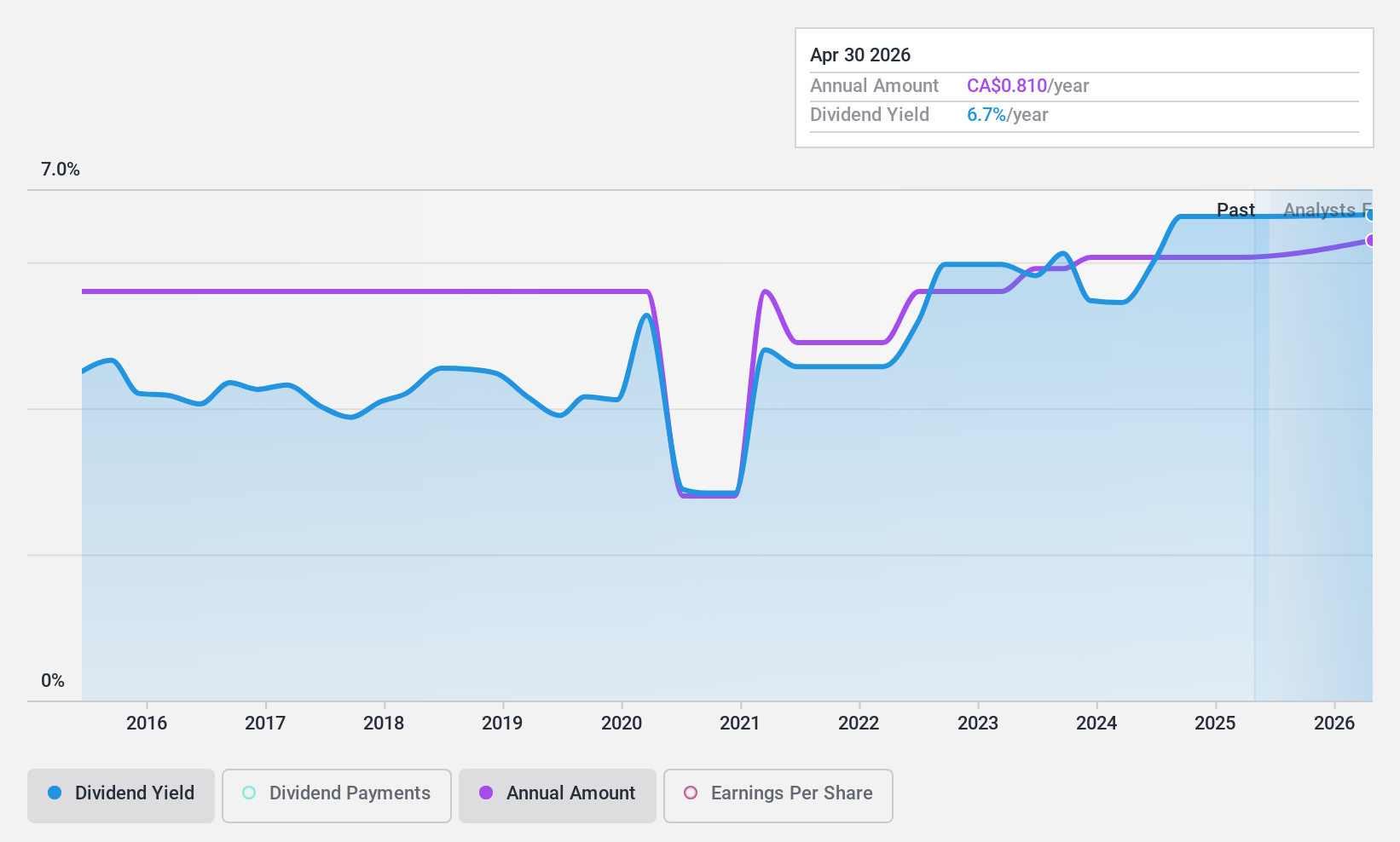

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally, with a market cap of CA$899.06 million.

Operations: Evertz Technologies Limited generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$500.44 million.

Dividend Yield: 6.6%

Evertz Technologies offers a high dividend yield of 6.6%, placing it in the top 25% of Canadian dividend payers, yet its sustainability is questionable due to a high payout ratio of 92.4%. While dividends are covered by cash flows with a reasonable cash payout ratio of 60.2%, earnings coverage is insufficient. Despite recent volatility and declines in sales and net income, the stock trades below fair value estimates, suggesting potential for price appreciation according to analysts.

- Dive into the specifics of Evertz Technologies here with our thorough dividend report.

- Our expertly prepared valuation report Evertz Technologies implies its share price may be lower than expected.

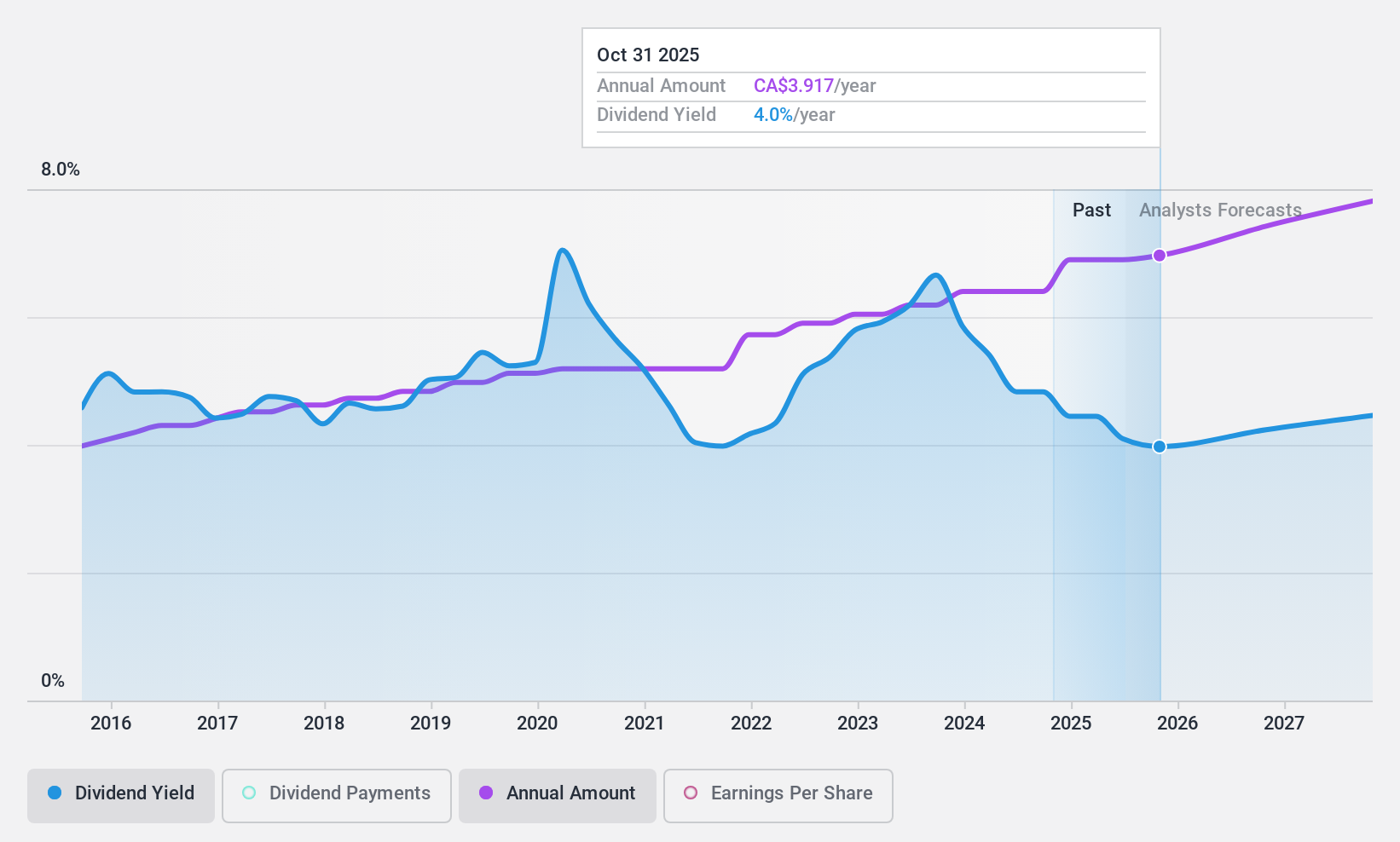

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$68.68 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Oil Sands segment at CA$24.61 billion, Refining and Marketing at CA$32.29 billion, and Exploration and Production at CA$2.03 billion.

Dividend Yield: 4%

Suncor Energy's dividend sustainability is supported by a low payout ratio of 36.9% and cash payout ratio of 32%, indicating dividends are well-covered by earnings and cash flows. However, its dividend yield of 4.02% is below the top Canadian payers, and past payments have been volatile and unreliable over the last decade. Despite recent earnings growth, Suncor's dividends remain vulnerable to fluctuations in financial performance amid debt financing activities impacting liquidity management strategies.

- Click here to discover the nuances of Suncor Energy with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Suncor Energy is trading behind its estimated value.

Taking Advantage

- Dive into all 30 of the Top TSX Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives