Will Celestica’s (TSX:CLS) Audit Chair Transition Shape Its Governance And Risk Narrative?

Reviewed by Sasha Jovanovic

- Celestica Inc. announced that Dr. Luis Müller will resign from its Board and as Audit Committee Chair after the January 28, 2026 meeting, with current director Amar Maletira set to assume the Audit Committee Chair role at that time.

- This orderly leadership transition in a key financial oversight role comes as Celestica attracts growing investor interest tied to its strong earnings outlook and hyperscaler-driven growth opportunities.

- With this planned audit leadership change in mind, we’ll now examine how it may influence Celestica’s investment narrative and risk profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Celestica Investment Narrative Recap

To own Celestica today, you largely have to believe its hyperscaler and AI infrastructure programs can keep supporting the current growth trajectory while the company manages customer concentration and execution risk in its CCS segment. The planned 2026 handover of the Audit Committee Chair role to Amar Maletira looks orderly and, on its own, does not materially change the near term earnings catalyst or the main risk around reliance on a few large customers.

The recent launch of Celestica’s DS6000 and DS6001 1.6 TbE data center switches is particularly relevant here, as it underpins the core thesis around hyperscaler driven growth and next generation networking ramps. These products tie directly into the company’s largest catalyst, where rapid investment in AI and advanced networking can deepen relationships with key cloud customers while also amplifying the revenue concentration risk if those same customers pull back.

But while growth linked to hyperscalers is appealing, investors should also be aware that...

Read the full narrative on Celestica (it's free!)

Celestica's narrative projects $17.4 billion revenue and $992.0 million earnings by 2028. This requires 17.9% yearly revenue growth and a $453.6 million earnings increase from $538.4 million today.

Uncover how Celestica's forecasts yield a CA$569.94 fair value, a 27% upside to its current price.

Exploring Other Perspectives

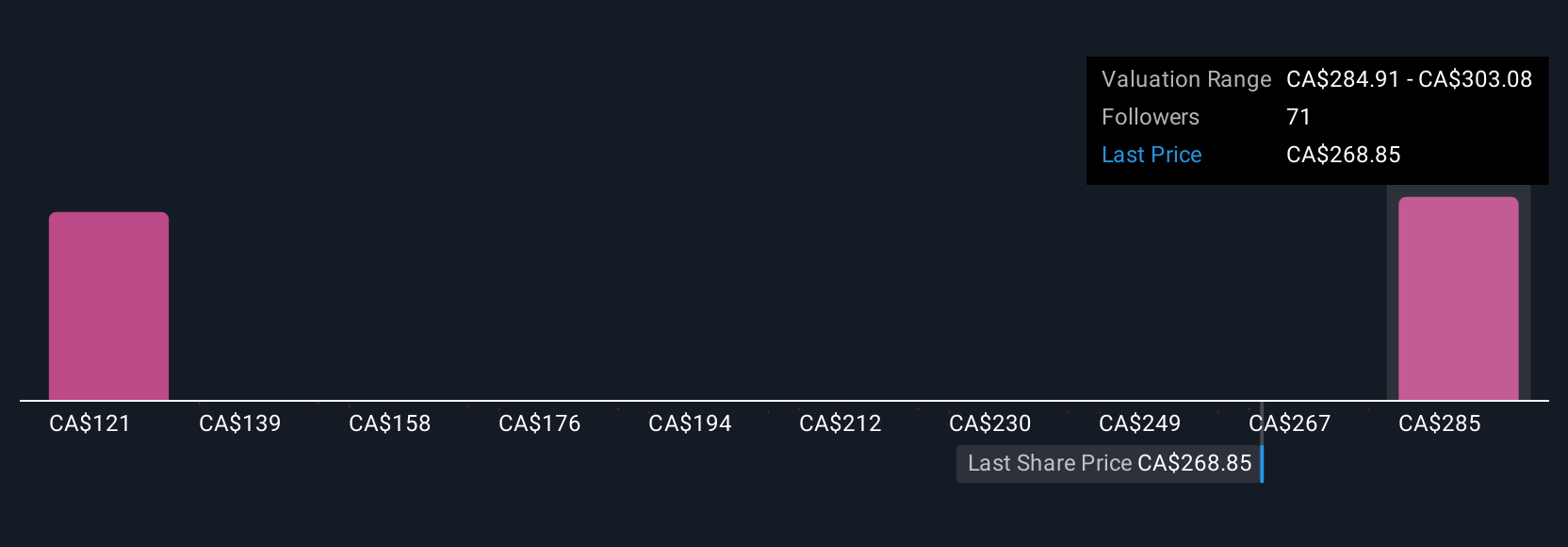

Twenty members of the Simply Wall St Community currently see Celestica’s fair value anywhere between CA$142.15 and CA$569.94, underscoring how differently investors can assess the same growth story. When you set those views against Celestica’s dependence on a handful of hyperscaler customers, it becomes clear why exploring multiple perspectives on both upside potential and concentration risk can be useful before making any decisions.

Explore 20 other fair value estimates on Celestica - why the stock might be worth less than half the current price!

Build Your Own Celestica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celestica research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Celestica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celestica's overall financial health at a glance.

No Opportunity In Celestica?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026