As trade tensions ease with new agreements and the Federal Reserve maintains steady interest rates, the Canadian market is navigating a complex economic landscape. In this environment, dividend stocks can offer a reliable income stream and potential stability for investors seeking to bolster their portfolios amidst these shifting dynamics.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 9.07% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.39% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.36% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.53% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.15% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.45% | ★★★★★☆ |

| SECURE Waste Infrastructure (TSX:SES) | 3.08% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.11% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.64% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.07% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$872.85 million.

Operations: Evertz Technologies Limited generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$496.59 million.

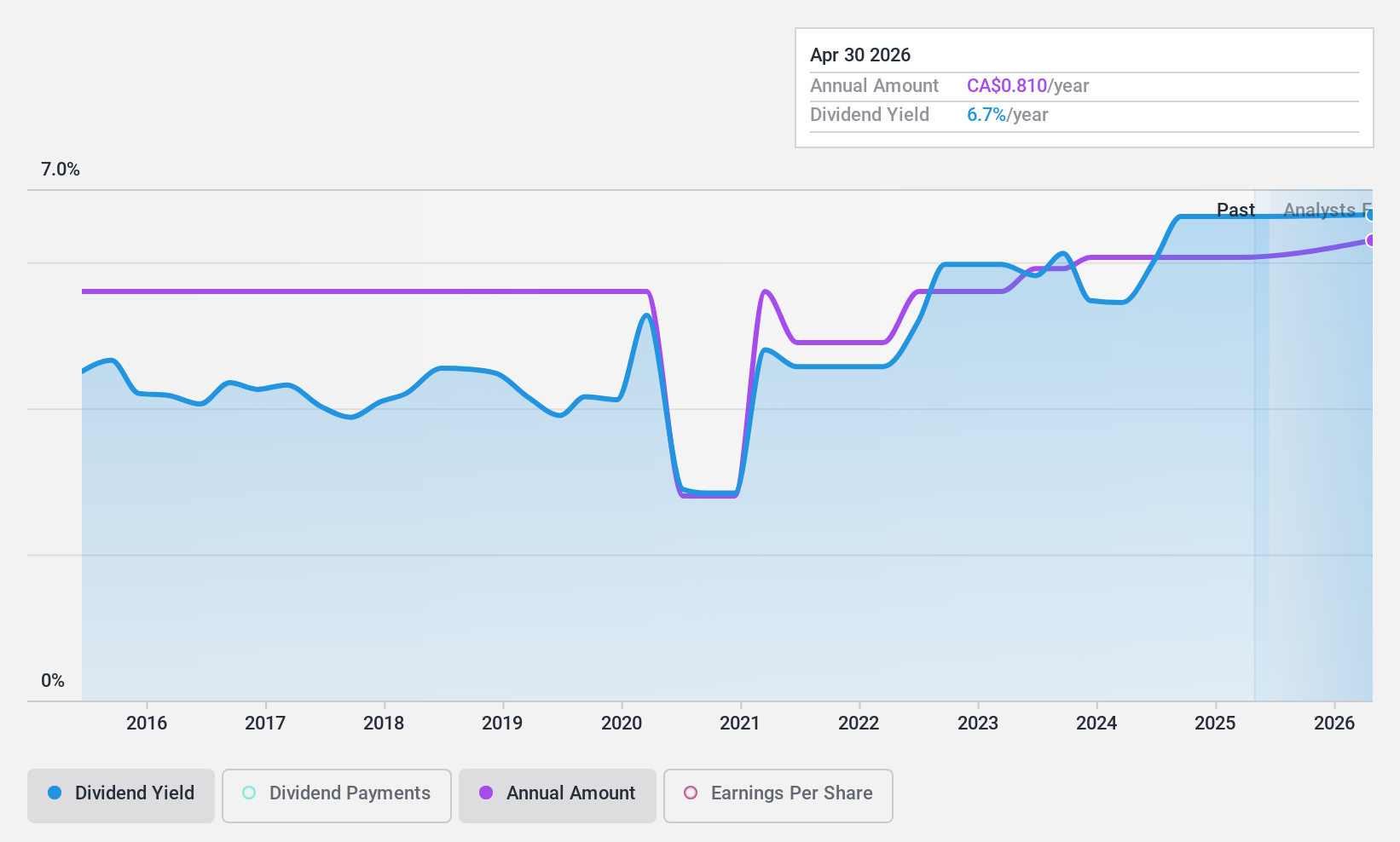

Dividend Yield: 6.8%

Evertz Technologies offers a dividend yield of 6.78%, placing it in the top 25% of Canadian dividend payers. Its dividends are well covered by earnings with a low payout ratio of 24.7%, and cash flows support the payments with a cash payout ratio of 64.6%. However, Evertz has an unstable dividend track record over the past decade despite recent increases. The stock trades at a favorable value, with its P/E ratio slightly below the market average.

- Get an in-depth perspective on Evertz Technologies' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Evertz Technologies shares in the market.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company offering asset management, wealth, insurance, and health solutions to individual and institutional customers across multiple countries including Canada, the U.S., and several Asian markets, with a market cap of CA$48.93 billion.

Operations: Sun Life Financial Inc.'s revenue is primarily derived from its operations in Canada (CA$17.19 billion), the United States (CA$14.80 billion), Asia (CA$3.04 billion), and Asset Management services (CA$6.82 billion).

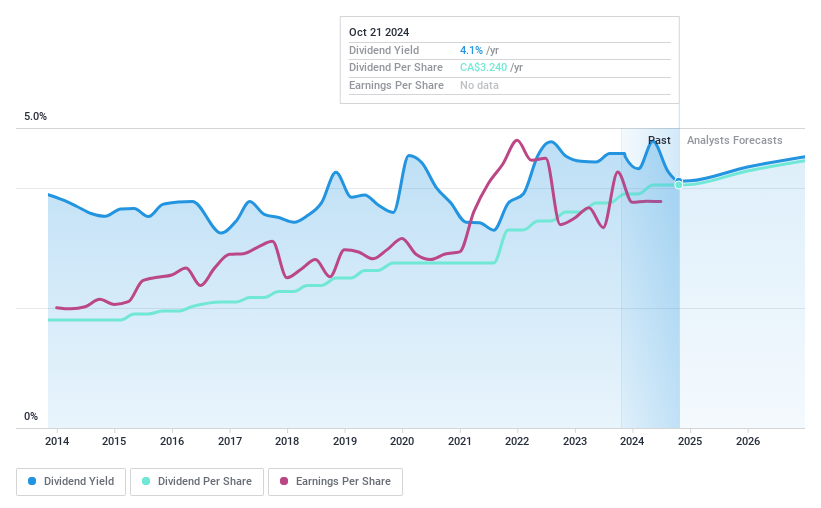

Dividend Yield: 4.1%

Sun Life Financial's dividend yield of 4.07% is lower than the top Canadian payers, but its payments have been reliable and stable over the past decade. The company maintains a sustainable payout ratio of 60.2%, with dividends well covered by cash flows at 44.2%. Recent earnings growth supports future payments, while a share repurchase program reflects strong capital management. A recent quarterly dividend increase to CAD 0.88 per share underscores Sun Life's commitment to returning value to shareholders.

- Click here and access our complete dividend analysis report to understand the dynamics of Sun Life Financial.

- Upon reviewing our latest valuation report, Sun Life Financial's share price might be too optimistic.

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wajax Corporation, with a market cap of CA$484.31 million, offers industrial products and services across Canada.

Operations: Wajax Corporation's revenue segments include Equipment at CA$1.05 billion, Product Support at CA$497.47 million, and Industrial Components at CA$549.62 million.

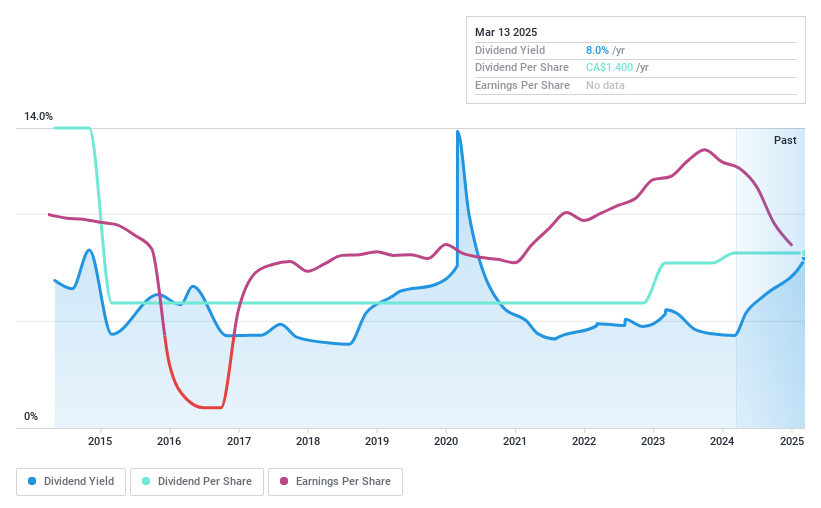

Dividend Yield: 6.3%

Wajax's dividend yield of 6.3% places it among the top Canadian payers, though its history of volatile and unreliable payments over the past decade raises concerns. Despite a reasonable payout ratio of 74% and cash payout ratio of 30.9%, indicating coverage by earnings and cash flows, interest payments are not well covered by earnings. Recent financials show decreased net income despite increased sales, with a CAD 0.35 per share dividend declared for Q2 2025.

- Navigate through the intricacies of Wajax with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Wajax is trading beyond its estimated value.

Key Takeaways

- Explore the 27 names from our Top TSX Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives